Please use a PC Browser to access Register-Tadawul

Amid TASI Rebound, Saleh Al-Rashed Company (SAR) Announces IPO with 74% Net Income Growth

Tadawul All Shares Index TASI.SA | 11216.93 | +0.25% |

Tadawul IPO Index TIPOC.SA | 4304.93 | +0.29% |

SAR IPO Overview

Saleh Abdulaziz Al Rashed & Sons Company (SAR), a leading Saudi provider of integrated construction materials, mining, and industrial spare-parts solutions, has announced its intention to proceed with an initial public offering (IPO) on the Main Market of the Saudi Exchange.

The company received approval from the Capital Market Authority (CMA) on September 22, 2025, to register its share capital and proceed with the offering. SAR also obtained conditional approval from the Saudi Exchange for listing on June 24, 2025. This will be a secondary offering, with all shares being sold by existing shareholders—the company itself will not receive any proceeds from the IPO.

Key IPO Information

- Total Shares Offered: 5,580,000 shares

- Percentage of Share Capital: 30% of total issued shares

- Total Share Capital: SAR 186 million

- Institutional Book-Building Period: February 1-5, 2026

- Retail Subscription Period: February 12-17, 2026

- Final Offer Price: To be determined after the institutional book-building period

Offering Structure

This is a secondary offering where all shares are being sold by current shareholders (the "Selling Shareholders"). Net proceeds from the offering will be distributed to the Selling Shareholders on a pro-rata basis after deducting offering expenses.

Introducing the new IPO feature on Sahm platform: A step-by-step guide to subscribing to the IPO

IPO Summary

| Category | Details |

|---|---|

| Company Name | Saleh Abdulaziz Al Rashed & Sons |

| Market | Main Market (TASI) |

| Core Activities | Building materials and spare parts |

| Company’s Capital | SAR 186 Million |

| Total Shares | 18.6 Million |

| Par Value | SAR 10 per share |

| Issue Percentage | The Offer Shares represent thirty per cent. (30%) of the Company’s share capital |

| Number of Offered Shares | 5.58 Million |

| Qualified Subscribers | Participating institutions & Retail investors |

| Total Number of Shares Offered to Retail Investors | 1.674 Million shares (30% of the offering size) |

| Minimum Number of Offer Shares to be Applied for by Individual Investors | 10 shares |

| Maximum Number of Offer Shares to be Applied for by Individual Investors | 250,000 shares |

| Minimum Number of Offer Shares to be Applied for by Institutional Investors | 100,000 shares |

| Maximum Number of Offer Shares to be Applied for by Institutional Investors | 929,999 shares |

About SAR:

Founded in 1975 and headquartered in Riyadh, SAR has grown from a single quarry operation into one of Saudi Arabia's leading integrated players in construction materials, mining, and industrial spare parts. With nearly five decades of experience, the company has built a reputation for disciplined strategy and consistent execution, delivering landmark projects across the Kingdom.

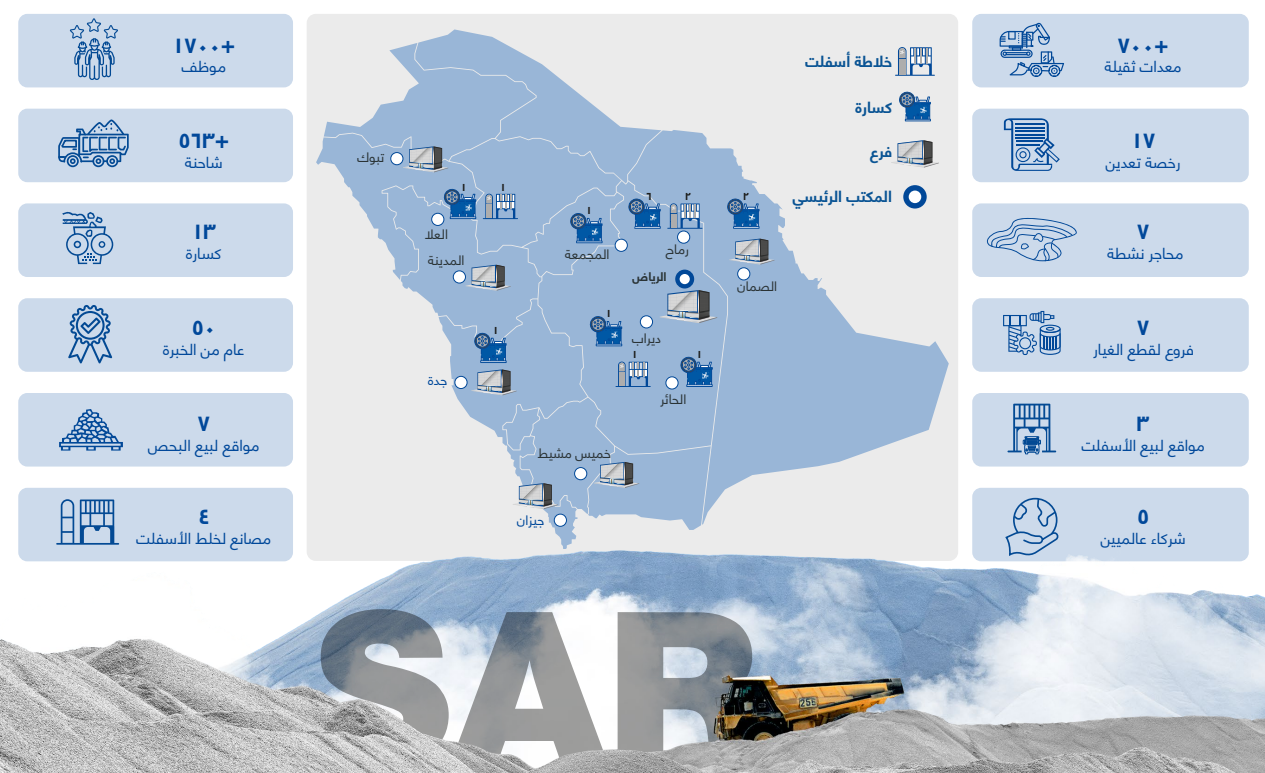

Operational Scale and Infrastructure

As of March 31, 2025, SAR operates an extensive integrated asset base including:

- 7 quarry sites with 13 crushers

- 4 asphalt mixing plants

- Fleet of approximately 563 trucks and 700 heavy machinery units

- 17 wholesale outlets across the Kingdom

This vertically integrated infrastructure enables the company to maintain end-to-end control across the entire value chain—from quarrying and production to logistics and after-sales service—ensuring reliability, efficiency, and quality throughout operations.

Market Position and Strategic Growth

SAR holds a 28% market share for aggregates in Riyadh as of year-end 2024, demonstrating its strong competitive position in the Kingdom's largest market. The company's long-term mining licenses provide operational security, with reserves sufficient for 15 to 20 years of extraction across key regions including Riyadh, the Eastern Province, and Madinah.

The company is actively expanding into new segments, including silica sand production. SAR has secured two exploration licenses and applied for extraction licenses, positioning itself to supply high-growth sectors such as glass manufacturing, coatings, water filtration, construction materials, and high-tech industrial applications.

Vision 2030 Alignment and ESG Commitment

In alignment with Saudi Arabia's Vision 2030, SAR's growth strategy focuses on four key pillars:

- Capacity expansion through deployment of high-efficiency crushers and expanded asphalt production

- Product diversification into new materials and applications

- Regional growth across underserved markets

- Digital transformation including SAP-based analytics and predictive maintenance systems

The company is equally committed to environmental, social, and corporate governance (ESG) standards. Key initiatives include expanding renewable energy adoption across quarry operations, implementing dust filtration systems, investing in reforestation and land rehabilitation, and increasing use of recycled aggregates and energy-efficient machinery.

SAR maintains compliance with international standards including ISO 9001:2015 (Quality Management), ISO 14001:2015 (Environmental Management), and ISO 45001:2018 (Occupational Health and Safety), along with all necessary environmental permits.

Financial Performance: Strong and Consistent Growth

SAR has demonstrated a track record of consistent profitable growth driven by disciplined management:

Revenue Growth:

- 2024 revenue: SAR 599.6 million (+20.2% year-over-year)

- Nine months 2025 (YTD Sep): SAR 545.4 million (+28.5% year-over-year)

EBITDA Performance:

- 2024 EBITDA: SAR 122 million (+33.9% growth), representing approximately 20% margin

- Nine months 2025 EBITDA: SAR 116 million (+38.8% year-over-year), representing 21% margin

Net Income:

- 2024 net income: SAR 60 million (+26.8% year-over-year)

- Nine months 2025 net income: SAR 66 million (+74.0% year-over-year)

Information above is sourced and summarised from the company's Prospectus.

Investor Groups

The IPO is divided into two tranches with specific allocation mechanisms:

Tranche A: Participating Parties (Institutional Investors)

This tranche is designated for parties entitled to participate in the book-building process, including:

- Investment funds

- GCC corporate investors

- Foreign corporate investors

Initial Allocation: 5,580,000 Offer Shares (100% of total offering)

Potential Adjustment: The Financial Advisor (ANB Capital Company) has the right, if there is sufficient demand from Individual Subscribers and in coordination with the Company, to reduce institutional allocation to 3,906,000 Offer Shares (70% of total offering).

Final allocation will be determined after the Individual Subscriber subscription period ends, using a discretionary allocation mechanism. Some participating entities may not receive any allocation.

Tranche B: Individual Subscribers (Retail Investors)

This tranche is open to:

- Saudi Arabian natural persons, including Saudi divorced women or widows with minor children from a marriage to a non-Saudi person (who can subscribe for their own benefit or in the names of their minor children, provided they prove their status)

- GCC natural persons

- Foreign natural persons (whether residing in the Kingdom or not)

Maximum Allocation: 1,674,000 Offer Shares (30% of total offering)

Important Subscription Rules

- Subscriptions made by a person in the name of their divorced wife will be deemed invalid, and the applicant will be subject to legal sanctions

- Duplicate subscriptions are prohibited—only the first subscription will be accepted; any second subscription will be considered void

- If Individual Subscribers do not fully subscribe to their allocated shares, the Financial Advisor may reduce the allocation proportionally in coordination with the Company

Shareholder Structure

The table below shows the ownership structure of SAR's substantial shareholders before and after the IPO:

| Shareholder | Pre-Offering | Post-Offering | ||||

|---|---|---|---|---|---|---|

| Number of Shares | Shareholding (%) | Overall Nominal Value (SAR) | Number of Shares | Shareholding (%) | Overall Nominal Value (SAR) | |

| Abdulaziz Saleh Abdulaziz Al Rashed | 6,664,380 | 35.8% | 66,643,800 | 4,665,066 | 25.1% | 46,650,660 |

| Abdullah Saleh Abdulaziz Al Rashed | 3,875,124 | 20.8% | 38,751,240 | 2,712,587 | 14.6% | 27,125,868 |

| Abdulaziz Saad Saleh Al Rashed | 1,395,000 | 7.5% | 13,950,000 | 976,500 | 5.3% | 9,765,000 |

| Saud Saad Saleh Al Rashed | 1,395,000 | 7.5% | 13,950,000 | 976,500 | 5.3% | 9,765,000 |

| Nourah Saleh Abdulaziz Al Rashed | 1,007,748 | 5.4% | 10,077,480 | 705,424 | 3.8% | 7,054,236 |

| Sara Saleh Abdulaziz Al Rashed | 1,007,748 | 5.4% | 10,077,480 | 705,424 | 3.8% | 7,054,236 |

| Shareholder Acting in Concert | 2,029,500 | 11.3% | 20,925,000 | 1,464,750 | 7.9% | 14,647,500 |

| Total | 17,437,500 | 93.7% | 174,375,000 | 12,206,251 | 65.8% | 122,062,500 |

Notes:

- Ownership percentages are rounded to the nearest decimal place

- Saud Saad Saleh Al Rashed is both a Substantial Shareholder and the minor son of Areej Saud Hamoud Al Dhaban (the Shareholder Acting in Concert). His shares are counted only once in the total to avoid double counting

- Shareholder Acting in Concert: Areej Saud Hamoud Al Dhaban holds 697,500 shares (3.8% pre-offering). As the legal guardian and mother of Saud Saad Saleh Al Rashed (7.5% pre-offering), Norah Saad Saleh Al Rashed (3.8% pre-offering), and Danah Saad Saleh Al Rashed (3.8% pre-offering), she disposes of their shares by agreement

Expected Offering Timetable

| Event | Date |

|---|---|

| Bidding and Book-Building Period for Participating Entities | A period of five business days commencing on Sunday, 13 Sha'ban 1447H (corresponding to 1 February 2026G), until the end of Thursday, 17 Sha'ban 1447H (corresponding to 5 February 2026G). |

| Deadline for Submission of Subscription Application Forms Based on the Number of the Offer Shares Provisionally Allocated for the Participating Entities | Wednesday, 23 Sha'ban 1447H (corresponding to 11 February 2026G). |

| Subscription Period for Individual Subscribers | A period of four business days commencing on Thursday, 24 Sha'ban 1447H (corresponding to 12 February 2026G) until the end of Tuesday, 29 Sha'ban 1447H (corresponding to 17 February 2026G). |

| Deadline for Payment of the Subscription Amount by Participating Entities Based on their Provisionally Allocated Offer Shares | Sunday, 27 Sha'ban 1447H (corresponding to 15 February 2026G) |

| Deadline for Submission of Subscription Application Forms and Payment of the Subscription Amount by Individual Subscribers | Tuesday, 29 Sha'ban 1447H (corresponding to 17 February 2026G). |

| Announcement of the Final Allocation of the Offer Shares | No later than Tuesday, 7 Ramadan 1447H (corresponding to 24 February 2026G). |

| Refund of Excess Subscription Monies (if any) | No later than Thursday, 9 Ramadan 1447H (corresponding to 26 February 2026G). |

| Expected Commencement Date for Trading the Shares on the Exchange | Trading of the Company's Shares on the Exchange is expected to commence after the completion of all of the relevant legal requirements and procedures. The trading commencement date of the Shares will be announced in local newspapers and Tadawul's website (www.saudiexchange.sa). |

Note: The above timetable and dates therein are indicative and subject to change. Actual dates will be communicated on the websites of Tadawul (www.saudiexchange.sa), the Financial Advisor (www.anbcapital.com.sa) and the Company (www.salrashed.com.sa).

Introducing the new IPO feature on Sahm platform: A step-by-step guide to subscribing to the IPO

Click to read the full Prospectus

Further updates regarding this IPO will be provided as more information becomes available.