Please use a PC Browser to access Register-Tadawul

Appian (APPN) Valuation Check After New US$500 Million US Army Enterprise Agreement

Appian Corporation Class A APPN | 25.14 | +2.44% |

Appian (APPN) recently announced a new Enterprise Agreement with the US Army, enabling up to US$500 million of software and cloud purchases over 10 years, alongside conditional authorization for its Appian Defense Cloud.

The US Army agreement and recent appointment of AI-focused executive David Link to the board arrive at a time when Appian’s share price is US$30.06, with recent momentum mixed. A 7 day share price return of 5.03% contrasts with a 30 day share price return decline of 16.01% and a 5 year total shareholder return decline of 85.76%, which suggests investors are still weighing long term execution risk despite the contract win.

If this kind of defense and AI story has your attention, it could be a good moment to see what else is setting up in aerospace and defense stocks.

With a 5 year total shareholder return decline of 85.76% and a recent US$500 million Army framework in hand, is Appian still trading below what its long term potential suggests, or is the market already pricing in future growth?

Most Popular Narrative: 26.7% Undervalued

With Appian closing at $30.06 against a widely followed fair value of $41.00, the dominant narrative frames today’s price as a discount on future execution.

Broad enterprise demand for application modernization and workflow automation is accelerating, with AI seen as a catalyst that dramatically lowers modernization costs and complexity, positioning Appian's platform for increased adoption, larger deal sizes, and improved revenue growth over the coming years.

Want to see how this modernization push translates into the $41.00 fair value? The narrative leans on compounding revenue growth, margin uplift, and a future earnings multiple that assumes real traction in mission critical workflows. Curious which specific financial step ups have to fall into place for that price to make sense?

Result: Fair Value of $41.00 (UNDERVALUED)

However, there are still clear pressure points, including intense competition from larger platforms and the risk that generative AI tools could dilute Appian’s low code differentiation.

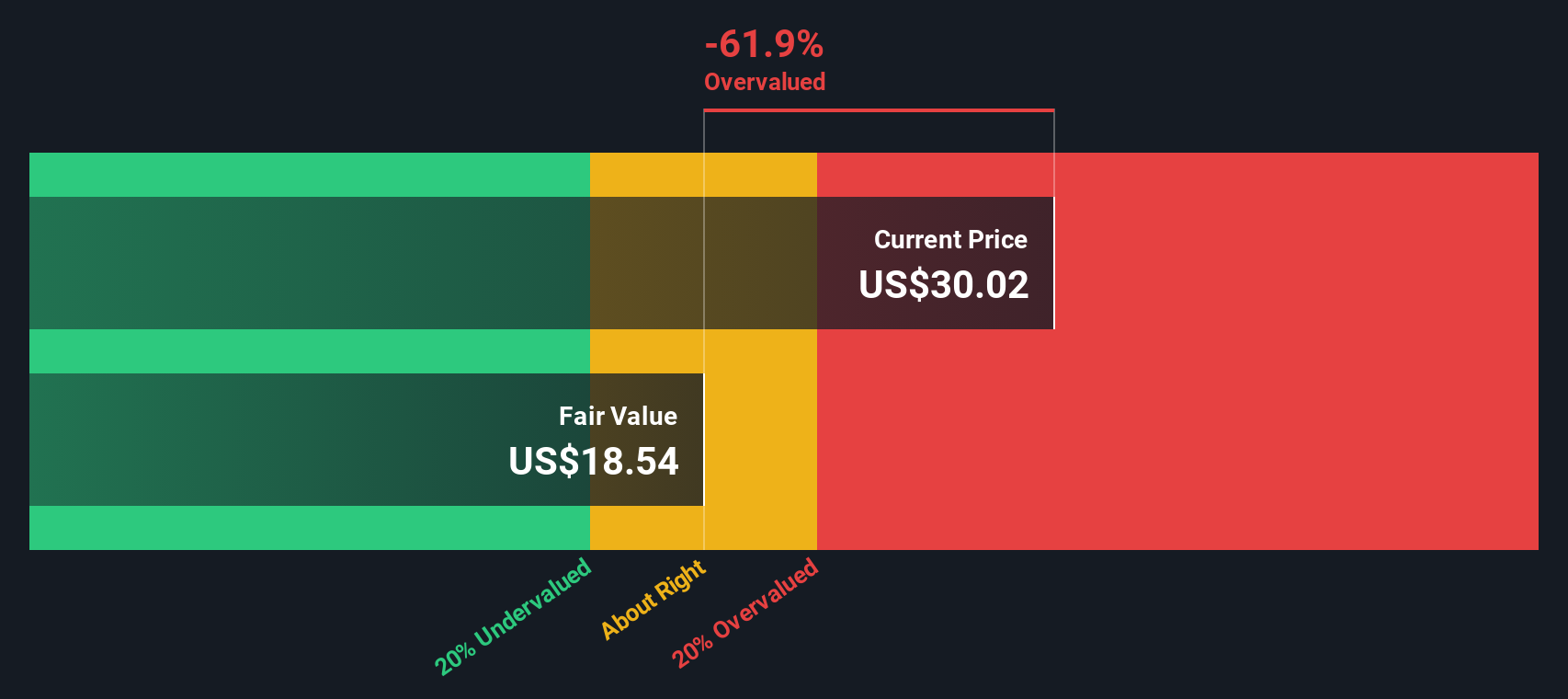

Another View: DCF Says Slightly Overvalued

While the popular narrative sees Appian as 26.7% undervalued at a fair value of $41.00, our DCF model points the other way. In that view, the shares trade above an estimated future cash flow value of $27.08, which raises a simple question: which story feels more realistic to you?

Build Your Own Appian Narrative

If you look at this and think the assumptions are off, or you simply prefer to test the numbers yourself, you can build a tailored view in minutes with Do it your way.

A great starting point for your Appian research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Appian has you thinking differently about where you put your money next, do not stop here. Broaden your watchlist with a few focused stock ideas.

- Spot potential turnaround stories by scanning these 885 undervalued stocks based on cash flows that the market may be pricing cautiously today.

- Zero in on cash generating businesses paying shareholders regularly with these 13 dividend stocks with yields > 3%.

- Lean into fast growing themes by checking out these 23 AI penny stocks that are tied to real business models, not just headlines.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.