Please use a PC Browser to access Register-Tadawul

Apple (AAPL): Margins Fall to 24.3%, Challenging Growth Story Behind Premium Valuation

Apple Inc. AAPL | 274.66 | -1.30% |

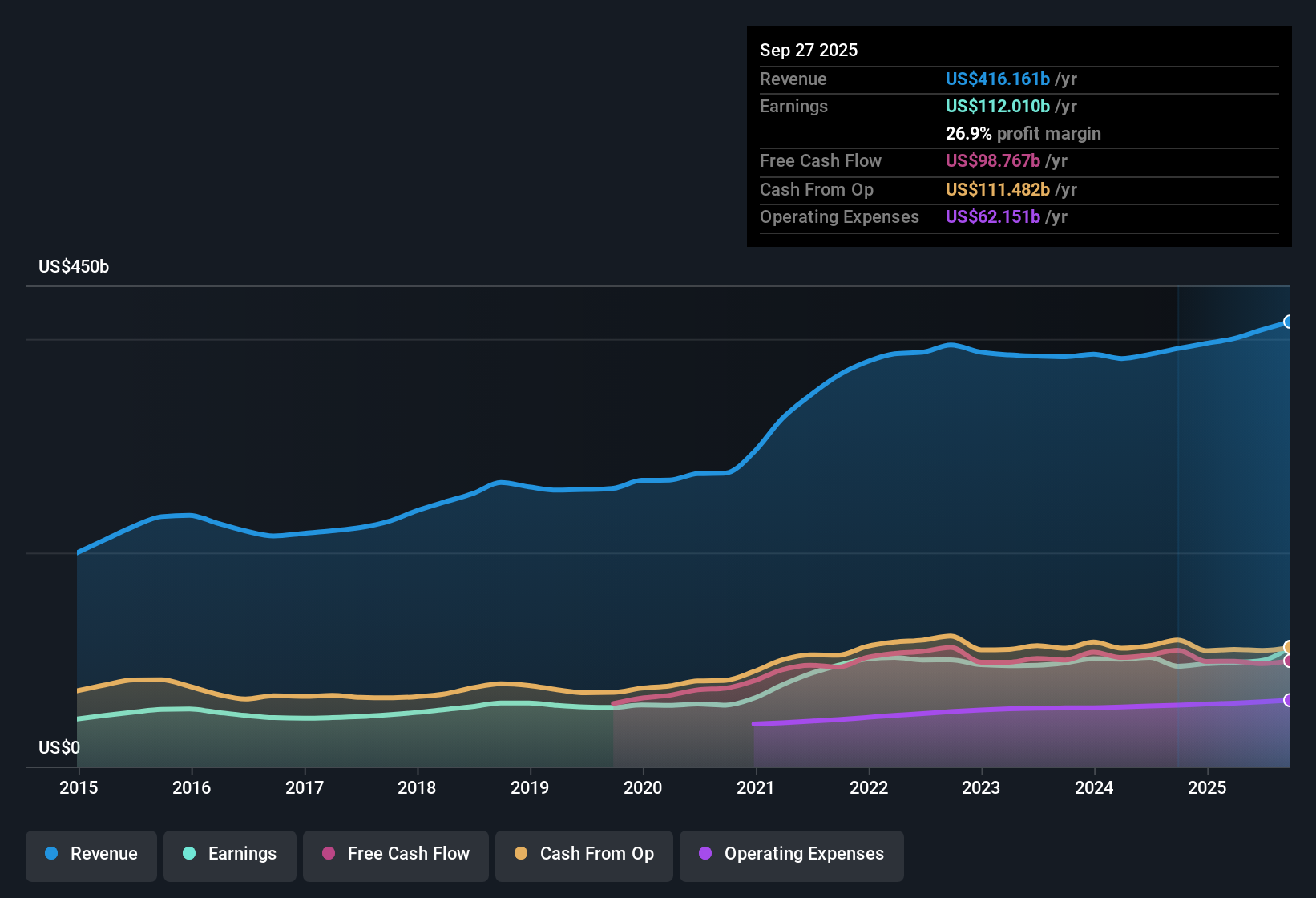

Apple (AAPL) reported earnings growth averaging 5.8% per year over the past five years, with net profit margins currently at 24.3% compared to 26.4% a year ago. Despite a forecast for earnings to rise by 8.2% annually and revenue by 5.7% per year, these figures lag behind the broader US market projections. Shares currently trade at $270.37, a premium to the estimated fair value of $231.08. The price-to-earnings ratio is 40.2x, which is well above peers and the global tech industry. While no major risks have been flagged and consensus still points to growth, investors are keeping a close eye on moderating profit margins and growth rates that trail the sector.

See our full analysis for Apple.Next, we will see how Apple’s headline numbers measure up to the big-picture stories. It is time to find out which market narratives get confirmed, and which are getting pushed back by the actual data.

Analysts Forecast Margins Rebounding to 28%

- Consensus projections show profit margins rising from today’s 24.3% to 28% in three years, following a noticeable drop from last year’s 26.4%. This anticipated upturn comes despite Apple’s recent earnings growth missing its five-year average, indicating a transition from short-term softness to expected margin rebuilding over the medium term.

- The analysts’ consensus view attributes this margin recovery to several catalysts:

- Expansion in high-growth emerging markets, ongoing development of the services ecosystem, and the introduction of new AI-powered product features are all expected to reinforce Apple’s premium pricing power and support the generation of more stable, higher-margin revenues.

- According to the consensus, margin improvements will come from both higher service adoption (with double-digit revenue gains in services and record paid subscriptions) and supply chain optimization, which should lower cost pressures and further bolster gross margin growth.

- The balance among these positive catalysts and the recent margin compression contributes to the analysts’ belief that Apple is positioned for a profit rebound that has yet to be fully reflected in headline numbers.

- Recent margin resilience despite sector headwinds keeps “high-quality earnings” in focus for investors interested in Apple’s long-term potential.

The consensus narrative encourages a closer examination of whether the expected gains from AI integration, emerging market expansion, and services materialize in the official margin numbers over the next three years. 📊 Read the full Apple Consensus Narrative.

Supply Chain and Regulatory Challenges Still Loom

- Analysts note that unpredictable tariff-related costs, such as the $1.1 billion impact forecast for next quarter, along with reliance on suppliers in China, India, and Vietnam, could create pressure on Apple’s margin recovery, potentially disrupt product availability, and erode earnings if global trade tensions intensify.

- The consensus narrative points out that regulatory scrutiny, particularly over the App Store and revenue-sharing arrangements with partners like Google, remains a significant threat:

- Some suggest that even as services revenues accelerate, tighter regulation or continued legal action could limit Apple’s net margins, especially if high-margin platform revenues encounter new restrictions or forced business model changes.

- Critics highlight that lengthening hardware upgrade cycles and increasing reliance on emerging market promotions introduce additional risk to sustaining topline growth, which could translate into lower profit margins if competitive pressures rise.

Premium Valuation Hinges on Delivering Growth

- With shares at $270.37, well above the DCF fair value of $231.08 and also exceeding the consensus analyst price target of $274.97, investors are paying 40.2 times earnings compared to 34.3x for peers and 23.9x for the global tech industry—a clear premium that incorporates high future expectations.

- According to the consensus narrative, for Apple to justify today’s valuation:

- Earnings would need to grow to $133.6 billion by 2028 (from $99.3 billion), with a sustained higher PE ratio of 31.4x, which remains well above the sector norm. Any setback in profit expansion or margin performance could increase the risk to the current valuation.

- Investors are counting on Apple’s consistent track record, but the relatively narrow gap between the current share price and the analyst target (just 0.8% higher) suggests most positive news may already be priced in, so further upside will depend on exceeding these ambitious forecasts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Apple on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your take on the numbers changed? If you see the story taking a different direction, you can craft your own narrative in moments. Do it your way

A great starting point for your Apple research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Apple’s premium valuation and slowing margin growth highlight the risk of paying for forecasts that may not fully materialize in future earnings.

If you want to target better value, try these 832 undervalued stocks based on cash flows to find stocks trading below intrinsic worth and reduce the odds of overpaying for growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.