Please use a PC Browser to access Register-Tadawul

Applied Digital Corporation (NASDAQ:APLD) Shares Slammed 28% But Getting In Cheap Might Be Difficult Regardless

Applied Digital APLD | 22.67 | -1.35% |

Applied Digital Corporation (NASDAQ:APLD) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. Still, a bad month hasn't completely ruined the past year with the stock gaining 39%, which is great even in a bull market.

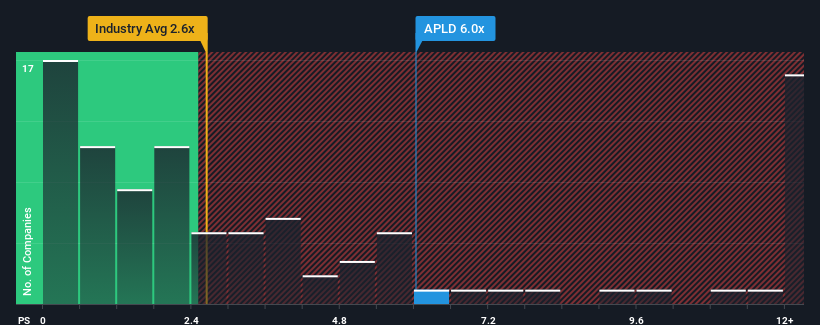

Although its price has dipped substantially, you could still be forgiven for thinking Applied Digital is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 6x, considering almost half the companies in the United States' IT industry have P/S ratios below 2.6x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Applied Digital's P/S Mean For Shareholders?

Applied Digital certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Applied Digital.What Are Revenue Growth Metrics Telling Us About The High P/S?

Applied Digital's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 85%. Still, revenue has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 50% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 9.9%, which is noticeably less attractive.

In light of this, it's understandable that Applied Digital's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Applied Digital's P/S

Even after such a strong price drop, Applied Digital's P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Applied Digital's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Applied Digital (at least 2 which don't sit too well with us), and understanding these should be part of your investment process.

If you're unsure about the strength of Applied Digital's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.