Please use a PC Browser to access Register-Tadawul

ARB IOT Group Limited (NASDAQ:ARBB) Shares Fly 34% But Investors Aren't Buying For Growth

ARB IOT GROUP LIMITED ARBB | 7.24 | +24.19% |

Despite an already strong run, ARB IOT Group Limited (NASDAQ:ARBB) shares have been powering on, with a gain of 34% in the last thirty days. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 7.4% over the last year.

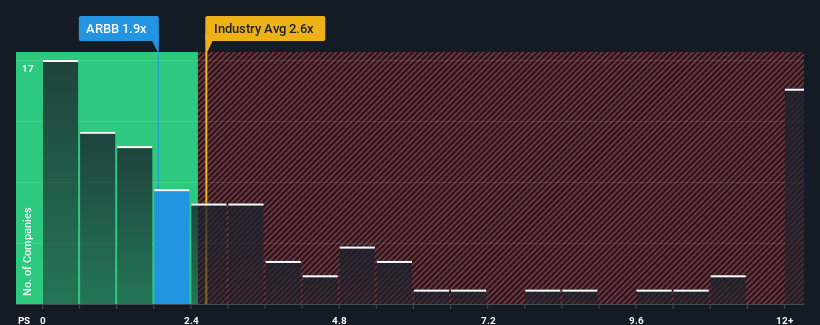

Even after such a large jump in price, ARB IOT Group may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.9x, considering almost half of all companies in the IT industry in the United States have P/S ratios greater than 2.6x and even P/S higher than 6x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

We've discovered 3 warning signs about ARB IOT Group. View them for free.

How ARB IOT Group Has Been Performing

For instance, ARB IOT Group's receding revenue in recent times would have to be some food for thought. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on ARB IOT Group will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on ARB IOT Group's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For ARB IOT Group?

ARB IOT Group's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 76%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 16% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Comparing that to the industry, which is predicted to deliver 17% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this information, we can see why ARB IOT Group is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Key Takeaway

The latest share price surge wasn't enough to lift ARB IOT Group's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

In line with expectations, ARB IOT Group maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.