Please use a PC Browser to access Register-Tadawul

Arch Capital Group ACGL Margins Soften As Combined Ratio Of 82.8% Tests Bullish Narratives

Arch Capital Group Ltd. ACGL | 98.49 | +0.15% |

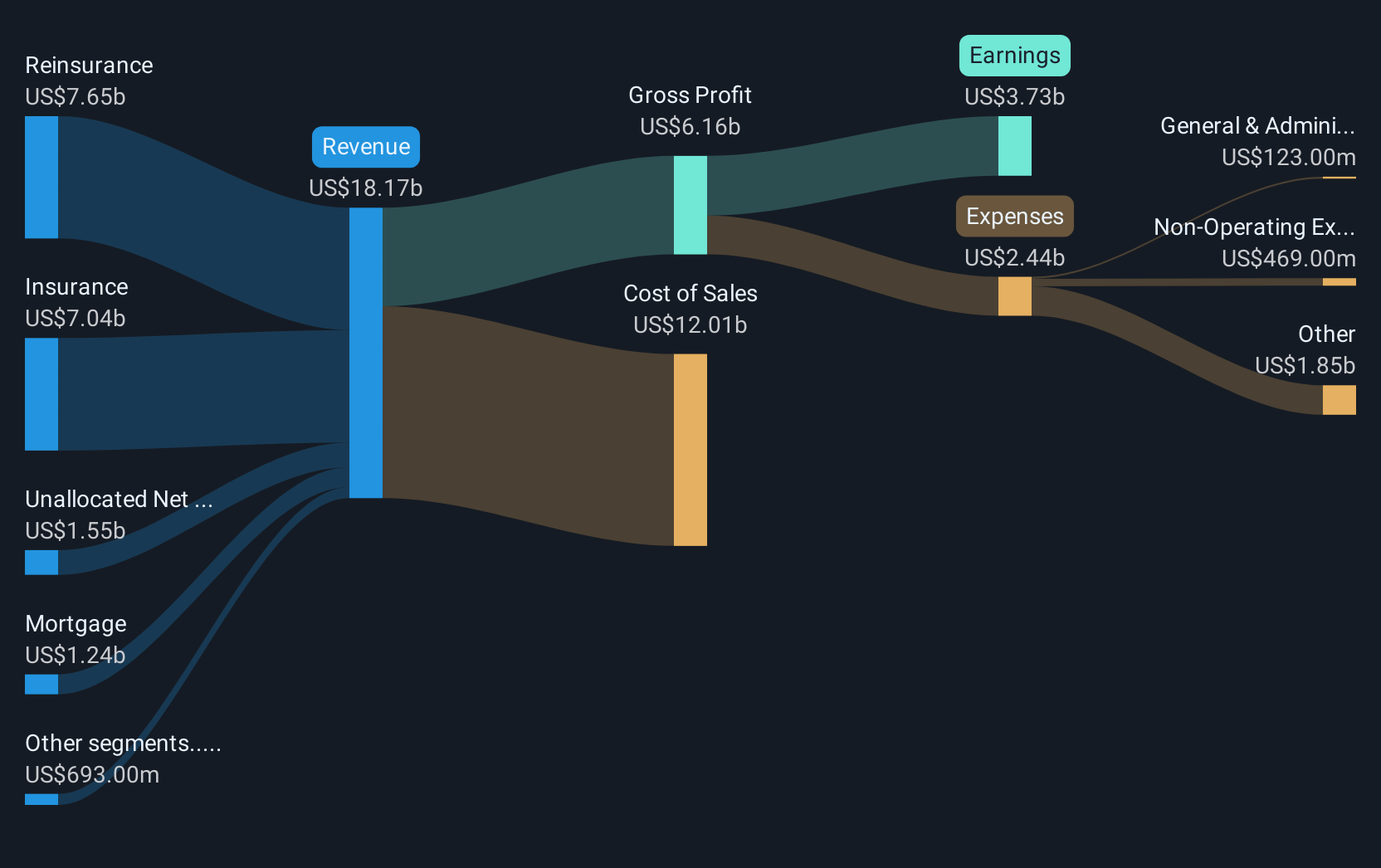

Arch Capital Group (ACGL) closed out FY 2025 with fourth quarter revenue of US$4.9b and basic EPS of US$3.42, alongside net income of US$1.2b. This contributed to trailing twelve month revenue of US$19.9b and EPS of US$11.83. Over recent quarters, revenue has moved from US$4.5b in Q4 2024 to US$5.1b in Q3 2025, before landing at US$4.9b in Q4 2025. Quarterly EPS shifted from US$2.48 to US$3.63 and then to US$3.42. All of this comes against a backdrop of an 82.8% trailing combined ratio, which keeps margins firmly in focus for investors parsing the quality of these results.

See our full analysis for Arch Capital Group.With the headline numbers on the table, the next step is to see how this earnings profile aligns with the stories investors already have in mind about Arch Capital, and where the data might either support those narratives or prompt a reassessment.

Margins Softening From 24.5% To 21.9%

- Net profit margin over the last 12 months sits at 21.9%, compared with 24.5% a year earlier, alongside a trailing combined ratio of 82.8% for FY 2025.

- Bears focus on margin pressure, and the recent slip in profit margin gives that view some backing. However, the current 21.9% level and US$4.4b of trailing net income still sit alongside five year earnings growth of 24.7% per year.

- Critics highlight that one year earnings growth of 2% is well below that five year pace, which they see as a sign that the strong run rate is harder to repeat.

- At the same time, the combined ratio stayed below 90% throughout FY 2025 and reached 79.8% in Q3 2025. This is a supportive data point for underwriting focused investors weighing that cautious narrative.

TTM Earnings Growth Slows To 2%

- Trailing 12 month earnings growth is 2%, which is much lower than the 24.7% per year pace over the last five years, even though trailing net income is US$4.4b on US$19.9b of revenue.

- Supporters of the bullish view argue that Arch’s focus on data driven risk selection and cycle management can support earnings over time, and the current figures give mixed but useful evidence for that claim.

- On one hand, the 2% recent earnings growth rate and the step down in profit margin from 24.5% to 21.9% sit uneasily beside the idea of steadily improving profitability.

- On the other hand, FY 2025 still produced quarterly EPS between US$3.30 and US$3.63 in Q2 and Q3, with net income over US$1.2b in both Q2 and Q4. This shows the earnings base is sizeable as bulls look at longer term stories in casualty and reinsurance.

P/E Around 8x And Deep DCF Discount

- At a share price of US$97.85, the stock trades at a P/E of about 8x, below peer and industry averages near 12x to 12.6x, and below a DCF fair value of about US$228.87, while analysts’ forecasts in the data point to average earnings and revenue declines of about 3.8% per year over the next three years.

- Consensus narrative points to potential for earnings to reach about US$4.0b and EPS of US$10.66 by around 2028, and the current figures give investors both support and pushback for that middle ground view.

- The trailing net income of roughly US$4.4b already sits close to that earnings level. This aligns with the idea that Arch is operating at a scale similar to the scenario used in consensus price targets around US$108.32.

- However, the forecast 3.8% per year declines in earnings and revenue over the next three years contrast with the past five year growth of 24.7% per year. Anyone relying on the consensus view needs to be comfortable with a slower earnings path than the historical record in the data.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Arch Capital Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Take a couple of minutes to test your own view against the figures and shape the story you think fits best, then Do it your way.

A great starting point for your Arch Capital Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Arch Capital’s slower 2% trailing earnings growth and softer net margin of 21.9% compared with 24.5% highlight pressure on profitability and momentum.

If that cooling earnings profile has you looking for fresher opportunities, check out screener containing 24 high quality undiscovered gems that spotlight companies with stronger growth stories and potentially more appealing upside right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.