Please use a PC Browser to access Register-Tadawul

Ardelyx, Inc. (NASDAQ:ARDX) Stock Catapults 37% Though Its Price And Business Still Lag The Industry

Ardelyx, Inc. ARDX | 5.73 | -14.99% |

Ardelyx, Inc. (NASDAQ:ARDX) shares have continued their recent momentum with a 37% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 58%.

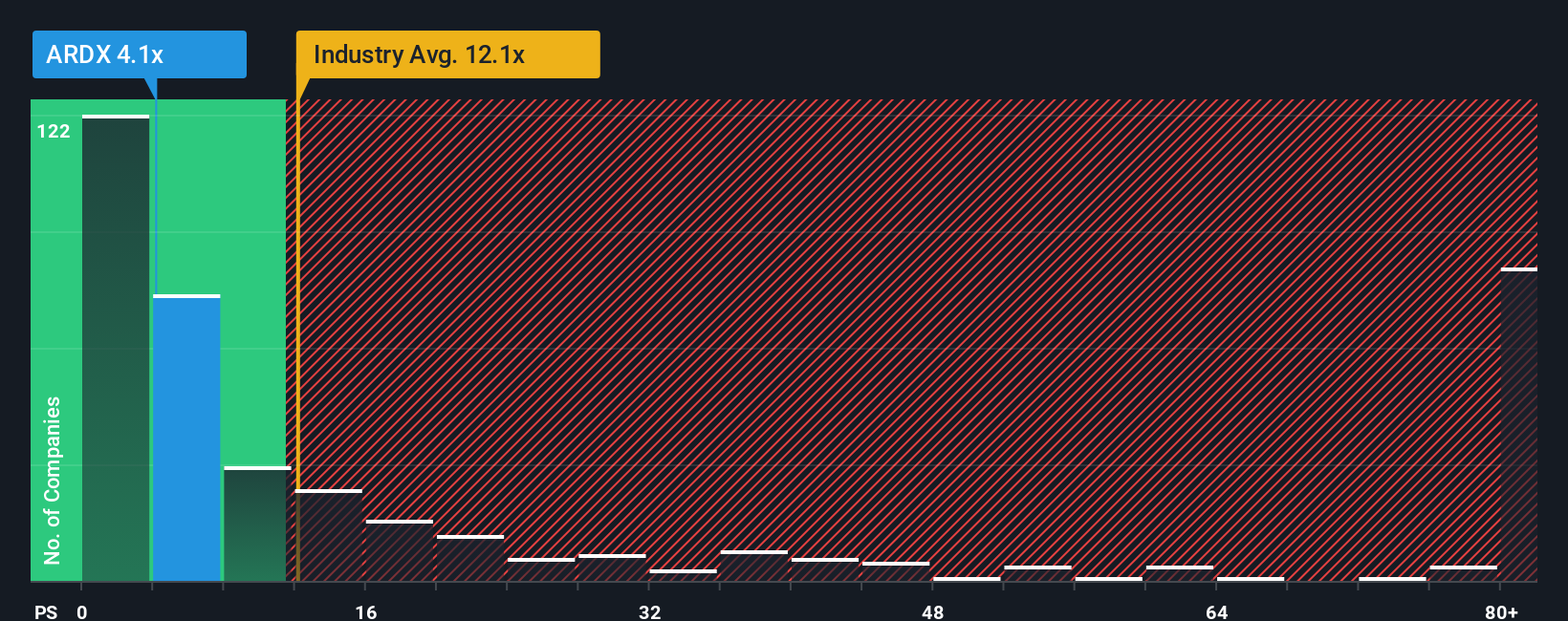

In spite of the firm bounce in price, Ardelyx may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 4.7x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 11.4x and even P/S higher than 79x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

How Ardelyx Has Been Performing

Recent times haven't been great for Ardelyx as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Ardelyx will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Ardelyx?

The only time you'd be truly comfortable seeing a P/S as depressed as Ardelyx's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered an exceptional 58% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 28% each year over the next three years. With the industry predicted to deliver 126% growth per year, the company is positioned for a weaker revenue result.

With this information, we can see why Ardelyx is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Ardelyx's P/S Mean For Investors?

Even after such a strong price move, Ardelyx's P/S still trails the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, our analysis of Ardelyx's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Ardelyx, and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.