Please use a PC Browser to access Register-Tadawul

Ardmore Shipping (ASC) Margin Reset To 10.3% Challenges Tanker Bull Narratives

Ardmore Shipping Corp. ASC | 15.13 | +1.68% |

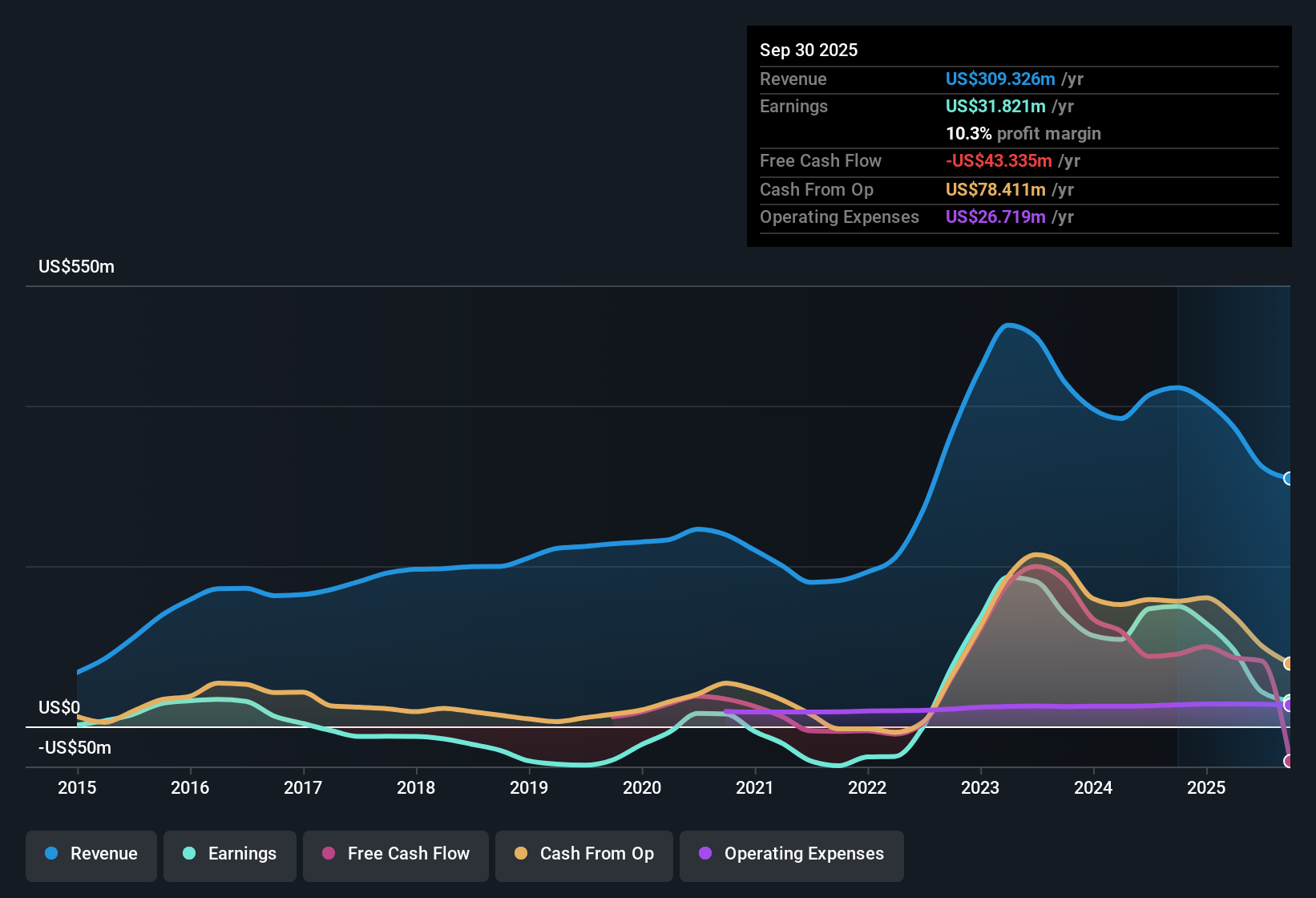

Ardmore Shipping (ASC) opened FY 2025 with third quarter revenue of US$81.2 million and basic EPS of US$0.30, alongside net income of US$12.1 million, setting a clear marker for how its product tanker business is currently trading. The company has seen quarterly revenue move from US$121.3 million in Q2 2024 to US$82.0 million in Q4 2024, then to US$74.0 million and US$72.0 million in Q1 and Q2 2025 before reaching US$81.2 million in Q3 2025. EPS over the same stretch shifted from US$1.48 to US$0.12, US$0.14, US$0.22 and now US$0.30, giving investors a detailed view of how top line and per share earnings are tracking through the tanker cycle as margins reset.

See our full analysis for Ardmore Shipping.With the latest numbers on the table, the next step is to see how this profit and margin profile lines up with the key Ardmore Shipping narratives that investors often lean on, and where those stories might now need updating.

Margins Reset To 10.3% On Trailing Basis

- Over the last 12 months, Ardmore’s net profit margin sits at 10.3%, compared with 35.4% a year earlier, alongside trailing revenue of US$309.3 million and net income of US$31.8 million.

- Consensus narrative talks about tighter tanker supply and longer trade routes supporting margins over time. However, the move from a 35.4% margin to 10.3% shows that recent reported profitability has been much thinner than that story suggests.

- FY 2025 Q3 net income of US$12.1 million on US$81.2 million of revenue is a very different profile to FY 2024 Q2, when net income was US$61.8 million on US$121.3 million of revenue.

- The five year average earnings growth rate of 37.3% contrasts with the most recent year, where earnings declined, which is important context if you are leaning heavily on the bullish view that margins can stay elevated.

P/E Of 17.4x With A 7% Dividend

- The shares trade on a P/E of 17.4x, higher than peers at 12x and the US Oil & Gas industry at 14.1x, while screening below the broader US market P/E of 19.5x, and the dividend yield is reported at 7% even though it is not well covered by free cash flow.

- Bears focus on valuation and income quality, and the current mix of a 17.4x P/E and a 7% dividend that is not comfortably backed by free cash flow gives them specific numbers to point to.

- The DCF fair value in the data is US$16.78, compared with a share price of US$13.10 and an allowed analyst price target of US$15.95, so anyone worried about overpaying can see that different valuation tools are giving different signals.

- The drop in trailing net profit margin from 35.4% to 10.3%, combined with dividend coverage concerns, directly challenges the idea that the current yield is low risk income.

Earnings Trend Vs Tanker Bull Story

- Trailing 12 month Basic EPS is US$0.78, down from US$3.54 to US$3.60 in the prior year snapshots, while quarterly EPS has moved from US$1.48 in FY 2024 Q2 to US$0.30 in FY 2025 Q3.

- Bulls often highlight tightening tanker supply and high utilization, and those themes are present in the consensus narrative. However, the earnings line over the last year has not tracked that bullish story in a straight line.

- Trailing revenue has shifted from US$413.4 million and net income of US$146.7 million in FY 2024 Q2 to US$309.3 million of revenue and US$31.8 million of net income in FY 2025 Q3, which is far below the period that bullish arguments sometimes reference.

- Analysts’ consensus view still links the business to longer trade routes and a modern fleet as positives, but the recent earnings decline versus the five year 37.3% average growth rate underlines how closely tied results are to the tanker rate cycle.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ardmore Shipping on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? If the figures tell you a different story, shape that view into your own narrative in just a few minutes and Do it your way

A great starting point for your Ardmore Shipping research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Ardmore’s thinner 10.3% trailing margin, lower trailing EPS and a 7% dividend that is not well covered by free cash flow highlight income and payout quality concerns.

If that mix of stretched payout and softer earnings makes you uneasy, it is a good time to check out 16 dividend fortresses built around companies with income profiles that look more robust on the numbers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.