Please use a PC Browser to access Register-Tadawul

Arista Networks (ANET) Valuation in Focus After Analyst Day Highlights AI, Cloud Growth Strategy and New Executive Moves

Arista Networks, Inc. ANET | 124.76 | -7.17% |

Most Popular Narrative: 17.7% Overvalued

According to the most widely followed narrative, Arista Networks is currently trading at a premium, with the stock seen as 17.7% above its fair value. The narrative highlights the company’s impressive performance and ambitious financial projections, but ultimately suggests that the market has already priced in much of the future growth story.

Perfect fit of Arista HW and Arista SW, as known from Apple devices, leads to high customer satisfaction and customer binding. I focus also on: More equity than debt. Ratio is at 0%. So debt free company!

Curious what drives confidence in such a lofty valuation? This narrative is built on bold growth assumptions and hints at a powerful combination of operational strength and margin potential. Wondering which financial milestones are being counted on to support that premium? Explore how the numbers fuel this compelling market stance.

Result: Fair Value of $127.06 (OVERVALUEED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifting market demand or unexpected competitive pressure could quickly challenge these optimistic growth assumptions and introduce volatility to the current valuation story.

Find out about the key risks to this Arista Networks narrative.Another View: Discounted Cash Flow Model

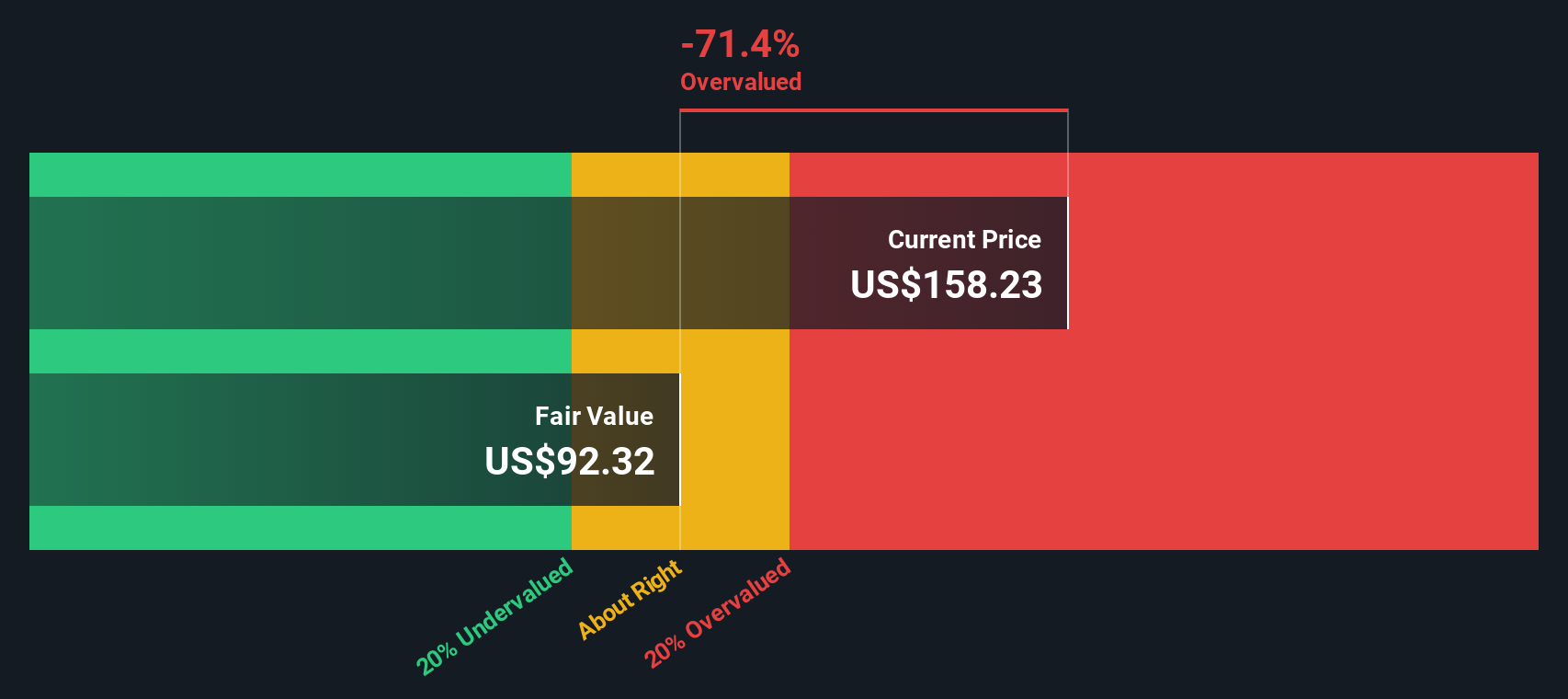

Contrasting with the upbeat market narrative, our SWS DCF model also signals that Arista Networks is trading above what its long-term cash flows would justify. This suggests a different perspective on the current price momentum. Is the optimism outpacing fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Arista Networks Narrative

If these takes do not align with your perspective, you can dig into the details yourself and shape a personal Arista Networks narrative in just a few minutes. Do it your way.

A great starting point for your Arista Networks research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Smart investors do not limit themselves to just one story. Make sure your portfolio stands out by tapping into breakthrough trends and emerging sectors shaping tomorrow’s market.

- Unlock the potential for robust income streams by tapping into companies known for dividend stocks with yields > 3%. These can help strengthen your returns even in uncertain times.

- Catalyze your growth strategy by zeroing in on AI penny stocks, firms at the forefront of artificial intelligence innovation. Turn industry disruption into your advantage.

- Position yourself ahead of the curve by targeting quantum computing stocks, which are poised to benefit from the rise of quantum computing technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.