Please use a PC Browser to access Register-Tadawul

Arista Networks (ANET) Valuation in Focus After Analyst Downgrade Highlights Cautious Growth and Margin Outlook

Arista Networks, Inc. ANET | 138.88 | +1.01% |

Arista Networks (ANET) shares drew renewed attention after a leading research firm revised its rating from Buy to Hold, citing expectations of moderating revenue growth and a minor contraction in operating margins for next year.

Arista Networks’ big gains over the last year, with its total shareholder return reaching a hefty 30.7%, have cooled recently. The share price climbed 10.4% year-to-date but dropped 13.7% in the past month. The rating downgrade and lingering questions about future growth have clearly shifted the market’s mood, even as demand from heavyweights like Microsoft and Meta continues to fuel longer-term optimism.

If you’re wondering what else tech has to offer right now, now’s the perfect moment to discover See the full list for free.

Given its rapid multi-year run and a recent pullback, the central question for investors is whether Arista Networks is now undervalued after the dip, or if all its future growth prospects are already reflected in the stock price.

Most Popular Narrative: 24.7% Undervalued

With a fair value pegged at $163.87 and Arista Networks last closing at $123.45, the most popular narrative suggests the stock trades well below its projected worth, sparking debate on whether the market is missing the company's longer-term earnings power.

The migration of AI networking from proprietary standards (InfiniBand, NVLink) to open Ethernet solutions is expanding Arista's addressable market. This trend is expected to drive sustained multi-year revenue growth as hyperscalers and enterprises favor open, scalable architectures for both back-end and front-end AI clusters.

What are the bold forecasts behind that high fair value? Revenue acceleration, margin resilience, and future profit multiples come together to justify this bullish view. Curious how these drivers stack up and whether they hold water? Uncover the numbers that could have Wall Street rethinking Arista’s true worth.

Result: Fair Value of $163.87 (UNDERVALUED)

However, reliance on a handful of major customers and intensifying competition could disrupt Arista’s steady growth story and introduce unexpected volatility to future results.

Another View: Peer Ratios Raise Questions

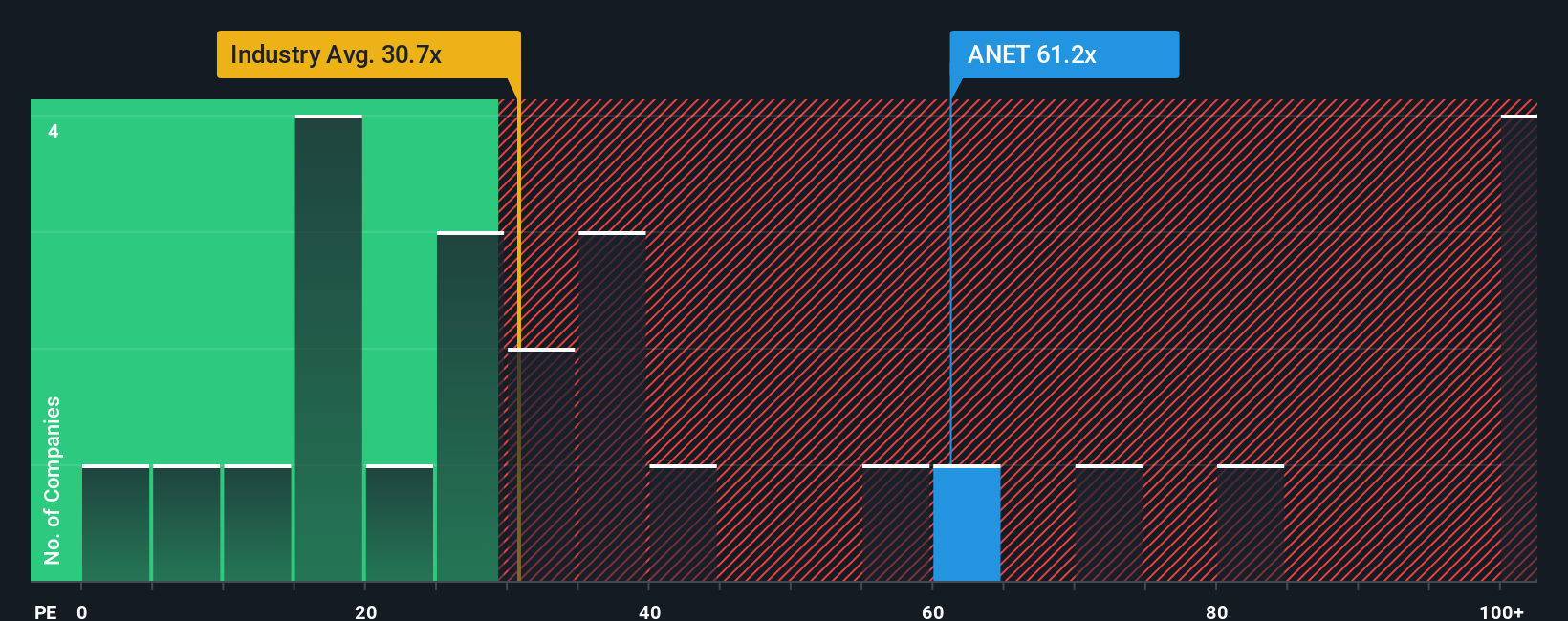

Looking through the lens of earnings multiples, Arista trades at 46.3 times earnings, much higher than the industry average of 30.8, and just above its fair ratio of 45.4. While this could signal optimism about future growth, it also means the bar for performance is quite high. Could investors be overestimating how much more Arista can deliver?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Arista Networks for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Arista Networks Narrative

Want a different perspective or like to dig into the numbers yourself? It only takes a few minutes to shape your own Arista story: Do it your way

A great starting point for your Arista Networks research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let smart opportunities pass you by. Equip yourself with fresh stock ideas using these targeted screeners tailored for bold, forward-thinking investors:

- Spot rising stars and seize potential gains before the crowd by checking out these 3587 penny stocks with strong financials on the move.

- Get ahead of the curve in the AI revolution with these 27 AI penny stocks powering tomorrow’s biggest breakthroughs.

- Boost your income stream by zeroing in on these 18 dividend stocks with yields > 3% delivering standout yields above 3% and robust financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.