Please use a PC Browser to access Register-Tadawul

Array Technologies, Inc. (NASDAQ:ARRY) Surges 32% Yet Its Low P/S Is No Reason For Excitement

Array Technologies ARRY | 7.92 | -3.18% |

Array Technologies, Inc. (NASDAQ:ARRY) shares have continued their recent momentum with a 32% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 50% in the last year.

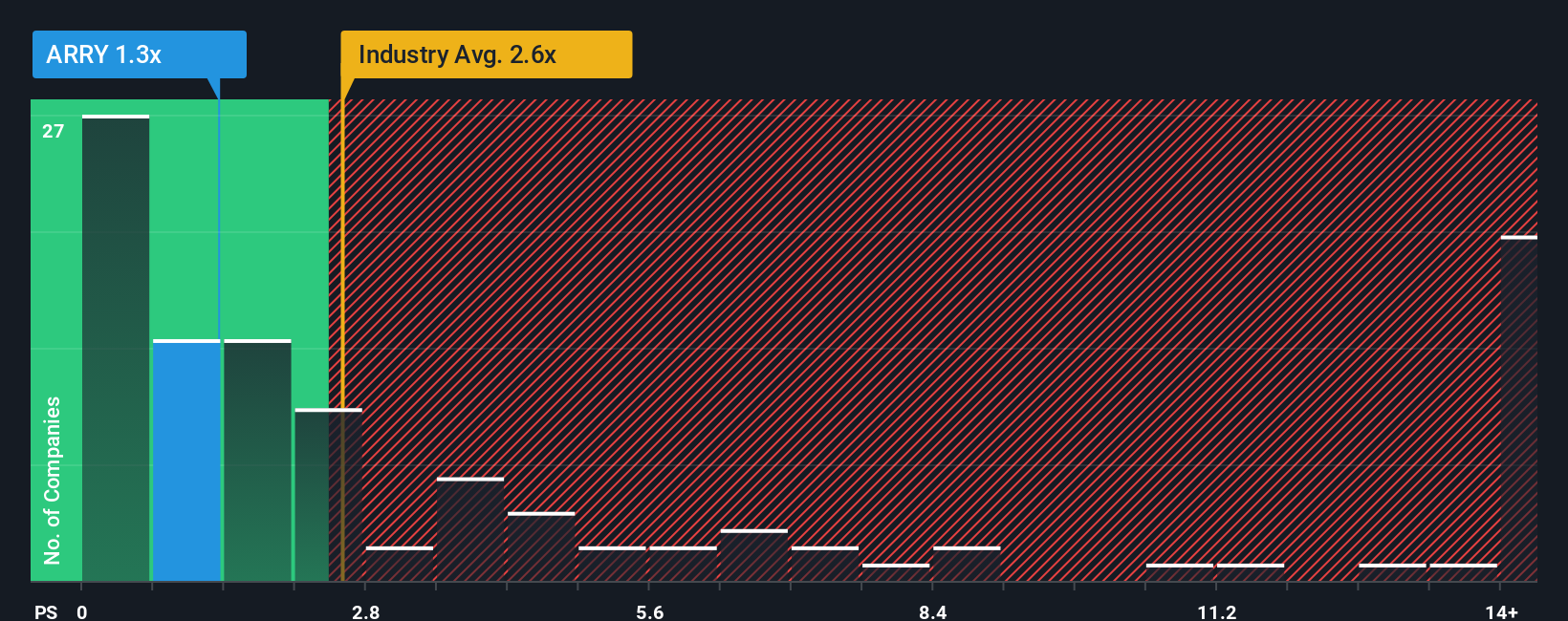

Although its price has surged higher, Array Technologies may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.3x, considering almost half of all companies in the Electrical industry in the United States have P/S ratios greater than 2.6x and even P/S higher than 7x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Has Array Technologies Performed Recently?

With revenue growth that's inferior to most other companies of late, Array Technologies has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Array Technologies.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Array Technologies' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.4% last year. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 8.7% each year as estimated by the analysts watching the company. With the industry predicted to deliver 17% growth each year, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Array Technologies' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Array Technologies' stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Array Technologies' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Having said that, be aware Array Technologies is showing 1 warning sign in our investment analysis, you should know about.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.