Please use a PC Browser to access Register-Tadawul

Artisan Partners Asset Management (APAM) Valuation Check After Positive Earnings ESP And Strong Preliminary AUM

Artisan Partners Asset Management, Inc. Class A APAM | 41.60 | -0.55% |

Artisan Partners Asset Management (APAM) is back in focus after analyst commentary pointed to a positive Earnings ESP and a track record of earnings beats, along with fresh data on its assets under management.

At a share price of US$44.31, Artisan’s recent movement has been relatively steady, with a 30 day share price return of 6.8% and a year to date share price return of 7%. The 1 year total shareholder return of 12.19% and 3 year total shareholder return of 55.52% show that investors who stayed invested have seen meaningful gains, suggesting momentum has been building over the medium term as assets under management updates and the recent board appointment keep the story in focus.

If you are looking beyond asset managers, this could be a good moment to widen your watchlist and check out fast growing stocks with high insider ownership.

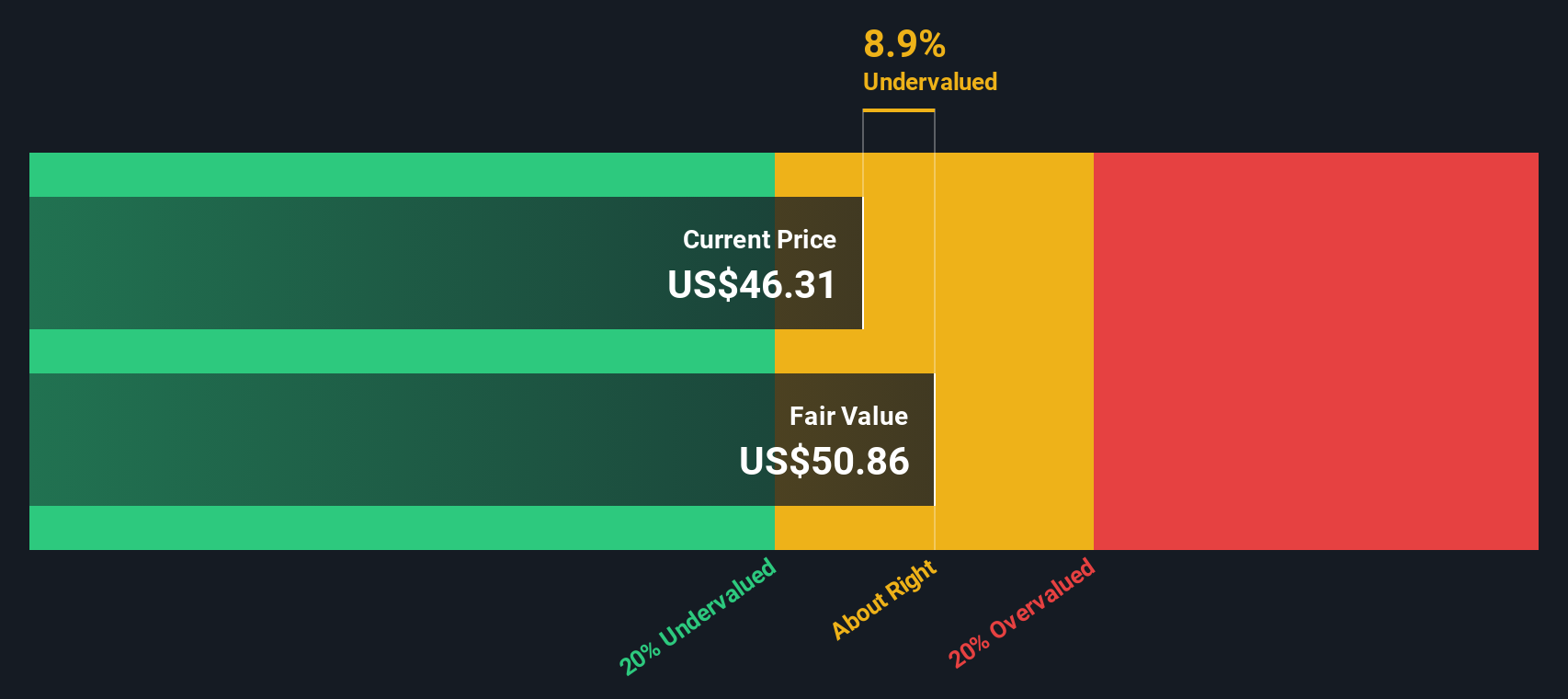

So with solid recent returns, growing revenue and net income, and an intrinsic value estimate suggesting a 6.4% discount, is Artisan Partners still offering a genuine value opportunity, or is the market already pricing in future growth?

Most Popular Narrative: 2.5% Overvalued

At a last close of US$44.31 versus a narrative fair value of US$43.25, the current setup suggests a small premium that hinges on finely balanced long term assumptions.

The analysts have a consensus price target of $46.125 for Artisan Partners Asset Management based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $51.0, and the most bearish reporting a price target of just $41.5.

Curious what kind of revenue path and margin profile need to line up to support that valuation work, under an 8% discount rate and tighter earnings assumptions?

The most followed narrative builds its view on moderate revenue expansion, slightly softer margins, and an earnings profile that grows steadily rather than rapidly, all discounted at about 8.29%. It also leans on a future P/E multiple that sits below the current Capital Markets industry level, which keeps the implied valuation from running too far ahead of those earnings estimates. On that basis, the narrative concludes that today’s price sits a touch above its fair value mark, although not by a wide margin.

Result: Fair Value of $43.25 (OVERVALUED)

However, there are still a couple of pressure points that could flip this view, including higher costs from new strategies and any disappointment around cash-linked dividends.

Another Angle on Value

That 2.5% overvaluation call sits awkwardly next to our own fair value estimate. Using our DCF model, APAM at US$44.31 is trading 6.4% below an internal fair value of US$47.36, which points to a mild margin of safety rather than a premium. Which interpretation do you find more persuasive?

Build Your Own Artisan Partners Asset Management Narrative

If these conclusions do not quite line up with your own view, or you would rather test the assumptions yourself, you can build a custom scenario in just a few minutes, starting with Do it your way.

A great starting point for your Artisan Partners Asset Management research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Artisan has your attention, do not stop there. Broaden your watchlist and use the Simply Wall St Screener to spot other opportunities quickly and confidently.

- Target potential high return setups by checking out these 3526 penny stocks with strong financials that already pass strict financial strength filters.

- Position yourself in fast moving themes by scanning these 20 cryptocurrency and blockchain stocks tied to digital assets and blockchain infrastructure.

- Strengthen your income focus by reviewing these 12 dividend stocks with yields > 3% that currently offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.