Please use a PC Browser to access Register-Tadawul

Assessing Advanced Energy Industries (AEIS) Valuation After Data Center Growth Focus And Industrial & Medical Deal Talk

Advanced Energy Industries, Inc. AEIS | 331.23 | +3.30% |

Recent commentary on Advanced Energy Industries (AEIS) is centering on its exposure to data center computing and semiconductor power delivery, alongside interest in a potential Industrial & Medical acquisition that could reshape the company’s earnings mix.

The recent focus on data center and semiconductor growth, along with talk of an Industrial & Medical acquisition, comes after a 31.76% 90 day share price return and a 97.30% one year total shareholder return from a last close of US$250.95. Together, these developments indicate that momentum may be building as investors reassess both growth potential and risk around the future earnings mix.

If this kind of power and semiconductor story has your attention, it could be a time to widen your watchlist with high growth tech and AI stocks as potential next candidates to research.

After a 97.30% one-year total shareholder return and a last close just below the current analyst price target, the key question is whether Advanced Energy Industries is still mispriced or if the market is already incorporating expectations for the next phase of growth.

Price-to-Earnings of 65x: Is it justified?

At a P/E of 65x on the last close of US$250.95, Advanced Energy Industries is priced well above both its own estimated fair level and key comparison points.

The P/E multiple compares the current share price to earnings per share, so a higher figure often means investors are paying more today for each unit of current earnings. For a power and semiconductor focused business like AEIS, this can reflect expectations for strong earnings progress as data center, semiconductor and industrial demand evolve.

Here, the 65x P/E is not just higher than peers at 30.2x and the broader US Electronic industry at 27.8x, it is also above the estimated fair P/E of 41.4x. Our fair ratio work points to 41.4x as a level the market could move toward if sentiment or forecasts change.

Result: Price-to-Earnings of 65x (OVERVALUED)

However, the rich 65x P/E leaves little room for disappointment if data center or semiconductor demand softens, or if any large Industrial & Medical deal underwhelms on returns.

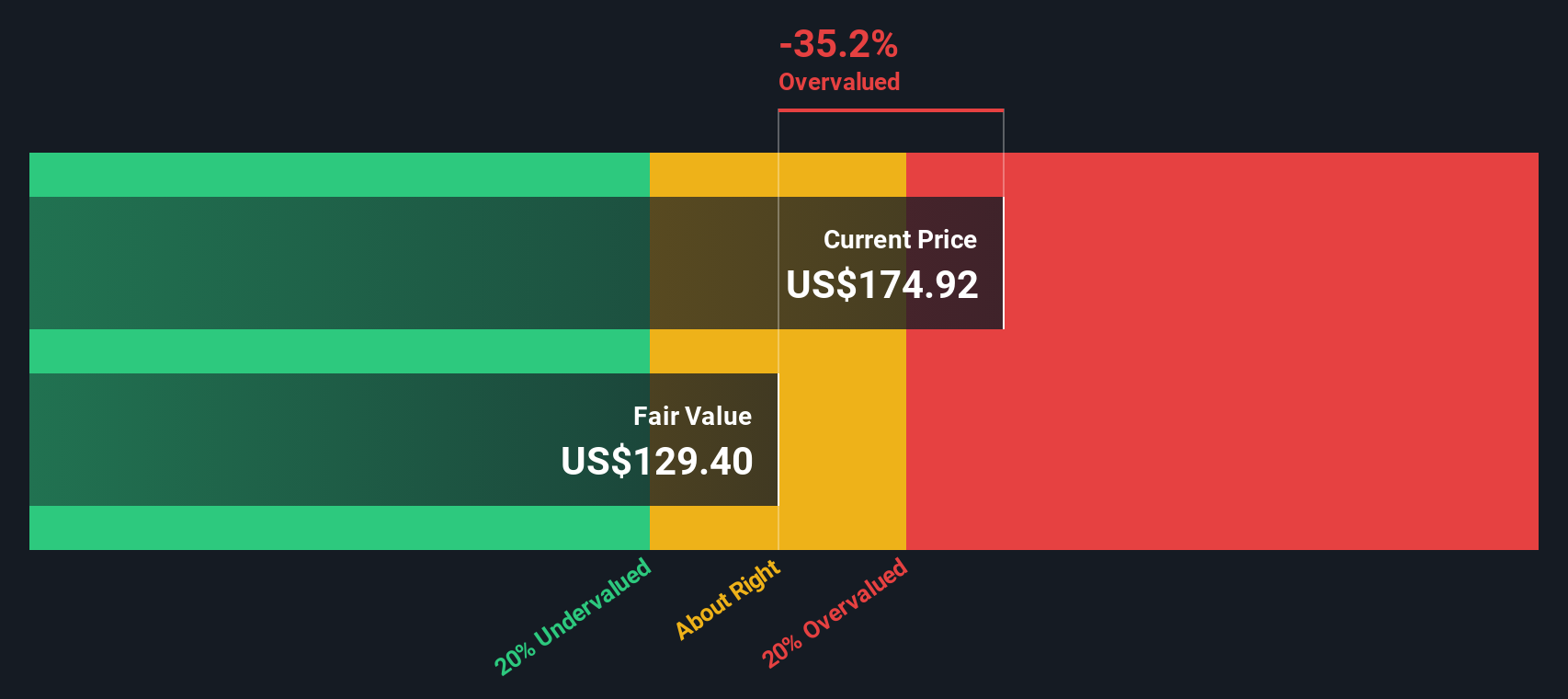

Another View: SWS DCF Model Also Flags Rich Pricing

Our DCF model points in the same direction as the high 65x P/E. With an estimated fair value of US$220.71 versus the current US$250.95, shares screen as overvalued on cash flow assumptions too. If both earnings multiples and cash flows are stretched, where is the margin of safety?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Advanced Energy Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Advanced Energy Industries Narrative

If you view the numbers differently or want to stress test your own assumptions, you can quickly build a personal view on AEIS by starting with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Advanced Energy Industries.

Looking for more investment ideas?

If you are interested in AEIS, there is no reason to stop here. Broaden your opportunity set now or you might miss other compelling setups.

- Spot potential high growth stories early by scanning these 3530 penny stocks with strong financials that already show stronger fundamentals than many larger peers.

- Target the intersection of computing and automation by checking out these 24 AI penny stocks that aim to turn AI trends into real revenue and cash flow.

- Hunt for mispriced opportunities using these 872 undervalued stocks based on cash flows that appear cheap based on cash flows rather than short term market sentiment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.