Please use a PC Browser to access Register-Tadawul

Assessing Amneal Pharmaceuticals (AMRX) Valuation After Recent Share Price Momentum

Amneal Pharmaceuticals, Inc. Class A AMRX | 14.50 | -0.68% |

Why Amneal Pharmaceuticals Is On Investors’ Radar

Amneal Pharmaceuticals (AMRX) has attracted fresh attention after recent share price moves, with the stock showing a 0.6% decline over the last day but gains over the past week, month, and past 3 months.

That recent pullback comes after a strong run, with a 27.8% 90 day share price return and a very large 3 year total shareholder return. Together, these point to momentum that has attracted fresh attention to Amneal’s growth prospects and risk profile.

If Amneal’s move has you thinking about opportunities in the sector, it could be a good moment to scan other healthcare stocks that are catching investors’ attention.

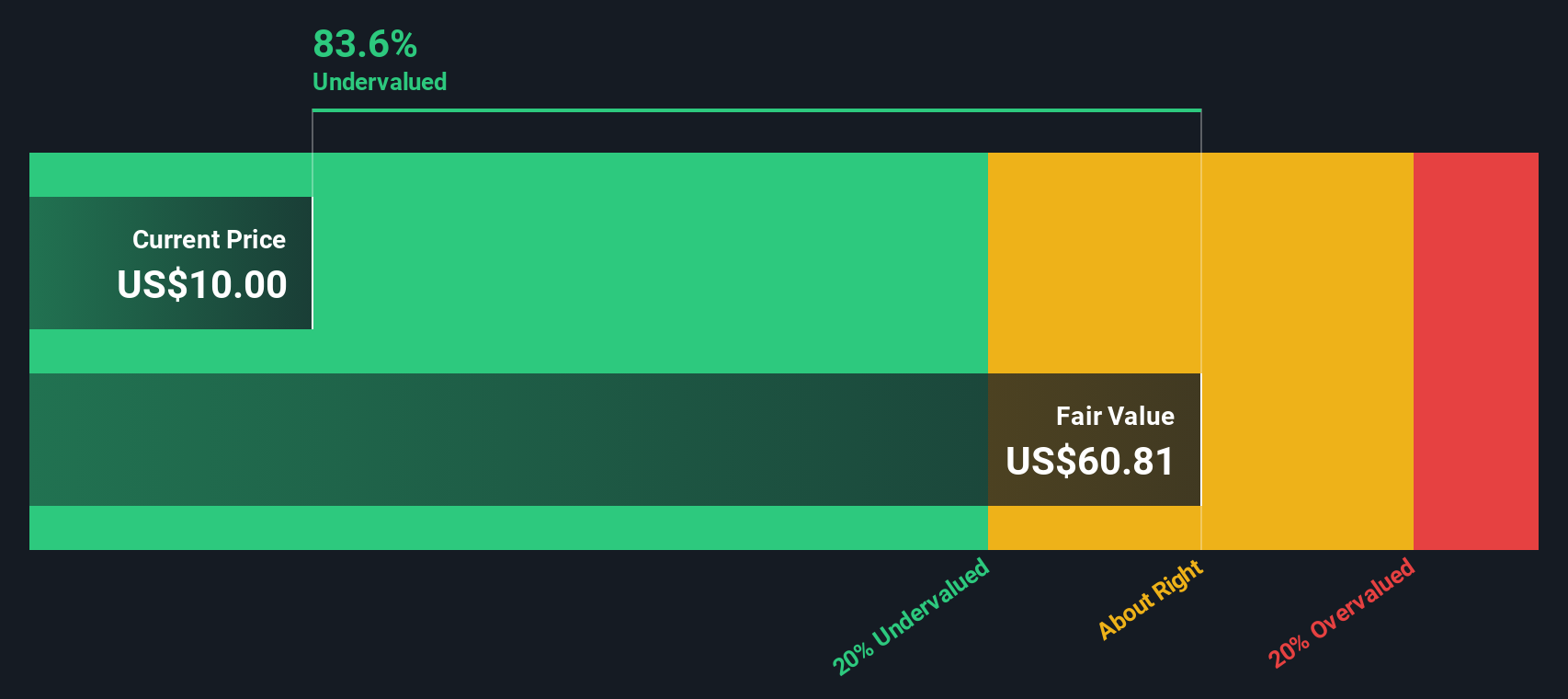

With Amneal trading at US$13.33 against a US$14.40 analyst target and an intrinsic value marker suggesting a sizeable discount, you have to ask: is this a genuine value opportunity, or is the market already baking in future growth?

Price to Sales of 1.4x: Is It Justified?

On a simple yardstick, Amneal’s 1.4x P/S against a US$13.33 share price lines up with an undervaluation story when you compare it with both peers and an estimated fair range.

The P/S ratio relates the company’s market value to its revenue, which is often useful for drug makers where earnings can be affected by one off items or recent shifts into profitability. For Amneal, this lens highlights how much investors are currently paying for each dollar of the US$2.93b in annual revenue.

Right now, that 1.4x P/S sits well below the peer group at 6x and the broader US Pharmaceuticals industry at 4.7x. This represents a strong relative discount. It is also below an estimated fair P/S of 3x, suggesting room for the market to move closer to that level if sentiment aligns with the revenue profile.

Result: Price to Sales of 1.4x (UNDERVALUED)

However, the investment case can quickly change if revenue growth of 7.3% slows, or if net income of US$5.9m highlights ongoing margin pressure in a competitive generics market.

Another Way To Look At Value

While the 1.4x P/S points to a discount, our DCF model presents an even more significant difference, with an estimated fair value of US$69.18 per share compared to the current US$13.33 price. If that gap is real and sustainable, what exactly is the market concerned about?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Amneal Pharmaceuticals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Amneal Pharmaceuticals Narrative

If you see the story differently or simply prefer to work through the numbers yourself, you can build a personalised view in minutes with Do it your way.

A great starting point for your Amneal Pharmaceuticals research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Ready To Find More Investment Ideas?

If Amneal has caught your eye, do not stop here; broaden your watchlist now so you are not looking back later wishing you had acted sooner.

- Spot potential bargains early by scanning these 879 undervalued stocks based on cash flows to find companies trading at a discount to their cash flow potential.

- Tap into future tech themes with these 23 AI penny stocks focused on businesses tied to artificial intelligence trends and applications.

- Add a different source of income by reviewing these 13 dividend stocks with yields > 3% to see companies offering dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.