Please use a PC Browser to access Register-Tadawul

Assessing AnaptysBio (ANAB) Valuation As Technical Strength Meets Improving Profitability Prospects

AnaptysBio, Inc. ANAB | 49.73 50.00 | +3.82% +0.54% Post |

Technical momentum meets improving fundamentals

Recent analysis flags AnaptysBio (ANAB) as fitting the Minervini Trend Template while also pointing to earnings growth and a move toward profitability. This mix has started to draw more focused investor attention.

The recent pullback, with a 7.1% 7 day share price return and 7.3% 30 day share price return, follows a strong 37.3% 90 day share price return and a very large 1 year total shareholder return of around 2x. This suggests momentum has paused rather than fully reversed around the current US$46.68 level.

If AnaptysBio’s profile has caught your interest, this could be a good moment to broaden your search to other healthcare stocks that might fit a similar thesis.

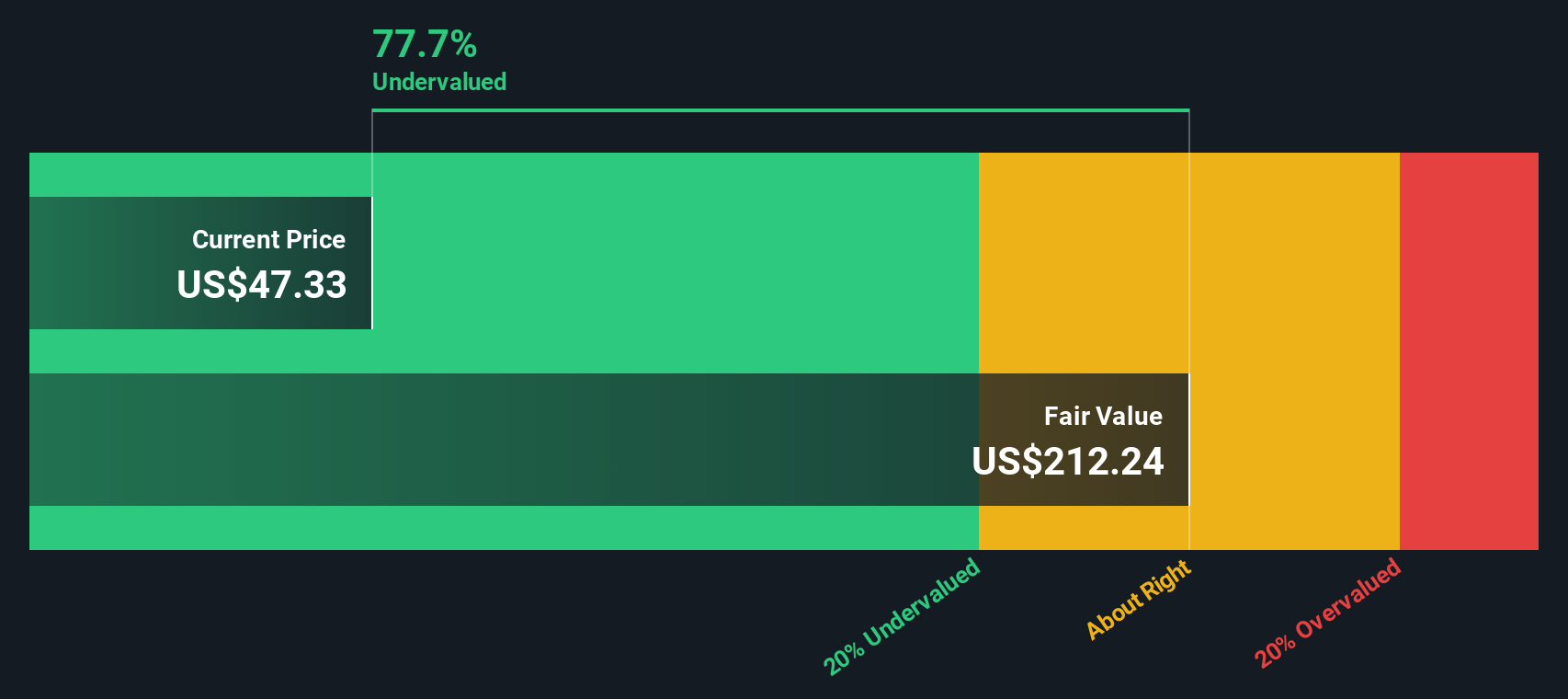

Yet with AnaptysBio trading at US$46.68, alongside an analyst price target of about US$67.92 and an intrinsic value estimate implying roughly a 78% discount, is this genuine mispricing, or is the market already banking on future growth?

Price-to-Sales of 7.6x: Is it justified?

AnaptysBio currently trades on a P/S of 7.6x, which screens as expensive versus both its peer group and an estimated fair P/S level.

The P/S multiple compares the company’s market value to its revenue, which is often used for unprofitable biotechs where earnings do not yet give a clear picture. At 7.6x sales, the market is putting a relatively high value on each US$1 of current revenue while the company remains loss making.

Compared to the estimated fair P/S ratio of 2.7x, the current 7.6x level sits meaningfully higher. This suggests the share price is rich relative to where that model implies the multiple could settle. At the same time, it is lower than the broader US biotech industry average of 11.4x, yet still above the 6.1x peer average. The stock therefore sits in a middle ground, cheaper than the wider group but pricier than closer peers and the fair ratio benchmark.

Result: Price-to-Sales of 7.6x (OVERVALUED)

However, you also need to weigh risks such as AnaptysBio’s US$84.63m net loss and the possibility that clinical or regulatory setbacks could challenge current market expectations.

Another view: DCF suggests deep undervaluation

While the 7.6x P/S ratio screens as expensive versus the fair ratio of 2.7x, our DCF model points in the opposite direction. On that view, AnaptysBio at US$46.68 trades around 78% below an estimated future cash flow value of about US$211.75.

This wide gap raises a practical question for you as an investor: is the market overpaying for current sales, or underestimating the long term cash generation the DCF is pointing to?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AnaptysBio for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 883 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AnaptysBio Narrative

If you see the numbers differently or prefer to stress test the assumptions yourself, you can build a personalised thesis in just a few minutes with Do it your way.

A great starting point for your AnaptysBio research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger portfolio, do not stop at one company, use the Simply Wall St Screener to uncover more targeted opportunities today.

- Zero in on potential value candidates by scanning these 883 undervalued stocks based on cash flows that align with your return and risk preferences.

- Tap into the growth story in artificial intelligence by reviewing these 24 AI penny stocks that are tied to real business models and financials.

- Add a different return profile to your watchlist by checking out these 13 dividend stocks with yields > 3% that focus on income through higher yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.