Please use a PC Browser to access Register-Tadawul

Assessing Arhaus (ARHS) Valuation After Recent Choppy Share Price Performance

Arhaus, Inc. Class A ARHS | 9.18 | +3.49% |

Arhaus stock at a glance

Arhaus (ARHS) has attracted investor attention after a mixed stretch, with a 15% gain over the past 3 months contrasting with weaker one year and year to date returns at recent prices near US$10.67.

Recent trading has been choppy, with a 14.9% 90 day share price return contrasting with weaker year to date share price performance and a 14.8% decline in the 1 year total shareholder return. This suggests that momentum has faded after earlier gains.

If Arhaus has you reassessing where you want exposure in retail and consumer trends, it could be a good moment to broaden your search with our 23 top founder-led companies.

With Arhaus posting modest revenue and net income growth, a value score of 2 and trading only slightly below the US$11.50 analyst target, you have to ask yourself: is this a genuine opportunity, or is future growth already priced in?

Most Popular Narrative: 7.2% Undervalued

With Arhaus last closing at $10.67 against a widely followed fair value estimate of $11.50, the core narrative hinges on how store expansion and margins hold up under that pricing.

The successful execution of showroom expansion in both mature and underpenetrated markets, paired with high-contribution-margin design studio concepts and a growing national footprint, creates a significant runway for revenue growth and EBITDA margin improvement as Arhaus gains market share in a fragmented industry.

Curious what kind of revenue path and margin profile justify that fair value and a higher future earnings multiple, especially against slower market wide growth assumptions? The full narrative lays out the growth, profitability and discount rate foundations analysts are using to call Arhaus about 7% undervalued.

Result: Fair Value of $11.50 (UNDERVALUED)

However, you also need to weigh risks such as demand swings hitting a high fixed cost base, and rising tariffs and input costs pressuring Arhaus' margins and earnings.

Another View: Earnings Multiple Sends A Different Message

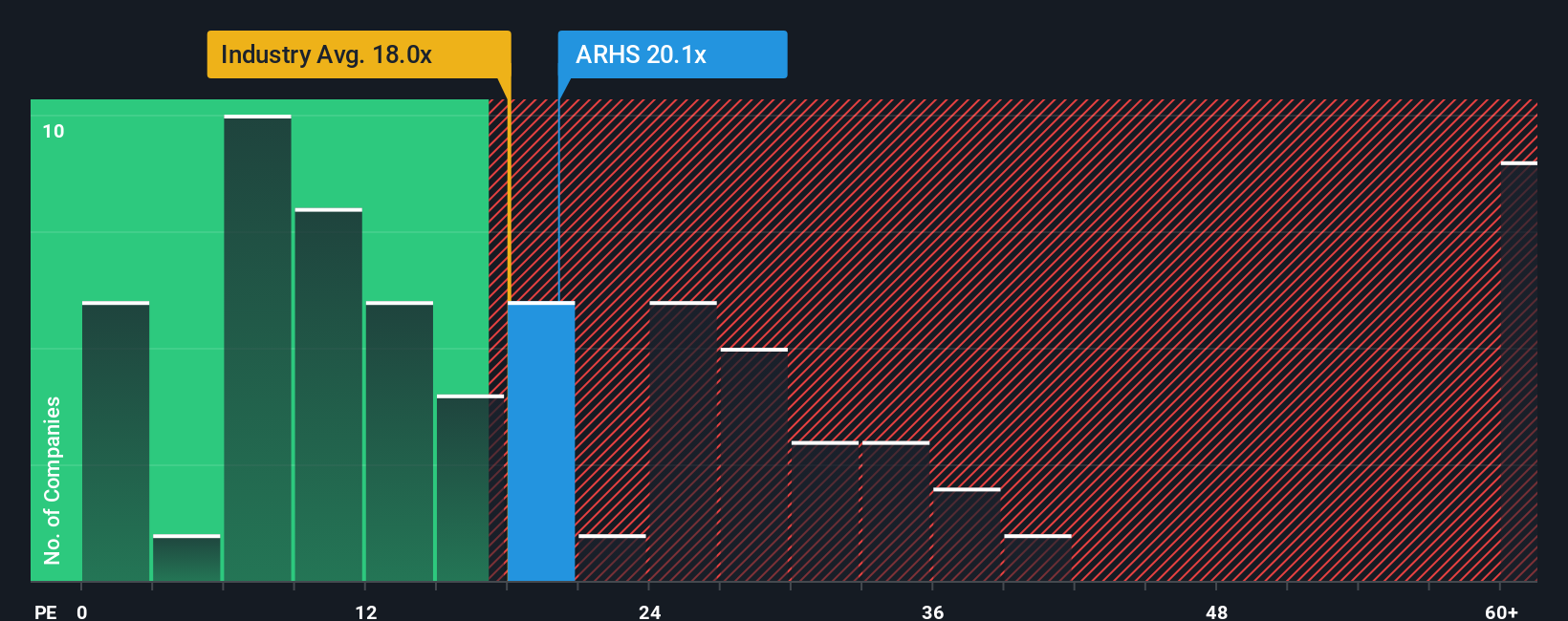

The analyst fair value of $11.50 paints Arhaus as about 7% undervalued, but the P/E picture is more cautious. At 20.5x earnings, Arhaus trades close to the US Specialty Retail average of 20.7x and above its own fair ratio of 13.7x, which points to valuation risk if sentiment cools.

Against peers on 25.4x, Arhaus looks cheaper. However, the gap to the 13.7x fair ratio suggests the market could still compress the multiple if growth or margins slip. Are you more comfortable with a story that leans on relative comparisons, or one that assumes the P/E holds up?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Arhaus for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 51 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Arhaus Narrative

If you look at these numbers and reach a different conclusion, or simply prefer to test your own assumptions, you can build a tailored narrative for Arhaus in a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Arhaus.

Ready for more stock ideas?

If Arhaus has sharpened your thinking, do not stop here. The next move that fits your style could be sitting in another corner of the market.

- Target reliable compounding by scanning companies with strong yields through our 14 dividend fortresses that focus on income without losing sight of quality.

- Hunt for mispriced opportunities using the screener containing 24 high quality undiscovered gems where solid fundamentals meet lower market attention.

- Prioritise capital protection with the 83 resilient stocks with low risk scores and see which businesses score well on resilience and downside risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.