Please use a PC Browser to access Register-Tadawul

Assessing Borr Drilling (NYSE:BORR) Valuation After A 47% Three Month Share Price Surge

Borr Drilling Limited BORR | 4.26 | +0.95% |

Borr Drilling (NYSE:BORR) is back on many investors’ radars after recent share price moves that contrast with its mixed return profile, including a roughly 47% gain over the past 3 months.

That recent 46.9% 90 day share price return contrasts with a slightly negative year to date share price move and a 1 year total shareholder return of about 1%, suggesting short term momentum has picked up while longer term results remain mixed.

If Borr’s recent jump has you thinking about where else momentum and ownership trends might matter, it could be a good time to look at fast growing stocks with high insider ownership as another source of ideas.

With a recent 47% 90-day surge, a value score of 4, about $1,024.5m in revenue and $72.3m in net income, the real question is whether Borr Drilling is still undervalued or if the market is already pricing in future growth.

Most Popular Narrative: 6.4% Undervalued

With Borr Drilling last closing at US$3.98 against a narrative fair value of US$4.25, the current pricing leaves a modest valuation gap that hinges on how future contracts, margins and balance sheet moves play out from here.

Underinvestment in new oil supply, together with accelerated retirement of aging global rig fleets, is limiting supply of modern jack-up rigs, favoring Borr Drilling's young, technologically advanced fleet and supporting higher dayrates and improved net margins.

Curious what kind of revenue path and margin profile sit behind that US$4.25 figure? The narrative leans on specific utilization assumptions, contract structures and a future earnings multiple that is usually reserved for much steadier cash generators. Want to see how those moving parts add up to the implied upside? The full narrative lays out the exact growth, profitability and discount rate inputs behind that call.

Result: Fair Value of $4.25 (UNDERVALUED)

However, you still need to weigh risks such as tighter environmental rules lifting costs and any reversal in rig demand expectations that could pressure utilization and margins.

Another Angle: What The Market Multiple Is Saying

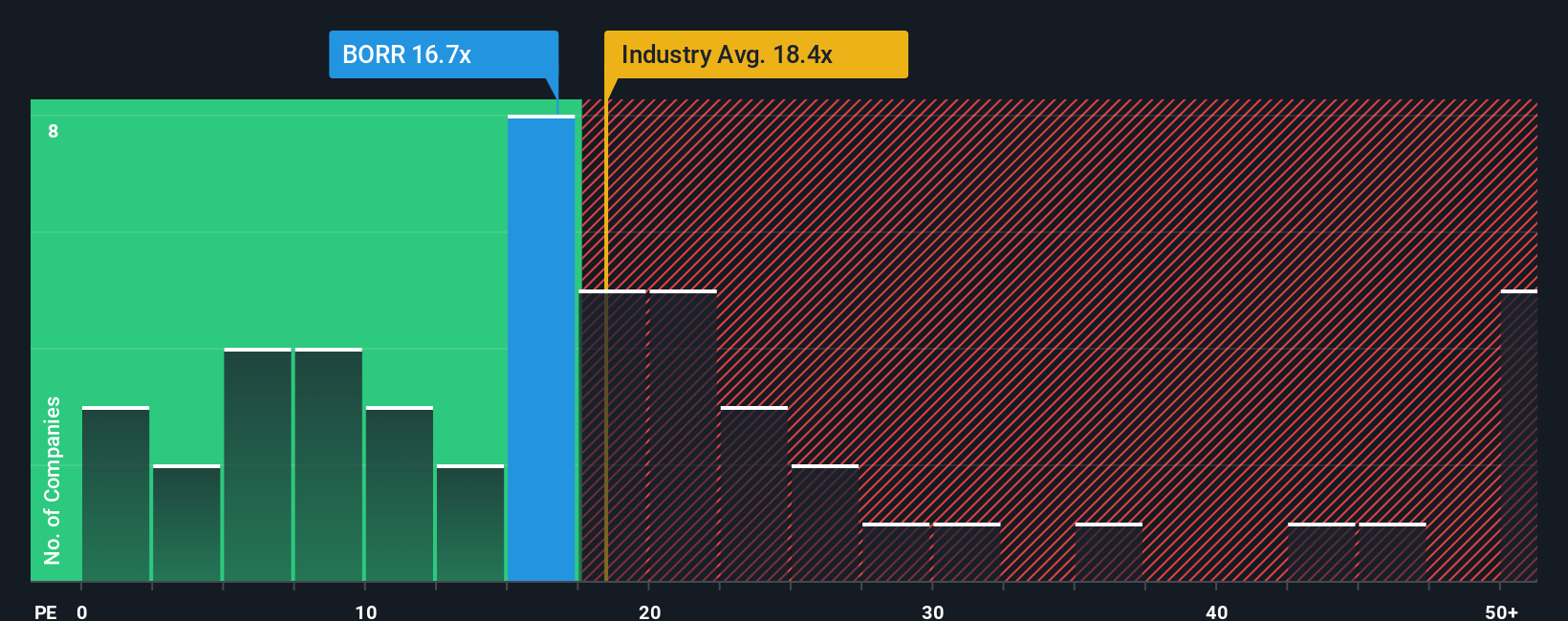

Our narrative fair value of US$4.25 suggests modest upside, but the current P/E of 16.9x sits above a fair ratio of 10.6x and below both peer (24.1x) and US Energy Services industry (18.7x) levels. That split picture hints at valuation risk, so which signal should be treated as the anchor?

Build Your Own Borr Drilling Narrative

If you see the assumptions differently or prefer running your own numbers, you can quickly build a custom thesis for Borr Drilling and Do it your way

A great starting point for your Borr Drilling research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Borr has sparked your interest, do not stop here; broaden your watchlist with other focused stock ideas that could fit your style and return goals.

- Target income potential by checking out these 14 dividend stocks with yields > 3% that may suit a yield focused approach while still keeping an eye on fundamentals.

- Spot mispriced opportunities early by scanning these 877 undervalued stocks based on cash flows that line up with your preferred quality and risk profile.

- Get ahead of the next big tech trend by reviewing these 25 AI penny stocks that tie real businesses to practical artificial intelligence use cases.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.