Please use a PC Browser to access Register-Tadawul

Assessing Cardinal Health (CAH) Valuation As Analyst Optimism Builds Before Upcoming Earnings

Cardinal Health, Inc. CAH | 201.11 | -0.68% |

Recent analyst updates on Cardinal Health (CAH) have kept attention on the stock, with several firms maintaining positive views as investors look ahead to the company’s second quarter fiscal 2026 earnings release on February 5.

At a latest share price of $207.19, Cardinal Health has posted a 31.79% 90 day share price return and a very large 5 year total shareholder return of around 4x, suggesting momentum has been building as earnings updates and analyst commentary keep the stock in focus.

If Cardinal Health’s recent run has you looking wider in healthcare, it could be worth checking out other healthcare stocks that are catching investors’ attention right now.

With the shares up strongly over 1 year and trading close to the average analyst price target, the key question now is simple: Is Cardinal Health still undervalued, or is the market already pricing in future growth?

Most Popular Narrative: 4.3% Undervalued

The most followed narrative puts Cardinal Health’s fair value at $216.60 per share, slightly above the last close of $207.19, and ties that gap to a detailed earnings roadmap.

The analysts are assuming Cardinal Health's revenue will grow by 9.0% annually over the next 3 years.

Analysts expect earnings to reach $2.2 billion (and earnings per share of $10.04) by about September 2028, up from $1.6 billion today. The analysts are largely in agreement about this estimate.

Curious how that earnings path supports a higher value than today’s price? The narrative leans on steady revenue gains, firmer margins, and a future P/E that sits above the broader healthcare sector.

Result: Fair Value of $216.60 (UNDERVALUED)

However, this hinges on Cardinal Health managing tighter drug pricing rules and avoiding contract losses that could pressure its slim margins and long term earnings path.

Another View: Multiples Tell A Different Story

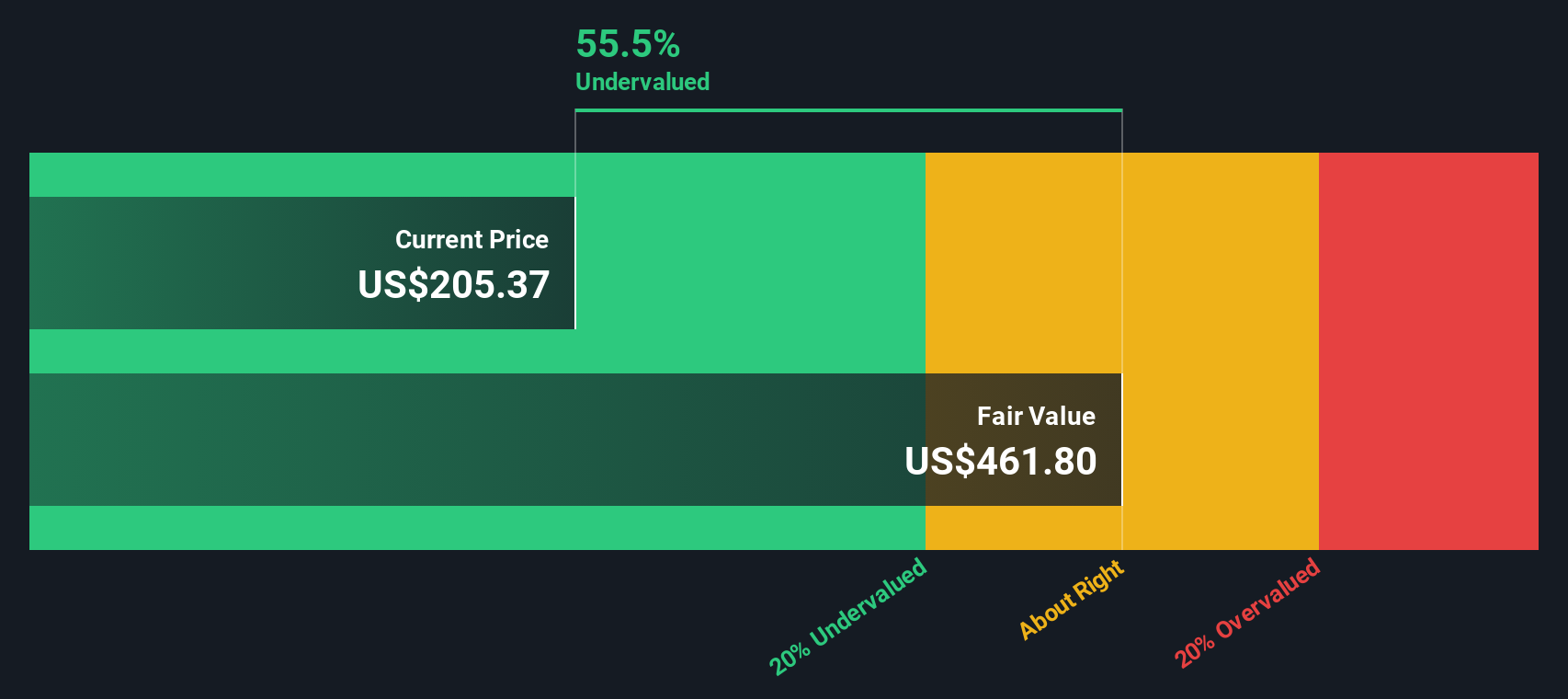

Our SWS DCF model points to Cardinal Health trading at about 55.1% below an estimated fair value of US$461.54, which suggests the shares are undervalued. That sits awkwardly next to a P/E of 30.9x that already looks full against peers and the wider US Healthcare sector. Which signal do you trust more?

Build Your Own Cardinal Health Narrative

If you look at these numbers and reach a different conclusion, or simply prefer to test your own assumptions, you can build a custom view in minutes with Do it your way.

A great starting point for your Cardinal Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Cardinal Health has sharpened your interest, do not stop here. Use the Simply Wall St Screener to uncover fresh ideas tailored to how you like to invest.

- Target potential value opportunities by scanning these 884 undervalued stocks based on cash flows that align with your return expectations and risk comfort.

- Explore technology-focused opportunities by reviewing these 26 AI penny stocks that are involved in automation and data driven business models.

- Support an income-focused strategy by reviewing these 12 dividend stocks with yields > 3% that may suit a portfolio built around regular cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.