Please use a PC Browser to access Register-Tadawul

Assessing Casey’s (CASY) Valuation After Analyst Upgrades Highlight Stronger Prepared Foods Fuel And Traffic Trends

Casey's General Stores, Inc. CASY | 665.86 | +0.30% |

Recent commentary from KeyBanc Capital Markets and RBC Capital Markets has drawn attention to Casey's General Stores (CASY), highlighting stronger prepared foods and beverage trends, steadier grocery margins, and continued fuel and traffic momentum.

Those stronger prepared foods, beverage and fuel trends have coincided with firm share price momentum, with a 7 day share price return of 5.29%, a 90 day share price return of 22.15%, and a 1 year total shareholder return of 53.12%. This suggests the market is reassessing Casey's General Stores as it expands into new regions like Texas.

If this kind of steady consumer demand appeals to you, it could be a good moment to broaden your search with our 22 top founder-led companies as potential long term compounders.

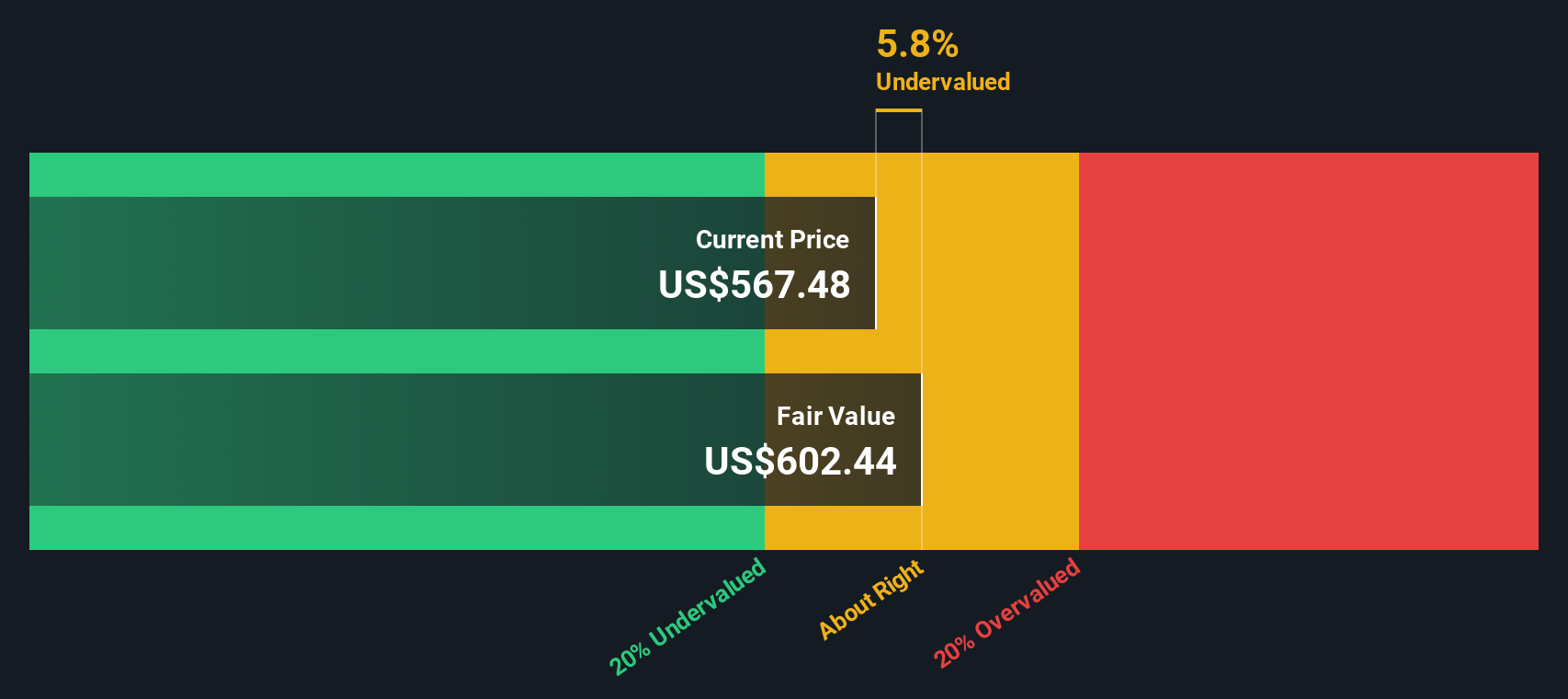

With Casey's shares up 22.15% over 90 days and 53.12% over 1 year, yet still showing an estimated 6% intrinsic discount, you have to ask: is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 9.8% Overvalued

Casey's General Stores last closed at $658.96, compared with a widely followed fair value narrative of $600. This comparison frames the current valuation debate.

Progress toward converting and remodeling acquired stores for Casey's full food/kitchen model creates a future catalyst for gross margin expansion and synergy capture, with expected benefits becoming more pronounced in the following fiscal year and supporting multi-year EPS growth.

Curious what kind of revenue lift, margin profile, and future earnings multiple are baked into that $600 figure, and how long the market is expected to wait for it to play out? The most followed narrative lays out a detailed blueprint. The assumptions behind that fair value might surprise you.

Result: Fair Value of $600 (OVERVALUED)

However, that blueprint can unravel if fuel traffic softens faster than expected, or if rural store acquisitions like CEFCO/Fikes take longer to lift margins.

Another View: Cash Flows Point the Other Way

While the popular narrative flags Casey's General Stores as about 9.8% overvalued at $600, our DCF model tells a different story. On that framework, the shares at $658.96 sit roughly 6% below an estimated fair value of $700.84, which indicates the cash flow math still appears supportive.

In simple terms, one perspective suggests the price already reflects a rich future, while another perspective suggests the current price has some room before it fully aligns with modeled cash flows. Which view do you think better matches your own expectations for Casey's margins, store growth, and fuel trends?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Casey's General Stores for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 52 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Casey's General Stores Narrative

If parts of this story do not quite fit your view, or you prefer to test the numbers yourself, you can build a fresh Casey's thesis in just a few minutes, starting with Do it your way.

A great starting point for your Casey's General Stores research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Casey's has sharpened your thinking, do not stop here. You can quickly surface other opportunities that match your style using focused screeners on Simply Wall St.

- Target quality at a discount by scanning our list of 52 high quality undervalued stocks that pair solid fundamentals with appealing prices.

- Lock in income potential by reviewing 14 dividend fortresses that aim for yield with an emphasis on resilience.

- Prioritise durability by checking 82 resilient stocks with low risk scores designed to highlight companies with more stable risk profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.