Please use a PC Browser to access Register-Tadawul

Assessing Catalyst Pharmaceuticals (CPRX) Valuation After Fresh Rare Disease Momentum And Earnings Outperformance

Catalyst Pharmaceuticals, Inc. CPRX | 24.30 | -0.49% |

Why recent attention on Catalyst Pharmaceuticals matters

Recent commentary around Catalyst Pharmaceuticals (CPRX) has focused on its rare disease portfolio, with FIRDAPSE and AGAMREE at the center, alongside upcoming trial readouts, regulatory events, and earnings performance.

Investors are also watching the company’s efforts to promote a higher approved FIRDAPSE daily dose and reach additional patient groups, in the context of fresh media coverage and growing interest in the stock.

At a share price of US$23.38, Catalyst Pharma has logged a 3% 1 day share price return and 11.49% 90 day share price return, while the very large 5 year total shareholder return contrasts with a modest 1 year total shareholder return of 2.01%. This suggests long term momentum with shorter term consolidation as investors absorb earnings beats and upcoming trial and regulatory events.

If Catalyst’s rare disease focus has your attention, this could be a useful moment to scan other specialist names through our curated healthcare stocks.

With a value score of 6, revenue of US$578.196m, net income of US$217.564m, and a large gap to the average analyst price target, should you view Catalyst as overlooked value, or assume the market is already baking in future growth?

Price-to-Earnings of 13.2x: Is it justified?

On a last close of US$23.38, Catalyst Pharmaceuticals trades on a P/E of 13.2x, which screens as inexpensive against both peers and the wider US biotech group.

The P/E ratio compares the current share price to the company’s earnings per share, so it gives you a quick sense of how much investors are paying for each dollar of current earnings. For a profitable rare disease business like Catalyst, this is a common yardstick because earnings are already established rather than purely hypothetical.

Here, the stock trades at a 13.2x P/E while the US biotechs industry sits around 19.8x and a peer group average is much higher at 60.1x. This means the market is pricing Catalyst’s earnings at a clear discount. Against an estimated “fair” P/E of 16.7x, there is also a gap that could close over time if sentiment shifts toward the level our fair ratio suggests the market could move towards.

Result: Price-to-Earnings of 13.2x (UNDERVALUED)

However, you still need to weigh concentration in a small rare disease portfolio, as well as any bumps around trial timelines, pricing decisions, or future regulatory outcomes.

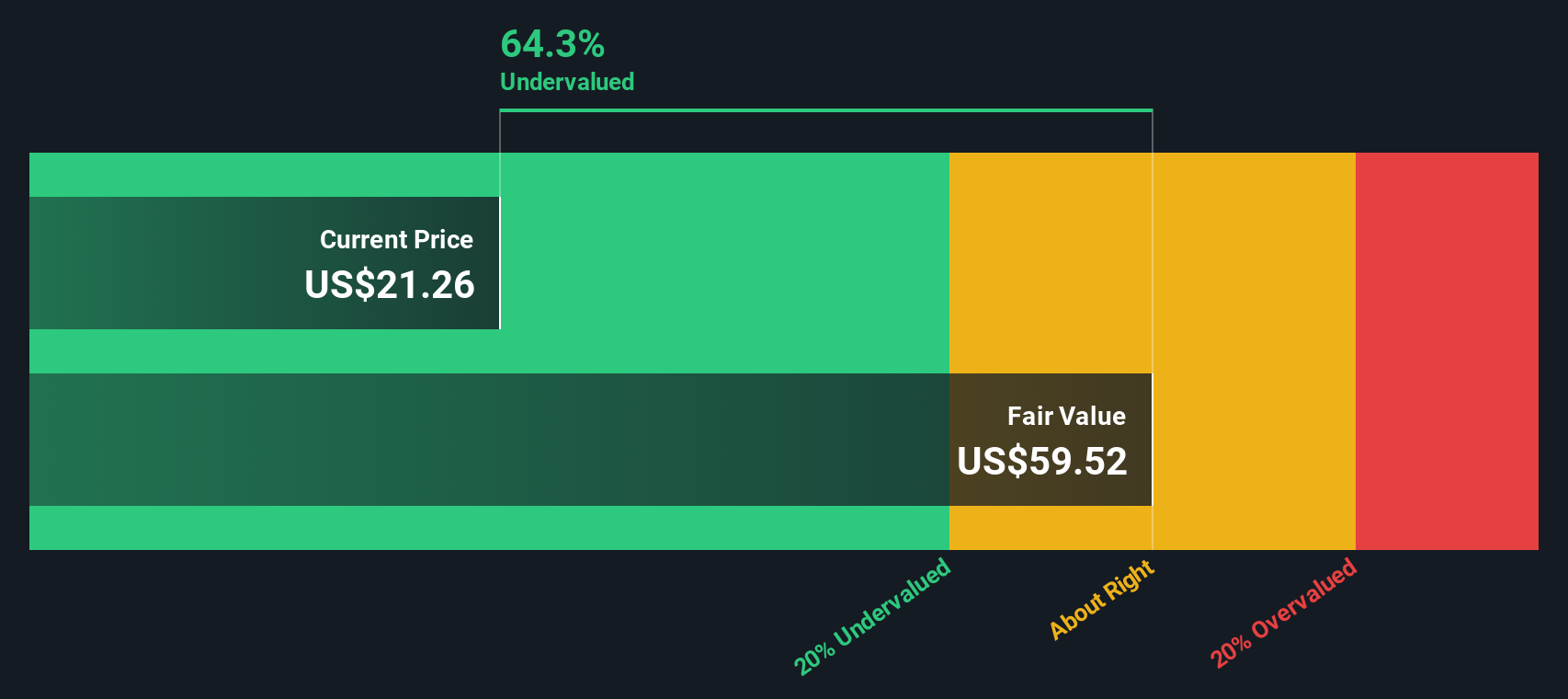

Another view using our DCF model

The P/E story already points to value, but our DCF model goes even further. With the shares at US$23.38 and our estimate of future cash flow value at US$64.47, the stock appears deeply undervalued. That kind of gap can signal potential opportunity, but it can also reflect a market that still has questions. Which side do you think is closer to the truth?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Catalyst Pharmaceuticals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Catalyst Pharmaceuticals Narrative

If you see the numbers differently or prefer to piece things together yourself, you can build your own view in just a few minutes, starting with Do it your way.

A great starting point for your Catalyst Pharmaceuticals research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Catalyst has sharpened your focus, do not stop here. Use the same structured approach across other themes so you are not relying on a single story.

- Scan for potential value by checking out these 872 undervalued stocks based on cash flows that might offer appealing prices relative to their current cash flow profiles.

- Explore developments in next generation technology by reviewing these 24 AI penny stocks that are associated with automation and data driven business models.

- Consider digital finance trends by assessing these 19 cryptocurrency and blockchain stocks that are linked to blockchain infrastructure and cryptocurrency exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.