Please use a PC Browser to access Register-Tadawul

Assessing Core & Main (CNM) Valuation After A Satisfactory Quarter And Improved Supply Chain Performance

Core & Main, Inc. Class A CNM | 56.39 | -0.42% |

Why Core & Main (CNM) Is Back on Investors’ Radar After Earnings

Core & Main (CNM) recently reported quarterly results, with revenue up 1.2% year on year and adjusted operating income ahead of analyst expectations. The shares have climbed 14.6% since that announcement.

Beyond the post earnings jump, Core & Main’s recent momentum is steady, with a 10.23% 1 month share price return and a 12.09% 3 month share price return, while the 3 year total shareholder return of about 3x signals a strong longer term journey.

If results like these have you thinking about what else is moving, it could be a good time to scan fast growing stocks with high insider ownership as another source of fresh ideas.

With shares up strongly over the past quarter and trading only modestly below the average analyst price target of US$61.06, you have to ask: is Core & Main still mispriced, or is the market already baking in its future growth?

Most Popular Narrative: 1.9% Undervalued

With Core & Main last closing at US$58.50 and the narrative fair value at about US$59.63, the implied gap is small but still points to a modest upside, built on specific assumptions about growth, margins and valuation multiples.

Core & Main anticipates generating strong operating cash flows, enabling further investment in organic growth and M&A, in addition to returning capital to shareholders through share repurchases, positively impacting earnings per share.

Curious what kind of revenue climb, margin lift and future P/E multiple are baked into that fair value? The entire story rests on those moving parts. Want to see exactly how tightly those assumptions are wired together in this narrative?

Result: Fair Value of $59.63 (UNDERVALUED)

However, you still need to weigh up risks such as weaker construction activity or higher interest and tariff costs, which could pressure sales, margins and earnings.

Another Angle on Valuation

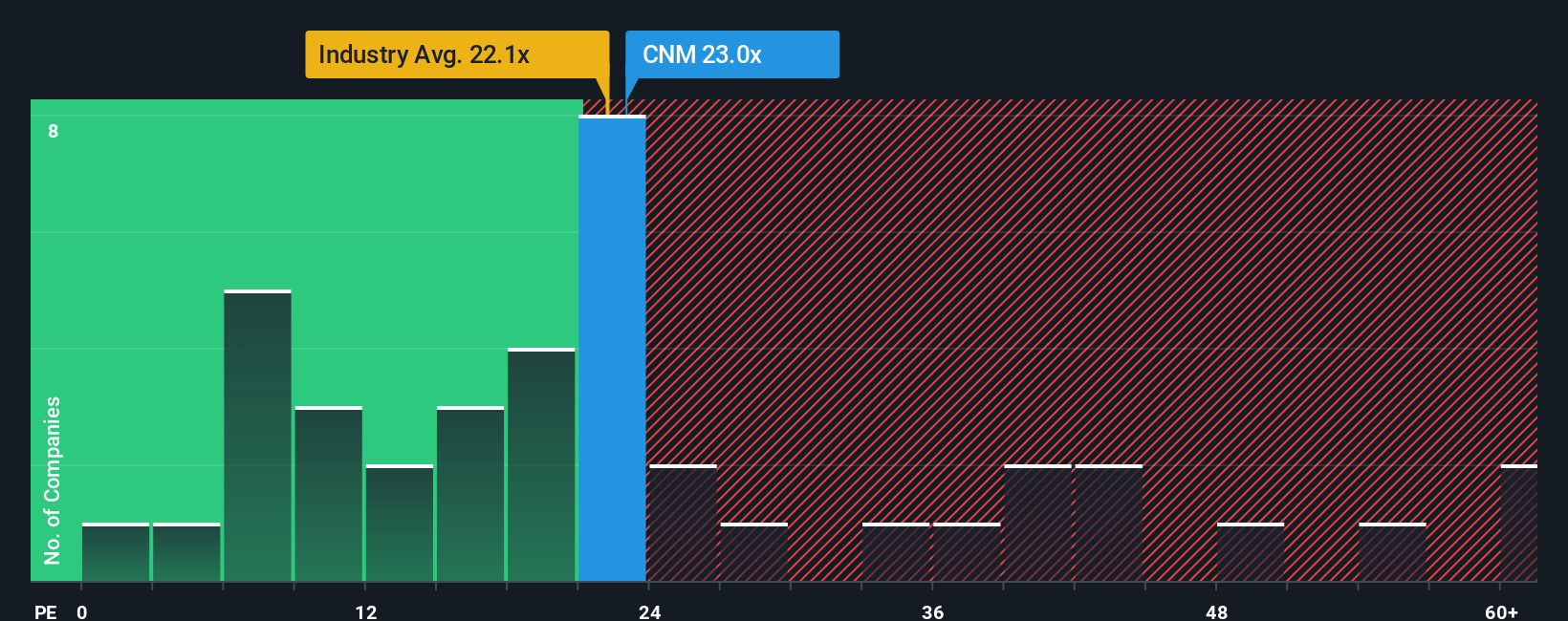

The fair value narrative suggests Core & Main is about 1.9% undervalued, but the earnings multiple tells a different story. At a P/E of 25.4x, the shares trade above both peers at 21.3x and the US Trade Distributors industry at 22.6x, even though the fair ratio points to 27.1x as a level the market could move toward. That sets up a tension between a modest upside case and a richer current pricing. Which signal do you trust more for your own checklist?

Build Your Own Core & Main Narrative

If this story does not quite match your view, or you prefer to work from the raw numbers yourself, you can build a custom thesis in just a few minutes by starting with Do it your way.

A great starting point for your Core & Main research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Core & Main has your attention, do not stop here. Use the screener to spot fresh opportunities that match your style before the market moves on.

- Target higher income potential by scanning these 12 dividend stocks with yields > 3% that already offer yields above 3% and might suit an income focused watchlist.

- Explore developments in artificial intelligence by checking out these 24 AI penny stocks that are directly exposed to this theme.

- Consider potential value ideas by filtering for these 863 undervalued stocks based on cash flows that could merit a closer look on your shortlist.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.