Please use a PC Browser to access Register-Tadawul

Assessing Denali Therapeutics (DNLI) Valuation After WORLDSymposium Clinical Updates And Regulatory Progress

Denali Therapeutics Inc. DNLI | 20.19 | -0.25% |

Denali Therapeutics (DNLI) has drawn fresh attention after presenting clinical and preclinical data at the 22nd Annual WORLDSymposium, updating investors on its Enzyme Transport Vehicle programs and upcoming regulatory milestones for rare disease candidates.

Those WORLDSymposium updates and the recent shareholder and analyst call come after a 90 day share price return of 35.13% and a 30 day share price return of 23.42%. However, the 1 year total shareholder return of a 5.26% decline and 5 year total shareholder return of a 68.77% decline show that the longer term picture has been tougher even as near term momentum has picked up around the current US$21.08 share price.

If Denali’s rare disease pipeline has caught your eye, this could be a good moment to broaden your search with our screener of 26 healthcare AI stocks for more specialized ideas in the space.

With shares up strongly in recent months, but still well below long-term levels and trading at a discount to analyst targets and some intrinsic estimates, is there still a buying opportunity here, or has the market already priced in future growth?

Discounted Cash Flow Suggests Upside From Current Price

On Simply Wall St’s DCF view, Denali Therapeutics shares at $21.08 are trading below an estimated future cash flow value of $32.63, implying a sizeable valuation gap.

The SWS DCF model estimates what a business could be worth by projecting future cash flows and then discounting them back to today using a required rate of return. For a company like Denali that is currently loss making, this approach focuses squarely on potential future cash generation from its drug pipeline rather than current earnings.

That framing is important for early stage biopharma names with minimal reported revenue and significant R&D spending, where traditional earnings based metrics can be less useful. Here, the model suggests the current price embeds a much more cautious view of Denali’s future cash flows than the DCF input assumptions used in the valuation.

Result: DCF fair value of $32.63 (UNDERVALUED)

However, investors still face meaningful risks around Denali’s loss making profile, with net income at a $498.744 million loss and the long development timelines across its broad pipeline.

Another View: Book Value Sends A Mixed Signal

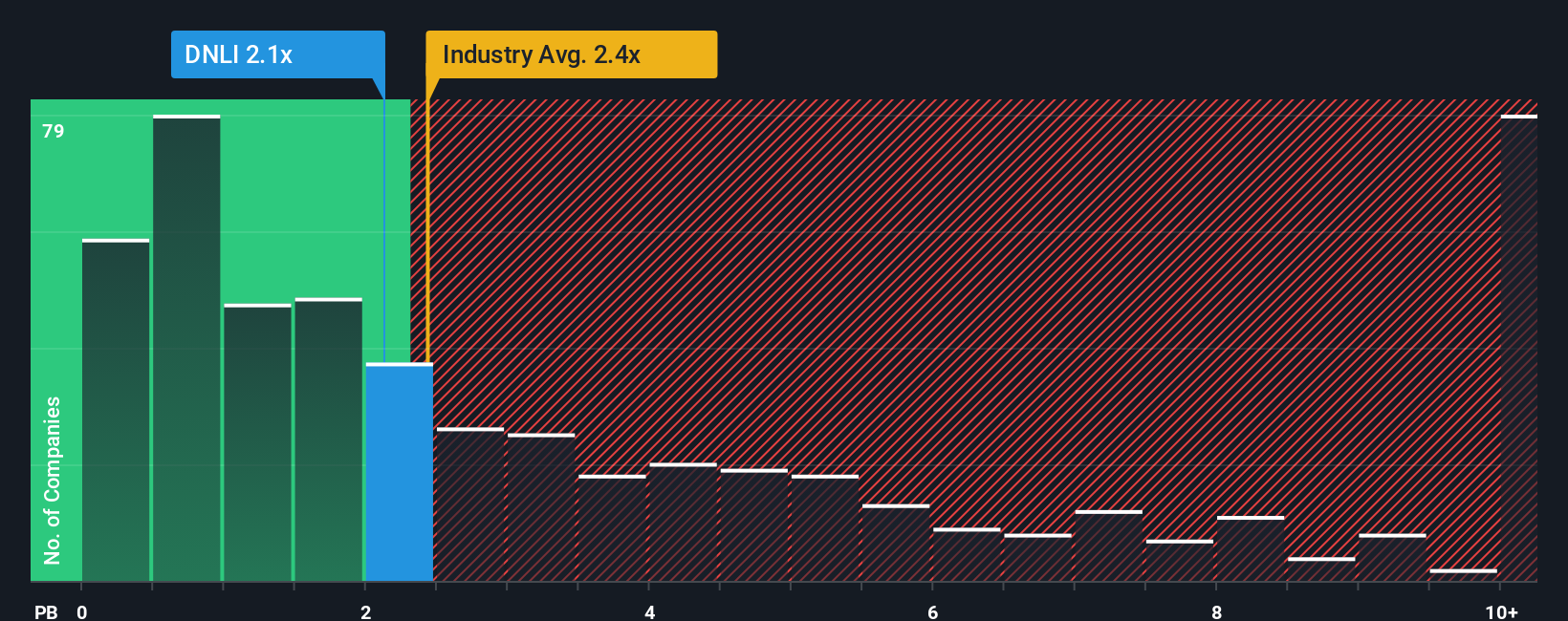

While the SWS DCF model points to upside, the P/B ratio tells a more cautious story. Denali trades at 3.6x book value, above the US Biotechs average of 2.6x, yet still flagged as good value versus a wider peer group at 13.5x. So which signal should you pay more attention to?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Denali Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 52 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Denali Therapeutics Narrative

If you see the data differently or prefer to run your own numbers, you can build a complete thesis in just a few minutes, your way, with Do it your way

A great starting point for your Denali Therapeutics research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If Denali has sharpened your curiosity, do not stop here. Use the Simply Wall St screener to quickly surface other opportunities that might better fit your approach.

- Lock in potential income ideas by checking companies in our 14 dividend fortresses that focus on higher yields with an eye on stability.

- Hunt for potential value by scanning the 52 high quality undervalued stocks and see which names currently line up with stronger fundamentals at discounted prices.

- Prioritise resilience first by reviewing the 84 resilient stocks with low risk scores to see which businesses currently carry lower overall risk scores.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.