Please use a PC Browser to access Register-Tadawul

Assessing Denali Therapeutics (DNLI) Valuation As WORLDSymposium Data And FDA Priority Review Draw Closer

Denali Therapeutics Inc. DNLI | 20.19 | -0.25% |

Denali Therapeutics (DNLI) is back in focus after announcing it will present clinical and preclinical data from its Enzyme Transport Vehicle programs at the 22nd Annual WORLDSymposium in early February.

The upcoming WORLDSymposium presentations and the FDA Priority Review have arrived after a strong run in the 1 month share price, with a 30 day share price return of 31.68% and a year to date share price return of 33.62%. However, the 1 year total shareholder return of a 6.7% decline and 5 year total shareholder return of a 69.19% decline show that longer term holders have faced a tougher journey.

If Denali’s rare disease focus has caught your attention, this could be a good moment to broaden your watchlist and look at healthcare stocks as potential next ideas.

So with Denali shares up more than 30% over the past month but still trading below some valuation estimates, are you looking at a fresh entry point, or has the market already priced in future growth?

Price-to-Book of 3.7x: Is it justified?

On a P/B basis, Denali Therapeutics at $21.74 screens as expensive versus the broader US Biotechs industry, even though some valuation estimates place the shares below fair value.

The P/B ratio compares a company’s market value to its book value, which is essentially net assets on the balance sheet. For a research stage biopharma with minimal current revenue and ongoing losses, investors often focus on this measure to judge how much they are paying for the asset base, pipeline and cash relative to peers.

For Denali, the P/B ratio of 3.7x is higher than the US Biotechs industry average of 2.6x. This suggests the market is assigning a richer tag to its assets than to the typical biotech name. However, when stacked against a narrower peer group, the same 3.7x P/B is described as good value compared with a peer average of 13.6x, which signals investors are paying far less per dollar of book value than for some closer comparables.

This leaves a split picture: expensive versus the wider industry, but cheaper versus a more concentrated set of peers. It highlights how much context can change the read on a single multiple.

Result: Price-to-book of 3.7x (ABOUT RIGHT)

However, there are still clear risks here, including Denali’s US$498.744m net loss and the possibility that key neurodegenerative and lysosomal programs disappoint clinically.

Another way to look at value

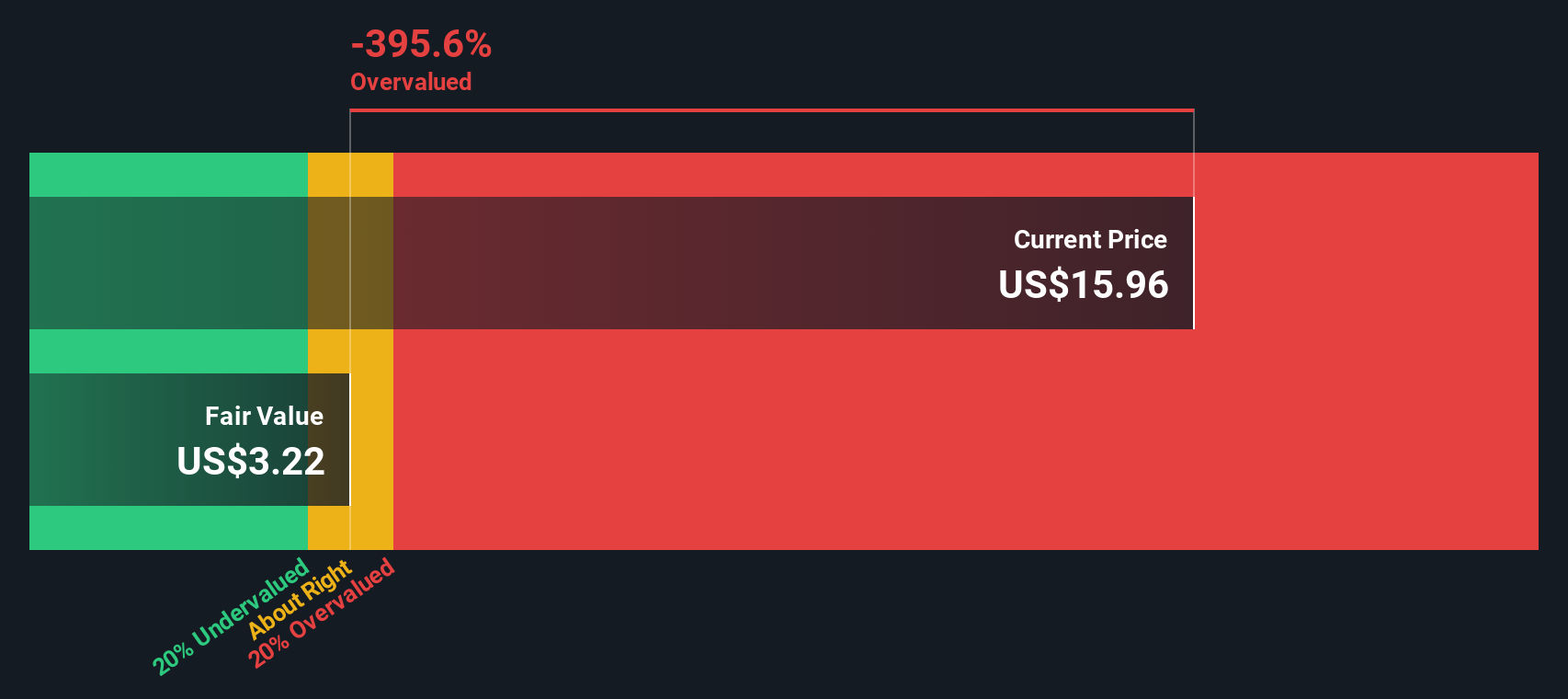

While the 3.7x P/B suggests Denali is roughly in line with some valuation estimates, our DCF model points a bit differently, with a fair value estimate of $31.58 versus the current $21.74. That 31.2% gap frames a key question: is the market being cautious or too sceptical?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Denali Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 868 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Denali Therapeutics Narrative

If you see the story differently or want to stress test these numbers yourself, you can build a personalised view in just a few minutes with Do it your way.

A great starting point for your Denali Therapeutics research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Once you have formed a view on Denali, do not stop there. Broaden your opportunity set with a few focused screens built to surface different kinds of ideas.

- Hunt for potential value by scanning these 868 undervalued stocks based on cash flows that may offer more for each dollar of cash flow you are paying for.

- Tap into fast moving themes in artificial intelligence through these 25 AI penny stocks that are tied to this technology trend.

- Target regular income by reviewing these 14 dividend stocks with yields > 3% that already meet a minimum yield hurdle of 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.