Please use a PC Browser to access Register-Tadawul

Assessing DoorDash (DASH) Valuation After Recent Share Price Weakness And Profit Growth

DoorDash, Inc. Class A DASH | 160.34 | -0.50% |

DoorDash (DASH) shares have faced pressure recently, with the stock showing negative returns over the past month and past 3 months. This has prompted many investors to reassess what they are paying for the business today.

Zooming out, DoorDash’s 30 day share price return of a 9.65% decline and 90 day share price return of a 19.56% decline contrast with its 1 year total shareholder return of 8.36%, hinting that recent momentum has faded compared with its longer term record.

If you are reassessing food delivery and ecommerce exposure, it could also be a useful moment to look at high growth tech and AI names through high growth tech and AI stocks for more ideas.

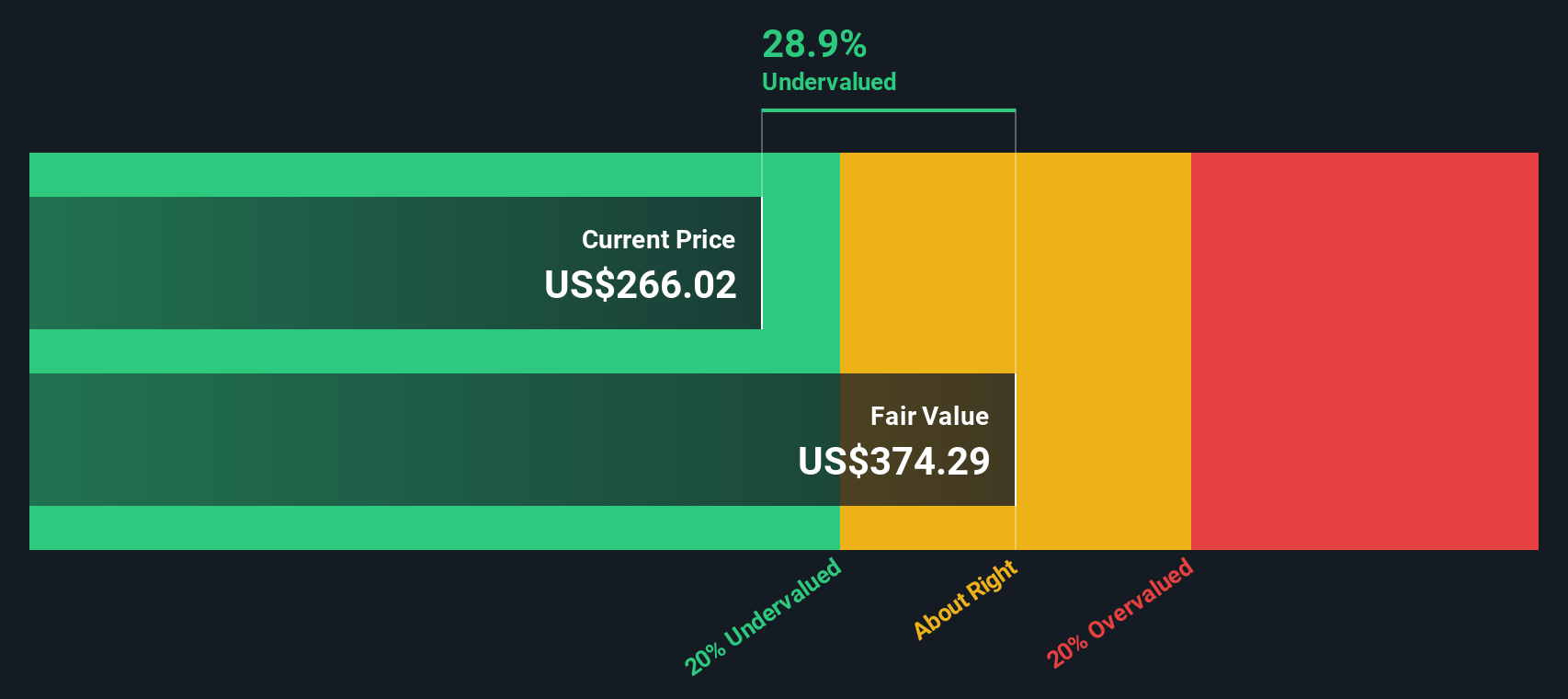

So with DoorDash posting annual revenue of US$12.6b and net income of US$863m, yet trading about 35% below the average analyst price target and at an indicated 51% intrinsic discount, is there a genuine entry point here, or is the market already baking in future growth?

Most Popular Narrative: 26% Undervalued

Compared with the last close at $204.62, the most followed narrative points to a fair value near $276, suggesting a sizeable valuation gap to unpack.

Accelerating growth of high margin revenue streams (notably, platform advertising and emerging SaaS offerings like the SevenRooms acquisition) is expanding DoorDash's profit pool beyond core delivery, supporting further earnings upside.

Want to see what sits behind that higher value? The narrative refers to rapid top line expansion, rising profitability and a richer mix of higher margin revenue. Curious how those ingredients combine into one fair value number?

Result: Fair Value of $276.39 (UNDERVALUED)

However, the story can change quickly if expansion costs climb faster than expected or if gig worker and regulatory pressures squeeze margins more than analysts currently factor in.

Another Angle On Valuation

Those narrative driven fair values around $276 line up with our DCF model, which also identifies DoorDash as undervalued, with the shares trading about 51% below an estimate of future cash flow value of $415.56. If the cash flows justify that gap, what is the market hesitating about?

Build Your Own DoorDash Narrative

If you are not fully on board with this view or simply prefer to test the numbers yourself, you can build a custom DoorDash thesis in minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding DoorDash.

Looking for more investment ideas?

If DoorDash is on your radar, do not stop there. The screener can help you quickly surface other ideas that fit your style before the market moves on.

- Spot potential mispricings early by scanning these 871 undervalued stocks based on cash flows that may offer stronger value based on their cash flow profiles.

- Zero in on cutting edge themes with these 24 AI penny stocks that focus on businesses tied to artificial intelligence trends.

- Tap into income focused opportunities through these 14 dividend stocks with yields > 3% that highlight companies with dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.