Please use a PC Browser to access Register-Tadawul

Assessing Fidelity National Information Services (FIS) Valuation After Fresh Fintech Awards And AI Leadership Recognition

Fidelity National Information Services, Inc. FIS | 49.13 | +0.27% |

Fidelity National Information Services (FIS) has drawn fresh attention after winning multiple industry awards for its risk management and cash and treasury management solutions, as well as leadership recognition in recent analyst reports on AI enabled treasury and risk platforms.

Despite the recent accolades for its AI enabled risk and treasury platforms, Fidelity National Information Services’ share price, which closed at US$46.95, has seen pressure. A 30 day share price return of 26.9% and a 1 year total shareholder return of 31.9% reflect ongoing reassessment of its prospects and risks.

If awards in AI and risk management have you thinking about where else technology could reshape finance, you might want to scan our list of 58 profitable AI stocks that aren't just burning cash as a starting point for other ideas.

With FIS shares under pressure despite recent recognition for its AI enabled risk and treasury platforms, the key question is whether the current valuation leaves upside on the table or if the market is already pricing in future growth.

Most Popular Narrative: 40.3% Undervalued

Fidelity National Information Services’ most followed narrative points to a fair value of about $78.68 per share versus the last close at $46.95, framing a wide valuation gap for investors to weigh.

Execution of operational simplification (for example, Worldpay divestiture, focused acquisitions like Everlink and Global Payments Issuer), strong cost reduction programs, and improved working capital management are expected to lower operating expenses and drive EBITDA margin expansion, supporting higher future earnings.

Curious what kind of revenue run rate and margin profile that story is built on, and how far earnings might scale from here? The full narrative sets out a detailed earnings ramp, paired with a future profit multiple that assumes FIS looks very different a few years from now.

Result: Fair Value of $78.68 (UNDERVALUED)

However, this story can unravel if fintech rivals eat into FIS’s core payment and banking franchises, or if acquisition integration issues drag on costs and execution.

Another View: Earnings Multiple Sends a Different Signal

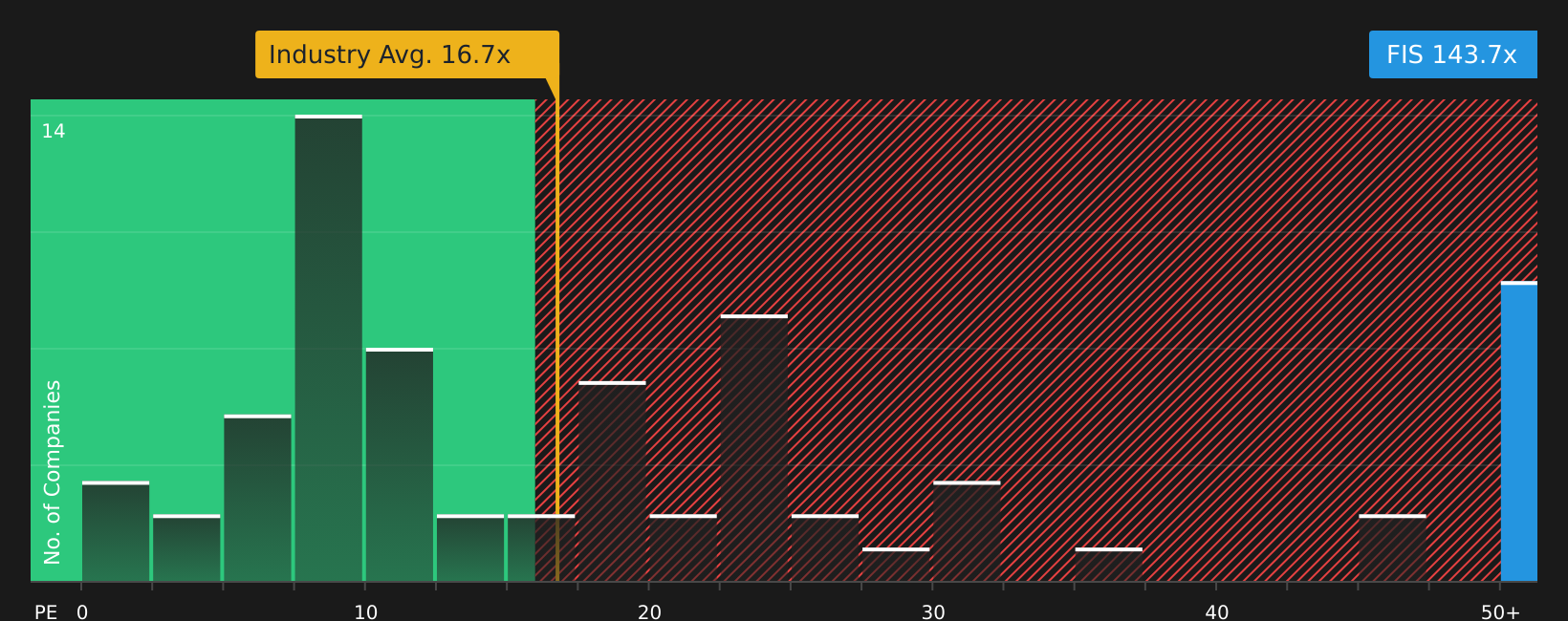

If you step away from fair value models and just look at what you are paying for current earnings, the picture is very different. FIS trades at a P/E of 137.4x, versus 15.3x for the US Diversified Financial industry, 12.2x for peers, and a fair ratio of 23.7x.

That means the share price already implies a much richer earnings story than either peers or the fair ratio suggest. This raises a simple question for you as an investor: are you comfortable paying this kind of premium for the growth path analysts have outlined?

Build Your Own Fidelity National Information Services Narrative

If you look at this and think the assumptions do not quite fit your view, or you would rather test the numbers yourself, you can build a custom story for FIS in just a few minutes, starting with Do it your way.

A great starting point for your Fidelity National Information Services research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If FIS has sharpened your thinking, do not stop here. The next move could come from a company you have not even considered yet.

- Spot potential mispricings by scanning our list of 55 high quality undervalued stocks that combine solid fundamentals with prices that may not fully reflect them.

- Strengthen your income game by reviewing 16 dividend fortresses, built for investors who want yields that can meaningfully contribute to their portfolio returns.

- Protect your downside by working through a 85 resilient stocks with low risk scores that focuses on businesses with more resilient risk profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.