Please use a PC Browser to access Register-Tadawul

Assessing Floor & Decor (FND) Valuation As Store Expansion Continues Despite Softer Housing Market

Floor & Decor FND | 68.99 | +4.34% |

Why Floor & Decor Holdings (FND) is back on investors' radar

Floor & Decor Holdings (FND) is drawing fresh attention after persisting with an aggressive store expansion plan despite softer housing activity. This is prompting investors to reassess how its growth ambitions line up with current market conditions.

At a share price of US$70.10, Floor & Decor has seen firm near term momentum, with a 30 day share price return of 9.77% and a 90 day gain of 19.10%. However, the 1 year total shareholder return of 32.24% and 5 year total shareholder return of 29.77% remain weak, suggesting recent optimism around its expansion plans contrasts with a tougher longer term experience for shareholders.

If this kind of rebound has you looking beyond just one specialty retailer, it could be a useful moment to broaden your watchlist with fast growing stocks with high insider ownership.

With revenue of US$4.66b and net income of US$216.8m, plus annual growth in both, the question is whether recent share price weakness leaves FND undervalued or if the market already reflects its future store driven growth story.

Most Popular Narrative: 9.3% Undervalued

At a last close of $70.10 against a narrative fair value of $77.27, the current price sits below where the most followed thesis thinks Floor & Decor should trade, which is why so much attention is going to the underlying assumptions.

Floor & Decor's ongoing aggressive store expansion strategy, opening 20 new warehouse-format stores this year and at least 20 planned for next year, with the infrastructure to accelerate openings further as housing market conditions improve, positions the company to capture outsized revenue growth and future operating leverage as end-market demand returns.

Curious what justifies that higher fair value? The narrative leans heavily on sustained revenue gains, firmer margins, and a future earnings multiple that assumes meaningful profit compounding. The full story ties those moving parts together.

Result: Fair Value of $77.27 (UNDERVALUED)

However, there are still real swing factors here, including the risk that weaker housing turnover keeps comparable sales under pressure, or that rapid store growth drags on margins.

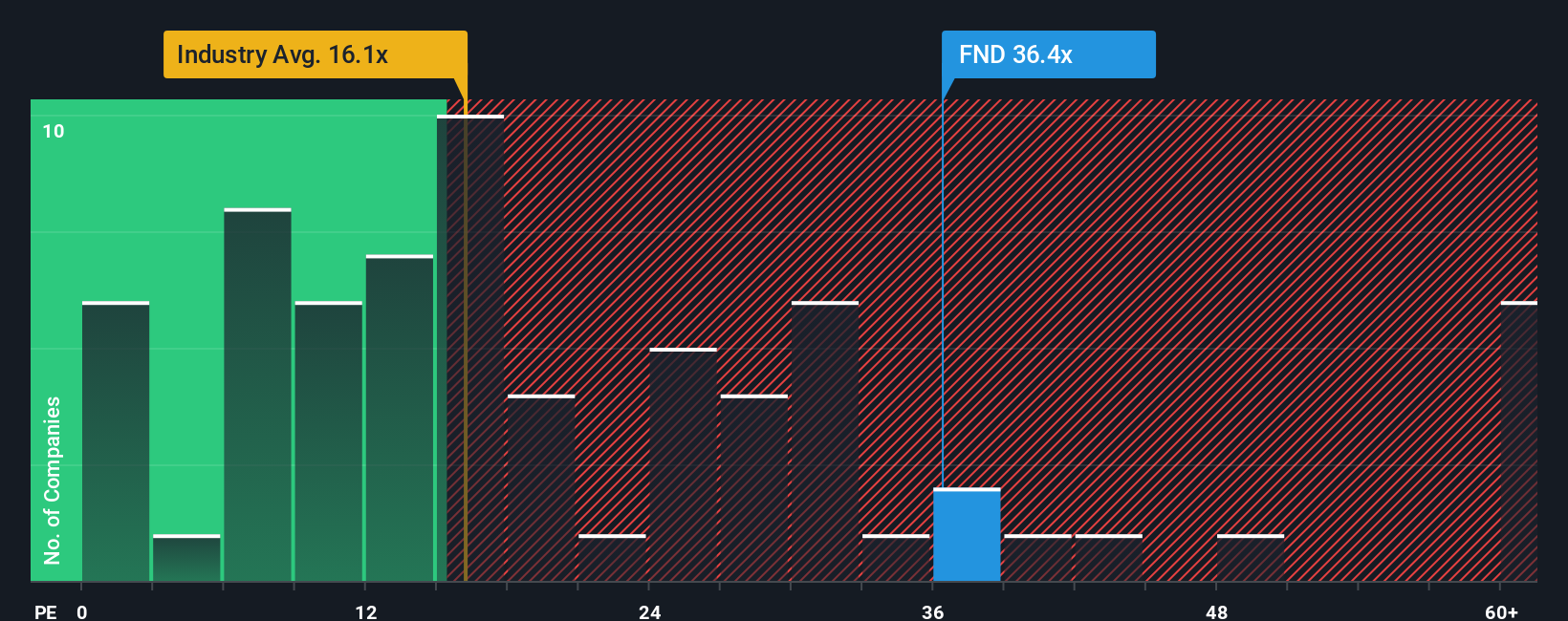

Another View: High P/E Puts Pressure On The Story

The narrative fair value suggests room for upside, but the current P/E of 34.8x is far higher than the US Specialty Retail average of 21x and a fair ratio of 18.1x. That premium leaves less room for error, so how confident are you that FND can keep justifying it?

Build Your Own Floor & Decor Holdings Narrative

If parts of this thesis do not quite fit how you see Floor & Decor, you can stress test the numbers yourself and build a custom view in minutes, starting with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Floor & Decor Holdings.

Ready to hunt for your next idea?

If Floor & Decor has sharpened your curiosity, do not stop here. Put a broader watchlist to work by scanning for fresh ideas in minutes.

- Spot potential bargains early by scanning these 867 undervalued stocks based on cash flows that align with your approach to cash flow and pricing.

- Zero in on future facing themes by filtering for these 29 AI penny stocks that match your risk and sector preferences.

- Strengthen your income focus by lining up these 11 dividend stocks with yields > 3% that might complement what you already hold.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.