Please use a PC Browser to access Register-Tadawul

Assessing GRAIL (GRAL) Valuation After Galleri PMA Milestone And Strong Clinical Data Progress

GRAIL Inc GRAL | 50.21 | -50.55% |

GRAIL (GRAL) has reached a key regulatory point, submitting the final module of its Premarket Approval application for the Galleri multi cancer early detection test to the U.S. Food and Drug Administration.

The latest PMA milestone comes after a mixed stretch for the shares, with a 1 day share price return of a 4.49% decline, a 30 day share price return of a 5.96% decline and a 90 day share price return of 20.42%, alongside a 1 year total shareholder return of 82.37%. This suggests longer term momentum has been stronger than the very recent pullback at the current share price of US$95.89.

If this kind of regulatory progress has your attention, it may be worth broadening your research with our screener of 25 healthcare AI stocks to spot other potential ideas in the space.

With GRAIL still loss making on US$141.827 million of revenue and trading about 20% below the US$115.00 analyst price target, you have to ask whether this regulatory progress is underappreciated or already fully pricing in future growth.

Most Popular Narrative: 16.6% Undervalued

At a last close of $95.89 versus a narrative fair value of $115, the current price sits below what the most followed model implies, putting the spotlight on the assumptions behind that gap.

Ongoing positive clinical trial results including substantially higher cancer detection and positive predictive value with consistent specificity for Galleri in population-scale studies are setting the stage for robust FDA approval and broad payer reimbursement, which could unlock significant new revenue streams and accelerate top-line growth.

Want to see what kind of growth and margin profile could support that higher fair value? The narrative leans on fast top line expansion, rising profitability and a rich future earnings multiple. Curious how those moving parts fit together over the next few years? The full story sits inside the detailed projections.

Result: Fair Value of $115 (UNDERVALUED)

However, sustained net losses, alongside heavy dependence on successful NHS Galleri readouts and broad payer reimbursement, could quickly challenge the upbeat narrative investors are leaning on.

Another Angle On Valuation

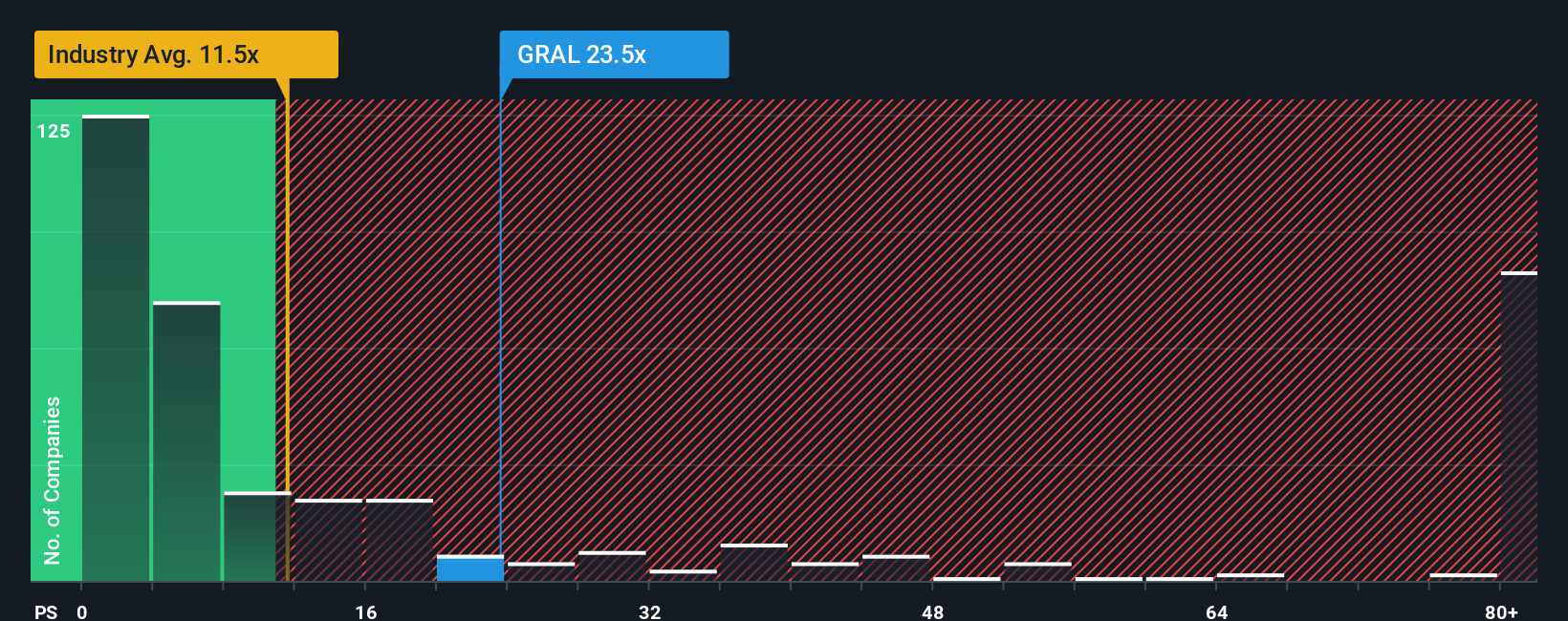

The narrative fair value of $115 paints GRAIL as 16.6% undervalued, but the P/S picture pulls the other way. At 27.6x sales versus a fair ratio of 2.4x, 12.3x for the US Biotechs average and 7.3x for peers, the stock screens as very expensive. So is growth powerful enough to justify that kind of premium risk?

Build Your Own GRAIL Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to test your own assumptions, you can build a custom narrative in just a few minutes using Do it your way.

A great starting point for your GRAIL research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger portfolio, do not stop with just one stock. Widen your search with curated ideas that match your style.

- Hunt for potential bargains that combine quality and a discount to fair value using our screener of 51 high quality undervalued stocks identified by the data.

- Prioritise resilience by checking out companies in our 85 resilient stocks with low risk scores that stand out for steadier risk profiles.

- Spot companies that the market has not fully focused on yet by scanning our screener containing 24 high quality undiscovered gems with solid underlying fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.