Please use a PC Browser to access Register-Tadawul

Assessing Green Plains (GPRE) Valuation After Analyst Upgrades And 45Z Carbon Credit Momentum

Green Plains Inc. GPRE | 14.02 | +3.32% |

Green Plains (GPRE) is back in focus after analysts highlighted its carbon capture progress and the impact of 45Z tax credits, following recent earnings that showed stronger EBITDA support from these low carbon initiatives.

After a strong run, with a 30 day share price return of 22.54% and a 90 day share price return of 41.38%, Green Plains now trades at US$13.70. A 1 year total shareholder return of 105.40% contrasts with weaker 3 and 5 year total shareholder returns.

If this focus on low carbon fuels has your attention, it could be a good moment to scan our 25 power grid technology and infrastructure stocks as another way to find energy transition opportunities.

With Green Plains now trading close to some analyst targets after sharp recent gains, the key question is whether current prices still leave room for mispricing or if the tax credit and carbon capture story is already fully reflected.

Most Popular Narrative: 18.6% Overvalued

With Green Plains last closing at $13.70 against a narrative fair value of about $11.56, the current price sits above that widely followed estimate, which builds heavily on future low carbon earnings.

Monetization of substantial carbon credits and asset optimization (including noncore asset sales and deleveraging) are significantly improving free cash flow and liquidity, enabling reinvestment into growth projects or further debt reduction, directly impacting free cash flow generation and long-term earnings power.

Curious how much of that fair value hangs on higher margins, rising cash generation, and a richer earnings multiple, all tied to low carbon incentives and coproducts? The narrative spells out the exact growth path and assumptions that need to land for that price to stack up.

Result: Fair Value of $11.56 (OVERVALUED)

However, this hinges on policy support for 45Z and carbon credits, and on Green Plains turning current operating losses into consistent profitability. That could shift the story quickly.

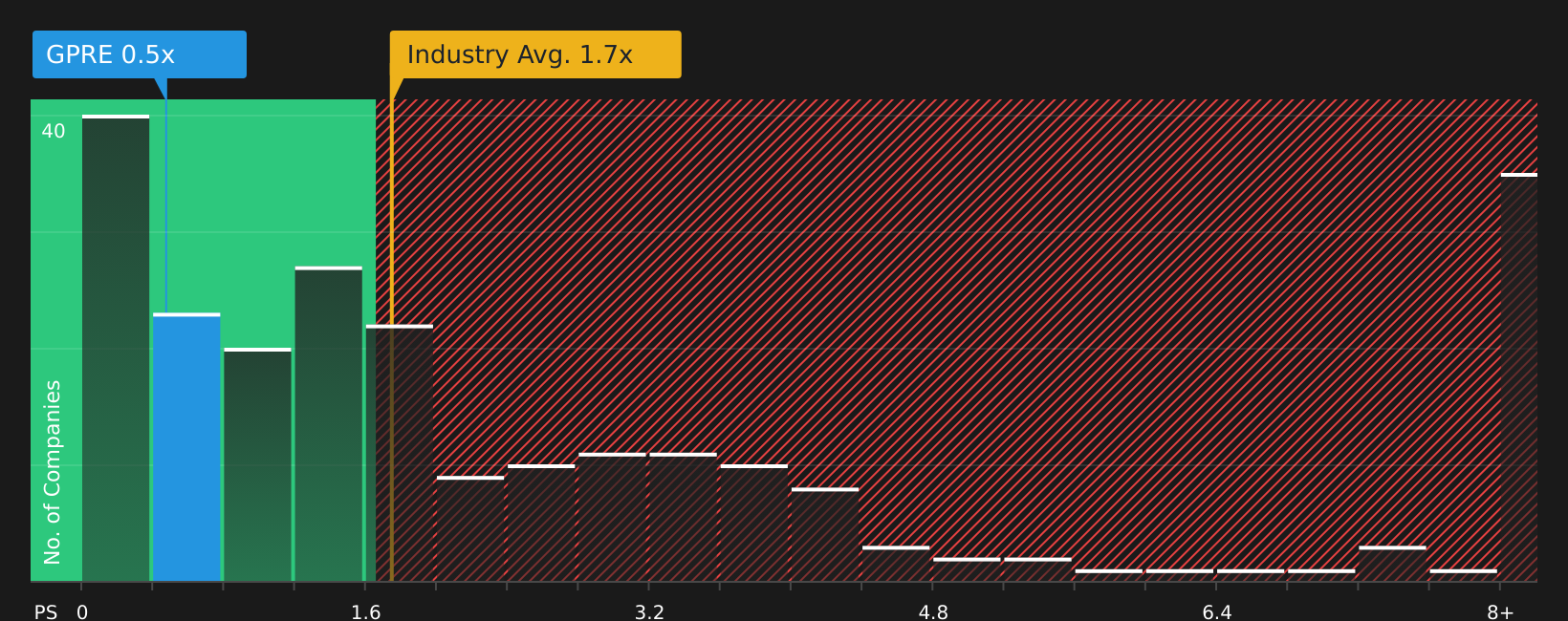

Another View: Multiples Point To A Very Different Story

While the narrative fair value of about $11.56 suggests Green Plains looks 18.6% overvalued, the current P/S of 0.5x paints a very different picture. It sits below both the peer average of 0.8x and the US Oil and Gas sector at 1.6x, and even below the 0.6x fair ratio our model suggests the market could move toward. That gap cuts both ways, offering potential upside if sentiment shifts, but also raising the question of why the discount exists in the first place.

Build Your Own Green Plains Narrative

If you look at these numbers and reach a different conclusion, or simply prefer to test your own assumptions against the data, you can build and publish a full thesis in just a few minutes. All you need to do is hit Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Green Plains.

Looking for more investment ideas?

If Green Plains has sharpened your interest, do not stop here. Use the screener to spot other opportunities that might fit your style and goals.

- Target value first and see which companies in our 53 high quality undervalued stocks are currently offering a price that looks appealing relative to their fundamentals.

- Prioritize resilience and check out companies in our 85 resilient stocks with low risk scores that score well on stability and downside protection.

- Hunt for future leaders by scanning our screener containing 23 high quality undiscovered gems that combine quality fundamentals with relatively low investor attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.