Please use a PC Browser to access Register-Tadawul

Assessing Hamilton Insurance Group (HG) Valuation As Earnings And Sales Headwinds Raise Investor Concerns

Hamilton Insurance Group, Ltd. Class B HG | 30.42 | +3.79% |

Recent concerns around Hamilton Insurance Group (HG)

Recent commentary around Hamilton Insurance Group (HG) has focused on a projected 2% sales decline, reduced operational productivity, and a significant contraction in earnings per share, which together appear to be weighing on investor sentiment.

Hamilton Insurance Group’s recent share price moves tell a mixed story, with a 10.29% 90 day share price return and 36.20% 1 year total shareholder return contrasting with a softer 30 day share price return of 4.78% and a year to date share price return of 1.36%. This suggests that momentum has cooled slightly after a strong run.

If earnings concerns around Hamilton have you reassessing your exposure to financials, it could be a good moment to broaden your view with fast growing stocks with high insider ownership.

With Hamilton generating US$2,745.461m in revenue and US$438.406m in net income, and trading at a discount to analyst price targets and intrinsic estimates, you have to ask: is the stock undervalued, or is the market already pricing in future growth?

Price-to-Earnings of 6x: Is it justified?

On a P/E of 6x against the last close of US$26.90, Hamilton Insurance Group looks inexpensive when set beside both peers and broad industry benchmarks.

The P/E ratio links what you pay per share to the company’s earnings, which is especially watched for insurance businesses where profit quality and capital efficiency matter. For Hamilton, several data points point to the market assigning a relatively low earnings multiple despite a 25.5% return on equity and high quality earnings.

Hamilton is flagged as trading at good value compared to peers and the wider US insurance space, with its 6x P/E sitting below the peer average of 12.7x and the industry average of 12.6x. It is also viewed as good value versus an estimated fair P/E of 12.4x, a level the market could move toward if earnings and quality stay aligned with current indications.

Result: Price-to-Earnings of 6x (UNDERVALUED)

However, you still have to weigh the softer recent share price momentum and any further earnings pressure that could challenge the current low P/E narrative.

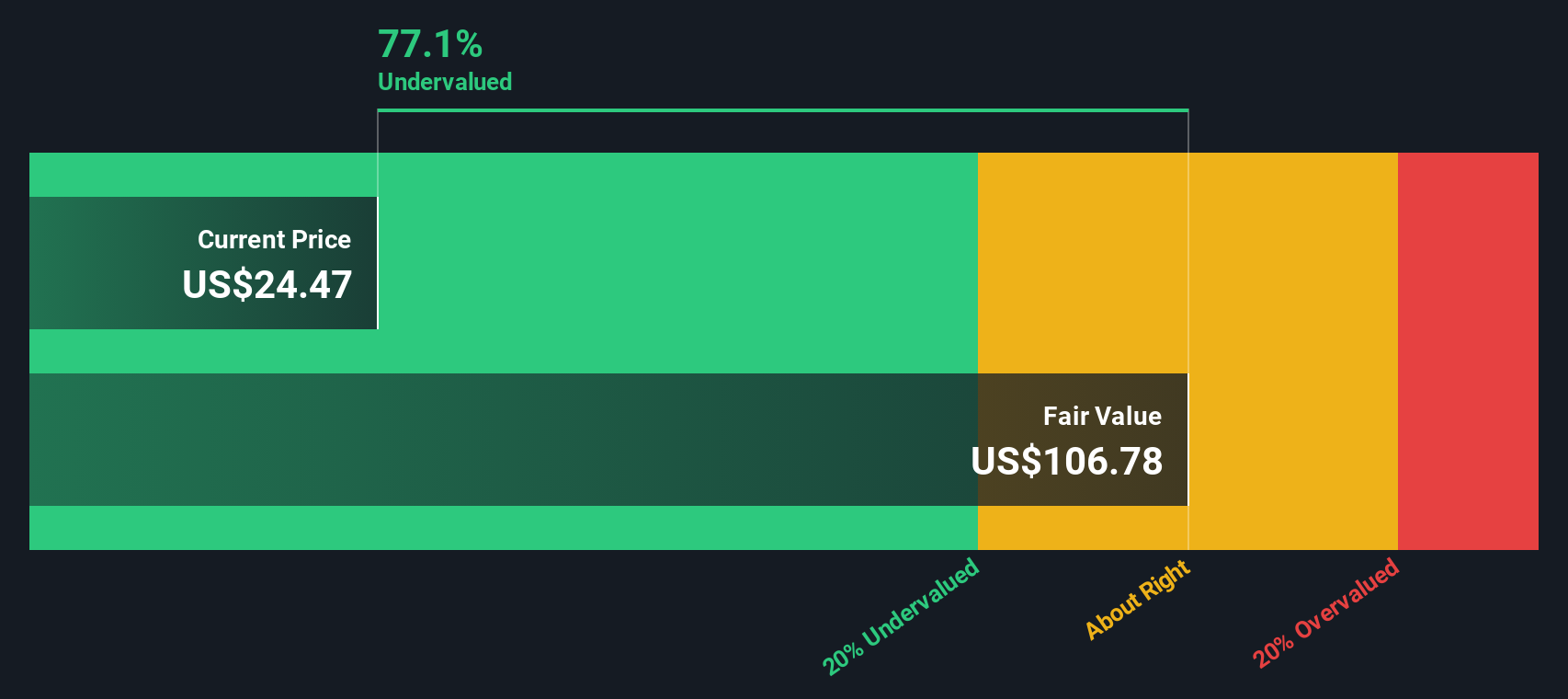

Another angle on value: the SWS DCF model

The P/E of 6x paints Hamilton as inexpensive, but our DCF model goes much further, with a fair value estimate of US$181.48 versus the current US$26.90 share price. That is a very large gap. Is this a genuine long term opportunity, or a sign that the model assumptions deserve extra scrutiny?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hamilton Insurance Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hamilton Insurance Group Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to piece together your own view from the ground up, you can build a full narrative for Hamilton in just a few minutes, starting with Do it your way.

A great starting point for your Hamilton Insurance Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Hamilton does not fully fit your plan, do not stop here. Broaden your watchlist now so you are not late to the next opportunity.

- Spot potential bargains early by scanning these 872 undervalued stocks based on cash flows that the market may be overlooking based on their cash flow profiles.

- Ride long term themes by focusing on these 19 cryptocurrency and blockchain stocks shaping digital assets and blockchain related trends across public markets.

- Target future facing growth by zeroing in on these 24 AI penny stocks that are building real businesses around artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.