Please use a PC Browser to access Register-Tadawul

Assessing Hawaiian Electric Industries (HE) Valuation After Insurance Funded Wildfire Lawsuit Settlements

Hawaiian Electric Industries, Inc. HE | 15.86 | +0.51% |

Hawaiian Electric Industries (HE) has reached preliminary agreements to resolve eight shareholder lawsuits tied to alleged wildfire risk disclosure failures, planning to use US$100 million in insurance proceeds without admitting wrongdoing.

The settlement news lands after a sharp shift in sentiment, with the share price at US$13.66 and a 90 day share price return of 25.44% alongside a 1 year total shareholder return of 53.31%. However, the 5 year total shareholder return of a 54.37% decline shows that longer term holders have had a very different experience. This suggests that recent momentum may reflect changing views on future wildfire related risks rather than a long run recovery story being firmly in place.

If this kind of turnaround story has your attention, it could be a good moment to widen your search and check out fast growing stocks with high insider ownership.

With HE trading at US$13.66 and sitting above the US$10.83 analyst price target, plus a mixed track record across 1, 3 and 5 year returns, you have to ask: is there real upside left here, or is the market already pricing in future growth?

Most Popular Narrative: 27.1% Overvaluled

Hawaiian Electric Industries' most followed narrative points to a fair value of US$10.75, which sits below the recent US$13.66 close and frames the current optimism.

Recent Hawaii legislation enabling wildfire liability caps, state funding for settlements, and securitization of wildfire safety investments significantly reduces legal and financial risk exposure while supporting large-scale infrastructure upgrades, which is likely to stabilize earnings and improve net margins. Progress in implementing enhanced wildfire safety measures, supported by dedicated funding mechanisms, reduces future risk of catastrophic losses, strengthens public trust and regulatory goodwill, and may result in more favorable treatment of capital expenditures in rate base calculations, thereby positively impacting future regulated earnings and revenue stability.

Curious how this story translates into numbers? Revenue expectations, margin rebuild and a re rated earnings multiple all sit at the heart of this valuation. Want to see exactly how those moving parts connect?

Result: Fair Value of $10.75 (OVERVALUED)

However, wildfire related litigation, along with the need to fund settlements and resilience projects, could still squeeze margins and keep pressure on earnings and cash flow.

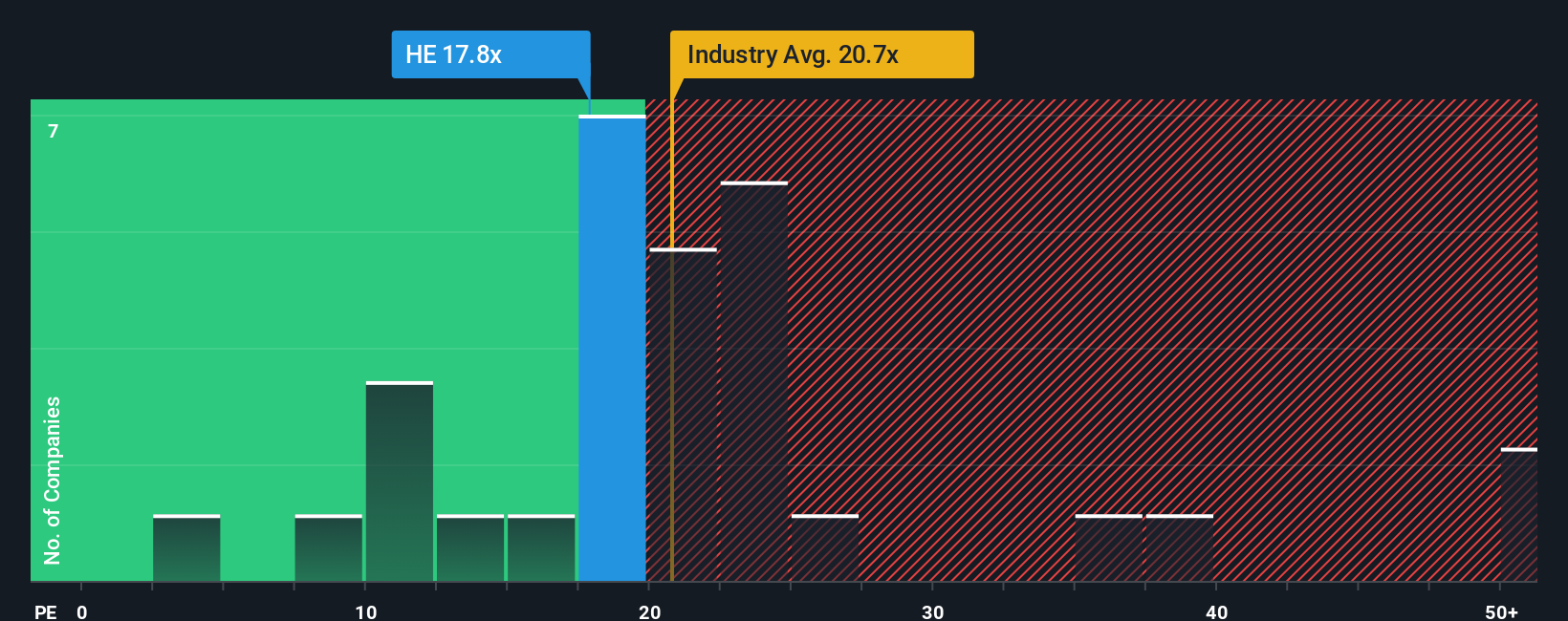

Another View: What The P/E Ratio Is Saying

That US$10.75 fair value comes from one narrative, but the current pricing tells a slightly different story. Hawaiian Electric trades on a P/E of 20.9x, above the US Electric Utilities industry at 20.0x and its own fair ratio of 13.6x, which points to valuation risk if expectations cool.

Build Your Own Hawaiian Electric Industries Narrative

If you look at HE and reach a different conclusion, or just prefer testing the assumptions yourself, you can build a custom view in minutes with Do it your way.

A great starting point for your Hawaiian Electric Industries research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If HE has you thinking differently about risk and reward, do not stop here. Broaden your watchlist and let fresh ideas compete for your attention.

- Spot potential turnaround names early by scanning these 3545 penny stocks with strong financials that already back their stories with stronger financials.

- Ride the AI wave more deliberately by focusing on these 28 AI penny stocks where artificial intelligence sits at the core of the business model.

- Hunt for mispriced opportunities by filtering for these 881 undervalued stocks based on cash flows that look cheap relative to their cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.