Please use a PC Browser to access Register-Tadawul

Assessing Hims & Hers Health (HIMS) Valuation After Regulatory And Legal Pressure On GLP 1 Offerings

Hims & Hers Health, Inc. Class A HIMS | 15.63 | -1.20% |

The sharp move in Hims & Hers Health (HIMS) has centered on mounting legal and regulatory pressure, including Novo Nordisk’s patent lawsuit over compounded semaglutide products, FDA scrutiny of compounding practices, and a Department of Justice referral.

At a share price of $16.30, Hims & Hers Health has experienced a sharp reset, with a 7 day share price return of 29.19% and a 30 day share price return of 47.96%. The 1 year total shareholder return of 73.04% contrasts with a 3 year total shareholder return of 69.26%. This underscores how recent legal and regulatory headlines have shifted attention toward risk rather than past gains.

If the legal overhang around GLP 1 treatments has you reassessing opportunities in healthcare, it could be worth sizing up 25 healthcare AI stocks as another way to look at the sector’s future potential.

With Hims & Hers Health now trading at $16.30, sitting at a very large implied discount to both analyst targets and some intrinsic value estimates, you have to ask yourself: is pessimism overdone, or is the market already bracing for weaker growth?

Most Popular Narrative: 81.1% Undervalued

Compared with the last close at $16.30, the most followed Hims & Hers Health narrative from BlackGoat points to a far higher long term value benchmark.

Hims & Hers Health isn’t a telehealth gimmick or a GLP-1 hype stock; it’s quietly becoming the top-of-funnel infrastructure layer for healthcare in the United States. It is executing a strategy similar to Amazon, Spotify, and Costco: deliver more value per dollar spent, reinvest scale advantages, and win via customer-centric efficiency.

Curious what kind of revenue trajectory and margin profile could justify a fair value several times above today’s price? The narrative leans on compound growth, rising profitability, and a rich future earnings multiple, all wired into a detailed cash flow path. The exact mix of these assumptions is where the story gets interesting.

Result: Fair Value of $86.09 (UNDERVALUED)

However, that story can unravel quickly if regulatory scrutiny around GLP 1 compounding tightens further, or if legal disputes with major drugmakers meaningfully disrupt key treatment lines.

Another Angle on Valuation

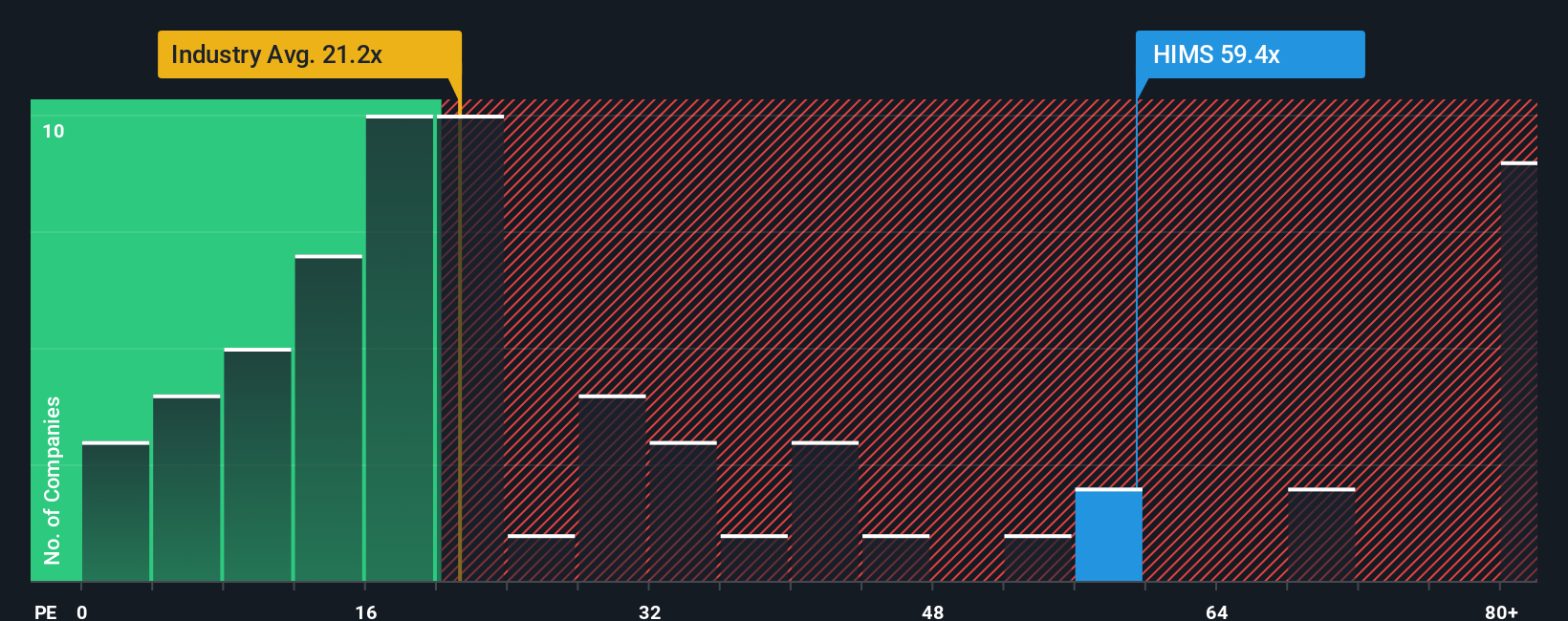

Those rich long term narratives sit against a much simpler reality today. Hims & Hers Health trades on a P/E of 27.7x, which is higher than the US Healthcare industry at 23.3x and above its own fair ratio of 23.8x, even though it is cheaper than peers at 68.8x. That premium might reflect quality, or it might just leave less room for error, so how comfortable are you paying up at this stage of the story?

Build Your Own Hims & Hers Health Narrative

If you see the numbers differently or prefer to test your own assumptions, you can quickly create a personalized Hims & Hers Health story in just a few minutes, starting with Do it your way.

A great starting point for your Hims & Hers Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger portfolio, do not stop with one stock story. Broaden your watchlist with focused ideas from our screeners.

- Target potential mispricings by checking out 56 high quality undervalued stocks that line up quality fundamentals with more modest market expectations.

- Strengthen your income stream by reviewing 13 dividend fortresses that aim to pair higher yields with robust payout profiles.

- Dial down portfolio stress by considering 86 resilient stocks with low risk scores designed for investors who want resilience front and center.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.