Please use a PC Browser to access Register-Tadawul

Assessing HubSpot (HUBS) Valuation After A Sharp Share Price Pullback

HubSpot, Inc. HUBS | 233.50 | -2.45% |

Recent share performance and business profile

HubSpot (HUBS) has caught investor attention after a sharp pullback, with the stock showing negative returns over the month, past 3 months, year to date, and past year, despite positive annual revenue and net income growth.

The company generated US$3,131.266m in revenue and US$45.911m in net income. This reflects a business that is currently profitable while continuing to invest in its cloud-based customer relationship management platform across the Americas, Europe, and Asia Pacific.

At a share price of US$243.85, HubSpot’s recent 30 day share price return of a 29.38% decline and 90 day share price return of a 38.48% decline point to fading momentum, which is also reflected in the 69.97% one year total shareholder return decline.

If HubSpot’s pullback has you reassessing growth stories in software, it could be a good moment to scan 57 profitable AI stocks that aren't just burning cash for other potential opportunities with earnings already in place.

With HubSpot shares down sharply over the past year, yet tied to a growing CRM business and trading below some analyst targets, the key question is simple: Is this a reset that creates a buying opportunity, or is future growth already priced in?

Most Popular Narrative: 55.1% Undervalued

Against HubSpot’s last close of $243.85, the most followed narrative points to a fair value of $543.54, implying a large valuation gap that hinges on robust growth and margin assumptions.

Rapid adoption and expansion of AI-based functionality such as Customer Agent, Prospecting Agent, and connectors to leading LLMs are driving higher customer engagement, sticky workflows, and early-stage monetization opportunities (especially via credit-based AI features). This is setting the stage for stronger net dollar retention and potentially higher net margins in 2026 and beyond.

Want to see how this AI push and multi hub usage translate into that fair value? The core of the narrative links recurring revenue, rising margins and a future earnings multiple that assumes HubSpot keeps compounding its business model far beyond what the recent share pullback suggests.

Result: Fair Value of $543.54 (UNDERVALUED)

However, this hinges on AI features gaining real traction and on smaller and mid sized customers holding up, as weaker adoption or higher churn could quickly challenge that upside story.

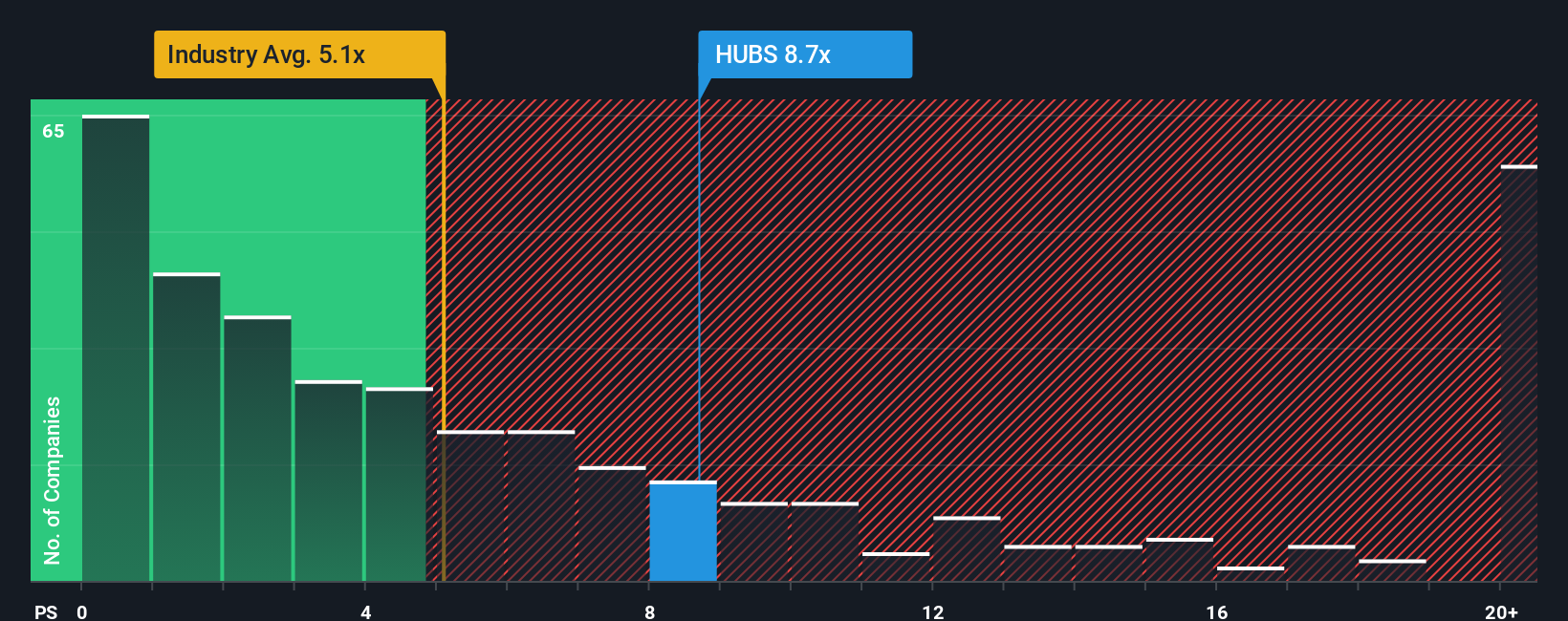

Another view on valuation: what the ratios say

While the narrative and fair value of $543.54 suggest HubSpot is undervalued, the current P/S of 4.1x looks expensive against the US Software industry at 3.6x, yet cheaper than peers on 7x and below a fair ratio of 8x. That gap can signal upside or show why the market is hesitant. Which side do you think is closer to reality?

Build Your Own HubSpot Narrative

If the assumptions behind these narratives do not quite fit how you see HubSpot, you can stress test the data yourself and build a version that reflects your own view in just a few minutes, then Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding HubSpot.

Looking for more investment ideas?

If HubSpot has sharpened your thinking, do not stop there. Use the Simply Wall St Screener to compare other stocks and pressure test your next move.

- Spot potential bargains quickly by scanning our list of 53 high quality undervalued stocks that pair quality fundamentals with prices that may not fully reflect them.

- Strengthen your downside protection by focusing on companies highlighted in the 85 resilient stocks with low risk scores where business risk scores stay on the lower side.

- Get ahead of the crowd by reviewing our screener containing 23 high quality undiscovered gems before they land on every other investor’s radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.