Please use a PC Browser to access Register-Tadawul

Assessing Insulet (PODD) Valuation After Omnipod 5 And Data Platform Expansion In The Middle East

Insulet Corporation PODD | 241.89 | -2.89% |

Insulet (PODD) is drawing fresh attention after expanding its Omnipod 5 Automated Insulin Delivery System into Saudi Arabia, Kuwait, Qatar, and the UAE, alongside launching its Omnipod Discover data platform in these markets.

Despite fresh attention around the Middle East rollout, Insulet’s recent trading tells a different story, with a 30 day share price return of 15.63% decline and a 1 year total shareholder return of 13.48% decline, suggesting momentum has been fading even as new markets open up.

If this Omnipod 5 expansion has you thinking about where healthcare and tech intersect, it could be a good moment to scout 25 healthcare AI stocks as potential next ideas to research.

With shares down over the past year even as revenue and net income grow, and with the stock trading below both an intrinsic estimate and the average analyst target, is there a genuine opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 34.3% Undervalued

Insulet’s most followed narrative pegs fair value at $369.64 versus a last close of $242.74, framing the Middle East push within a much bigger long term growth story.

Rapidly rising adoption of Omnipod 5 in both the U.S. and international markets, driven by strong clinical evidence, ease of use, and superior integration with the latest glucose sensors, is positioning Insulet to capture a disproportionately large share of the expanding global diabetes device market, supporting outsized top-line revenue growth for several years.

Curious what underpins that fair value gap? Revenue expansion, earnings compounding and a rich future multiple all sit at the heart of this narrative. The exact mix of growth, margin and discount rate assumptions is where it gets interesting.

Result: Fair Value of $369.64 (UNDERVALUED)

However, this hinges on Omnipod staying ahead of rival diabetes technologies, and on international expansion delivering enough usage to justify ongoing investment.

Another Take: Rich Multiple Versus Undervalued Narrative

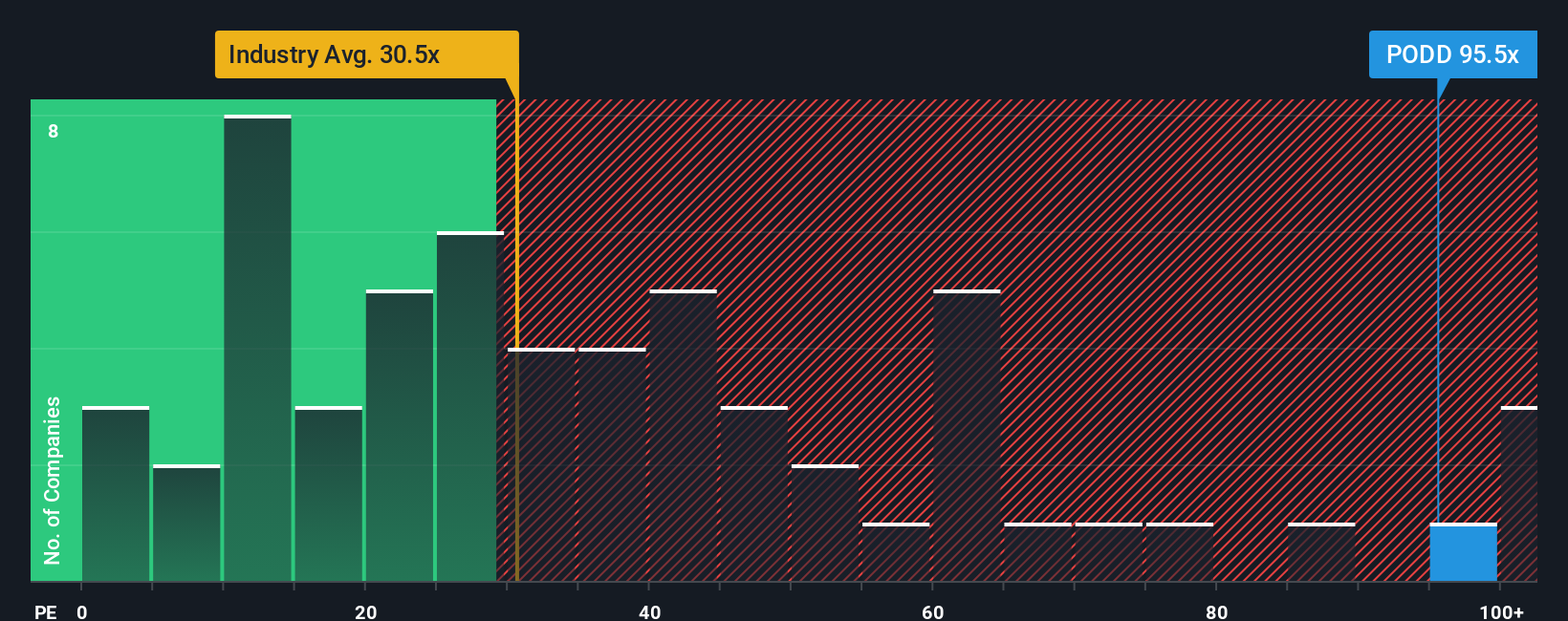

There is a clear tension here. On one hand, Simply Wall St’s fair value estimate of $333.46 and the popular narrative both flag Insulet as undervalued at $242.74. On the other hand, the current P/E of 69.4x is far above the US Medical Equipment industry at 30.4x, peers at 42.8x, and a fair ratio of 33x. This points to meaningful valuation risk if sentiment cools.

When one model argues for upside and another flags a stretched P/E against both peers and a fair ratio that the market could drift toward, it raises a simple question for you as an investor: which signal do you trust more at this price?

Build Your Own Insulet Narrative

If you are not convinced by these views or simply prefer to test your own assumptions against the numbers, you can build a personalised thesis in a few minutes by starting with Do it your way.

A great starting point for your Insulet research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Insulet has sharpened your focus, do not stop here; broaden your watchlist with a few targeted screens that surface very different types of opportunities.

- Zero in on quality at a discount by scanning our 54 high quality undervalued stocks that combine solid fundamentals with prices below intrinsic estimates.

- Strengthen your income pillar by reviewing 13 dividend fortresses that offer higher yields while still keeping an eye on stability.

- Prioritise resilience by checking 83 resilient stocks with low risk scores designed to highlight companies with calmer risk profiles when markets feel unsettled.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.