Please use a PC Browser to access Register-Tadawul

Assessing International Seaways (INSW) Valuation As Strong Tanker Cash Flows Support Capital Returns

International Seaways, Inc. INSW | 67.47 | +0.66% |

Why a cybersecurity talk in Davos matters for a tanker owner

International Seaways (INSW) is on investor radar after its Global CISO, Amit Basu, appeared at the Global Cyber Future Dialogue in Davos, spotlighting cybersecurity risks in the tanker shipping business.

The Davos appearance comes at a time when momentum in International Seaways’ shares has been strong, with a 30 day share price return of 19.09% and a 1 year total shareholder return of 71.54% alongside 5 year total shareholder returns of more than 4x.

If this mix of tanker exposure and cybersecurity focus has caught your eye, it could be a good moment to see what else is moving in energy linked transport, including aerospace and defense stocks.

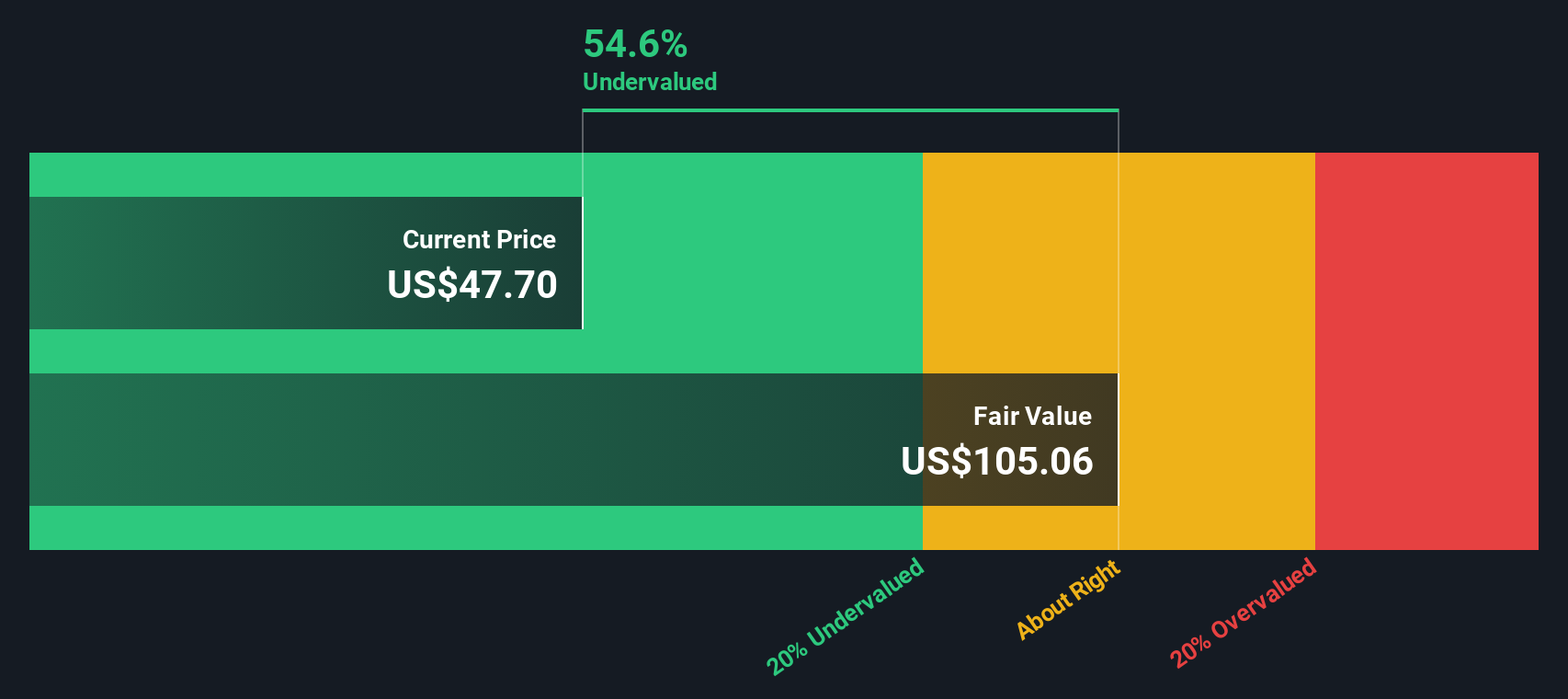

With International Seaways trading at US$58.07 against an analyst target of US$60.20 and an indicated intrinsic value gap of about 52%, you have to ask: is there still mispricing here, or is the market already baking in future growth?

P/E of 13.2x, is it justified?

At a P/E of 13.2x, International Seaways trades slightly below both the estimated fair P/E of 14.5x and the US Oil and Gas industry average of 13.4x, yet above its peer group average of 10.8x.

The P/E ratio compares the current share price to earnings per share, so for a tanker owner like International Seaways it reflects what the market is willing to pay for each dollar of current earnings from crude and product shipping.

On one hand, the SWS DCF model suggests the shares are trading at about a 51.7% discount to an estimated future cash flow value of US$120.19, and the fair P/E indication of 14.5x points to a level the market could move toward if those cash flows materialise. On the other hand, the current 13.2x P/E is above the 10.8x peer average, which may indicate investors are attaching a richer multiple than some similar companies, even though the stock sits slightly below the wider industry average of 13.4x.

Result: Price-to-earnings of 13.2x (ABOUT RIGHT)

However, you still have to weigh risks like sector wide P/E compression or any shift in charter demand that could challenge current earnings assumptions.

Another view: DCF says the gap is even wider

The P/E of 13.2x suggests International Seaways is roughly in line with where the market might settle, but our DCF model points to a future cash flow value of US$120.19 per share versus the current US$58.07 price. That kind of gap can signal mispricing or very cautious expectations. Which story do you think fits better?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out International Seaways for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own International Seaways Narrative

If this take does not quite match your view, or you prefer to rely on your own work, you can build a full thesis yourself in just a few minutes by starting with Do it your way.

A great starting point for your International Seaways research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If International Seaways has you thinking harder about your portfolio, do not stop here; broaden your watchlist now so you are not playing catch up later.

- Spot potential high impact opportunities early by checking out these 3534 penny stocks with strong financials that already clear basic financial quality hurdles.

- Position yourself at the intersection of medicine and machine learning through these 109 healthcare AI stocks that focus on applying AI to real world healthcare problems.

- Tap into digital asset themed businesses with these 19 cryptocurrency and blockchain stocks that sit on the front line of blockchain infrastructure and services.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.