Please use a PC Browser to access Register-Tadawul

Assessing Iovance Biotherapeutics (IOVA) Valuation After Revenue Guidance And 1,000 Patient Milestone

Iovance Biotherapeutics Inc IOVA | 2.87 | +0.70% |

Iovance Biotherapeutics (IOVA) recently told investors it expects to meet its 2025 revenue guidance of US$250 million to US$300 million, while surpassing 1,000 patients treated with its tumor infiltrating lymphocyte therapies globally.

The revenue guidance update and patient milestone come after a mixed stretch for investors, with the share price at US$2.45 and a 1-month share price return of 8.89% and a 90-day share price return of 16.67%, set against a 1-year total shareholder return decline of 61.72% and a 5-year total shareholder return decline of 95.20%. This suggests recent momentum has picked up after a difficult longer term experience.

If you are looking beyond Iovance and want more ideas in the same space, this could be a useful moment to review healthcare stocks.

With the share price at US$2.45, a very large discount to some analyst targets and a history of sharp long term declines, the key question is whether Iovance is now undervalued or if the market already reflects future growth.

Most Popular Narrative: 70.7% Undervalued

With Iovance Biotherapeutics last closing at US$2.45 against a narrative fair value of US$8.35, the valuation gap centers on how aggressively future growth is modeled.

• Analysts are assuming Iovance Biotherapeutics's revenue will grow by 45.6% annually over the next 3 years.

For readers curious what kind of revenue ramp and margin shift could justify that valuation gap, along with a premium future earnings multiple rarely seen in this sector, the full narrative lays out the numbers behind that view in detail.

Result: Fair Value of $8.35 (UNDERVALUED)

However, there are still meaningful risks here, including regulatory uncertainty in Europe and the company’s heavy dependence on Amtagvi as its only approved product.

Another View: Market Ratios Send a Different Signal

While the narrative fair value suggests Iovance Biotherapeutics looks heavily undervalued, its current P/S ratio of 3.9x sits slightly above a fair ratio of 3.7x. That gap is small, but it hints that, on sales alone, the market might already be pricing in some optimism. Is this a cushion or a thin margin of safety?

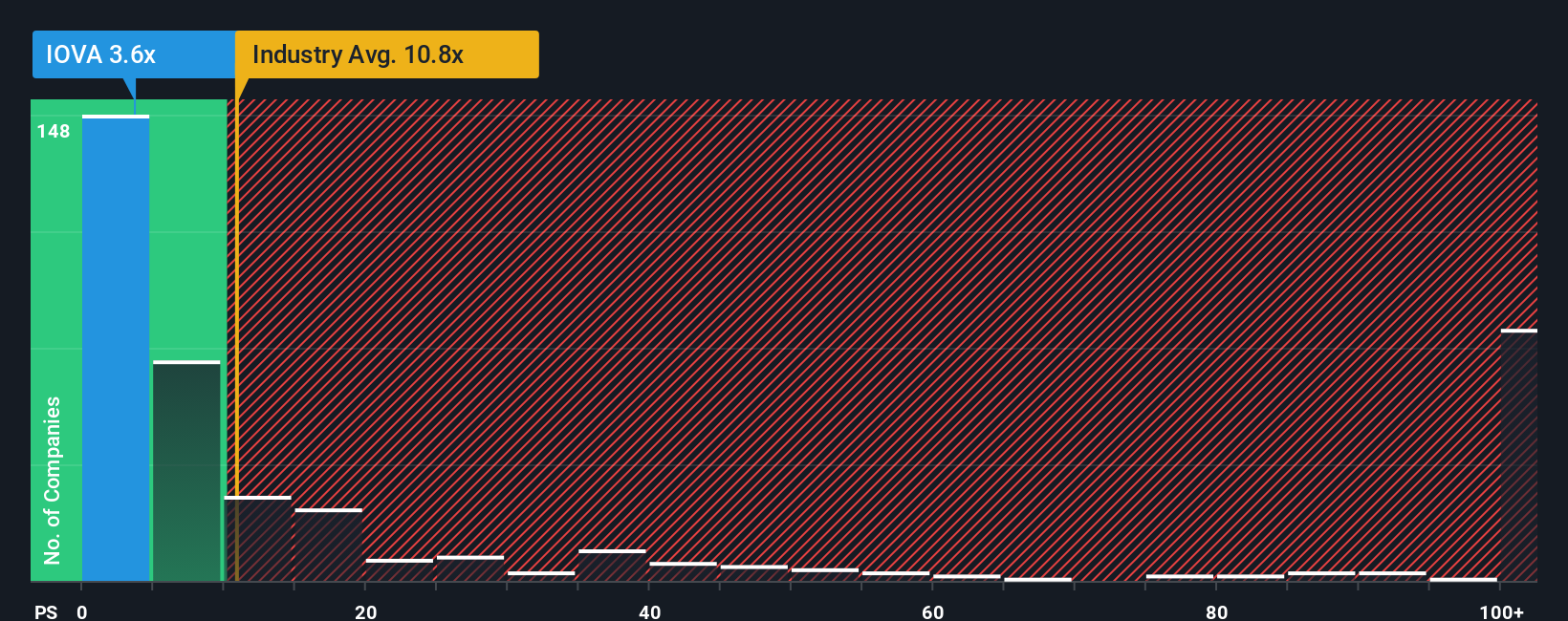

Compared with peers, the picture shifts again. Iovance trades on a P/S of 3.9x versus a 7.3x average for close peers and 12.4x for the broader US Biotechs industry, which points to a much lower sales multiple than many comparables. The question is whether that discount reflects risk that has not gone away or potential that has not yet been recognised.

Build Your Own Iovance Biotherapeutics Narrative

If you see the numbers differently or want to test your own assumptions, you can build a fresh Iovance view in just a few minutes, starting with Do it your way.

A great starting point for your Iovance Biotherapeutics research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you only stop at Iovance, you could miss other opportunities that better fit your goals, so take a few minutes to widen your watchlist with targeted screens.

- Target potential mispriced names by running a focused search through these 877 undervalued stocks based on cash flows that align with your preferred risk and return profile.

- Tap into cutting edge trends by scanning these 28 AI penny stocks that are tied to real business models rather than just headlines.

- Lock in income-focused candidates by filtering for these 12 dividend stocks with yields > 3% that match your yield expectations and payout preferences.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.