Please use a PC Browser to access Register-Tadawul

Assessing J&J Snack Foods (JJSF) Valuation After A 30% One Year Shareholder Return Decline

J & J Snack Foods Corp. JJSF | 84.65 | -0.49% |

Why J&J Snack Foods (JJSF) is On Investors’ Radar Today

J&J Snack Foods (JJSF) is drawing fresh attention after recent trading left the shares about 30% lower over the past year, even as revenue and net income show single digit to low double digit annual growth.

At a share price of $94.21, J&J Snack Foods has a 30 day share price return of 4.84% and a 90 day share price return of 7.13%. However, the 1 year total shareholder return of 30.07% decline suggests recent momentum is still trying to repair a longer period of weaker sentiment.

If this kind of rebound story has your attention, it could be a good moment to broaden your watchlist and check out fast growing stocks with high insider ownership.

So with J&J Snack Foods trading about 30% below its 1 year level yet carrying analyst targets and intrinsic estimates above the current US$94.21 price, is this a genuine entry point, or is the market already baking in future growth?

Most Popular Narrative: 14.4% Undervalued

J&J Snack Foods most followed narrative pegs fair value at $110 a share versus the recent $94.21 price, which sets a clear gap to examine.

The company is poised to benefit from increasing demand for convenient, ready-to-eat snacks and higher out-of-home entertainment traffic, as demonstrated by robust performance in foodservice pretzels and Dippin' Dots sales tied to venues and theaters, supporting future revenue growth as consumer routines continue to normalize.

Curious how a modest revenue trajectory and firmer margins could still back a richer earnings profile and valuation multiple than the broader food sector? The narrative lays out exactly which long range earnings path and pricing power assumptions have to hold up to reach that $110 figure.

Result: Fair Value of $110 (UNDERVALUED)

However, you still need to weigh the pressure from ingredient cost inflation and the weak Retail segment, where frozen novelty and handheld sales have already slipped.

Another View: Earnings Multiple Flags A Richer Price

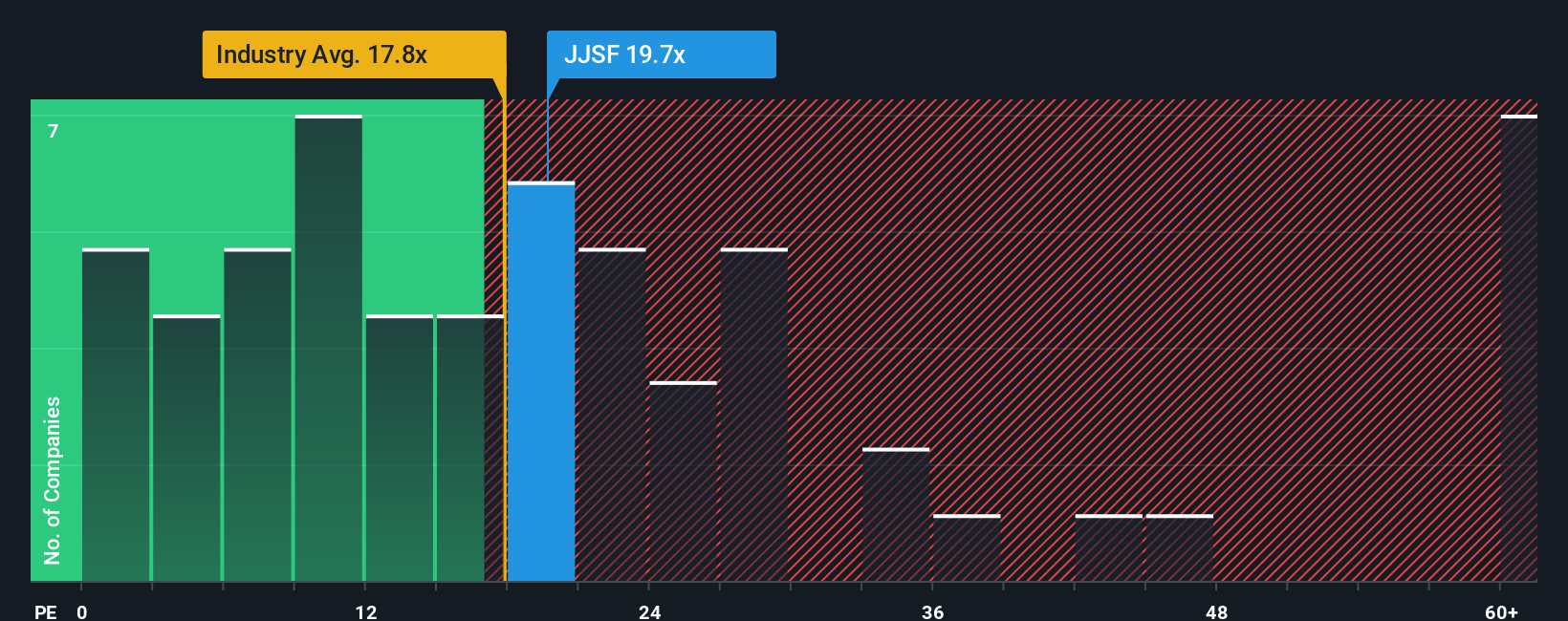

While the narrative and cash flow based work point to J&J Snack Foods trading below fair value, the current P/E of 27.3x tells a different story. It sits well above the US Food industry at 20.7x and the fair ratio of 15.9x, even though it is far below peers at 72.4x.

In plain terms, the stock is already priced at a premium to the sector and to where our fair ratio suggests the market could settle. This raises the question: is this a sensible premium for moderate growth, or a valuation risk if sentiment cools?

Build Your Own J&J Snack Foods Narrative

If you see the numbers differently or want to stress test your own assumptions, you can spin up a custom J&J Snack Foods view, start fresh and Do it your way.

A great starting point for your J&J Snack Foods research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready to widen your opportunity set?

Do not stop at a single stock story when you can quickly compare themes, sectors, and return profiles across hundreds of ideas tailored to what matters to you.

- Spot potential mispriced names by scanning these 881 undervalued stocks based on cash flows that line up with your own view on cash flows and quality.

- Ride major tech shifts early by checking out these 24 AI penny stocks shaping how artificial intelligence reaches real-world products and services.

- Strengthen your income watchlist by filtering for these 13 dividend stocks with yields > 3% that may suit a yield focused approach without ignoring fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.