Please use a PC Browser to access Register-Tadawul

Assessing Knife River (KNF) Valuation After Wells Fargo Downgrade And Higher Price Target

Knife River Corporation KNF | 90.70 | +2.76% |

Wells Fargo downgrade puts Knife River in focus

Wells Fargo’s decision to downgrade Knife River (KNF) to Equal-Weight while lifting its price target to $81 has put fresh attention on the stock and how analysts currently view its prospects.

Knife River’s recent momentum has been firm, with a 23.6% 90 day share price return and year to date share price return of 10.31% taking the stock to $80.24, even though the 1 year total shareholder return is a 23.05% decline, which points to a recovering share price rather than a straight line move.

If this shift in sentiment has you rethinking your watchlist, it could be a good time to broaden your search with fast growing stocks with high insider ownership.

With KNF trading at $80.24 against an $81 Wells Fargo target and an average target of about $98, the key question is whether the recent rebound still leaves upside on the table or if the market is already pricing in future growth.

Most Popular Narrative: 17.1% Undervalued

With Knife River last closing at $80.24 against a narrative fair value of $96.80, the current share price sits below that assessment of worth.

In order for you to agree with the analyst's consensus, you would need to believe that by 2028, revenues will be $3.6 billion, earnings will be $264.4 million, and it would be trading on a PE ratio of 29.7x, assuming you use a discount rate of 8.1%.

Curious how a construction materials company lines up for that kind of earnings, margin shift, and premium P/E multiple? The full narrative spells out the assumptions behind it.

Result: Fair Value of $96.80 (UNDERVALUED)

However, you also need to weigh risks such as heavy reliance on public infrastructure funding and weather related project disruptions that could challenge those upbeat earnings assumptions.

Another View: Multiples Point To A Richer Price Tag

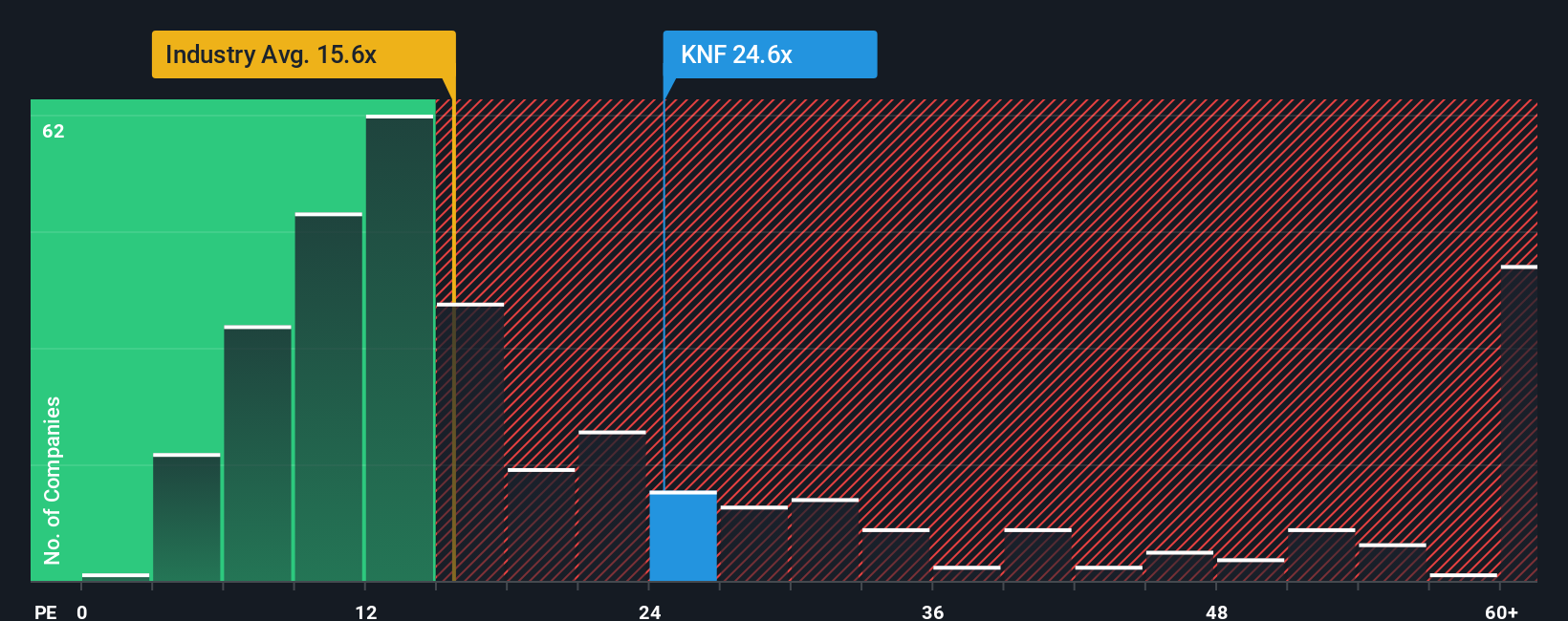

While the narrative fair value suggests Knife River looks 17.1% undervalued, its current P/E of 30.7x tells a different story. That multiple sits well above the global Basic Materials average of 15.2x, the peer average of 20x, and the fair ratio of 20.7x the market could move towards.

In practice, that gap means you are paying a higher price for each dollar of earnings, which could limit upside if expectations ease or growth stumbles. The question is whether you think Knife River’s future earnings path fully justifies paying such a premium today.

Build Your Own Knife River Narrative

If the consensus narrative does not quite match your view, it is straightforward to dig into the numbers yourself and build a version you trust, then Do it your way.

A great starting point for your Knife River research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Knife River has you thinking differently about your portfolio, do not stop here. The next opportunity you act on could be the one that makes the real difference.

- Spot potential bargains early by scanning these 3534 penny stocks with strong financials that pair smaller share prices with underlying financial strength.

- Ride powerful secular themes by focusing on these 24 AI penny stocks shaping how automation, data and software reshape entire sectors.

- Put cash flow at the center of your process with these 868 undervalued stocks based on cash flows that filter for companies priced below what their numbers suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.