Please use a PC Browser to access Register-Tadawul

Assessing Krystal Biotech (KRYS) Valuation After Analyst Optimism On Vyjuvek Expansion And Ophthalmic Pipeline

Krystal Biotech, Inc. KRYS | 261.80 | -0.33% |

Analyst optimism and product pipeline in focus

Krystal Biotech (KRYS) is back in the spotlight after several major research houses highlighted its potential to evolve into a multi product company, pointing to ophthalmic candidates KB803 and KB801 and the planned geographic expansion of Vyjuvek.

Those upbeat analyst views have landed alongside strong recent momentum, with Krystal Biotech’s share price at $282.27 and a 30 day share price return of 14.32%, while its 1 year total shareholder return of 77.49% and 3 year total shareholder return above 2.5x signal sustained strength rather than a short term spike.

If this kind of biotech story has your attention, it could be a good moment to scan other US-listed healthcare stocks that might fit a similar high research interest profile.

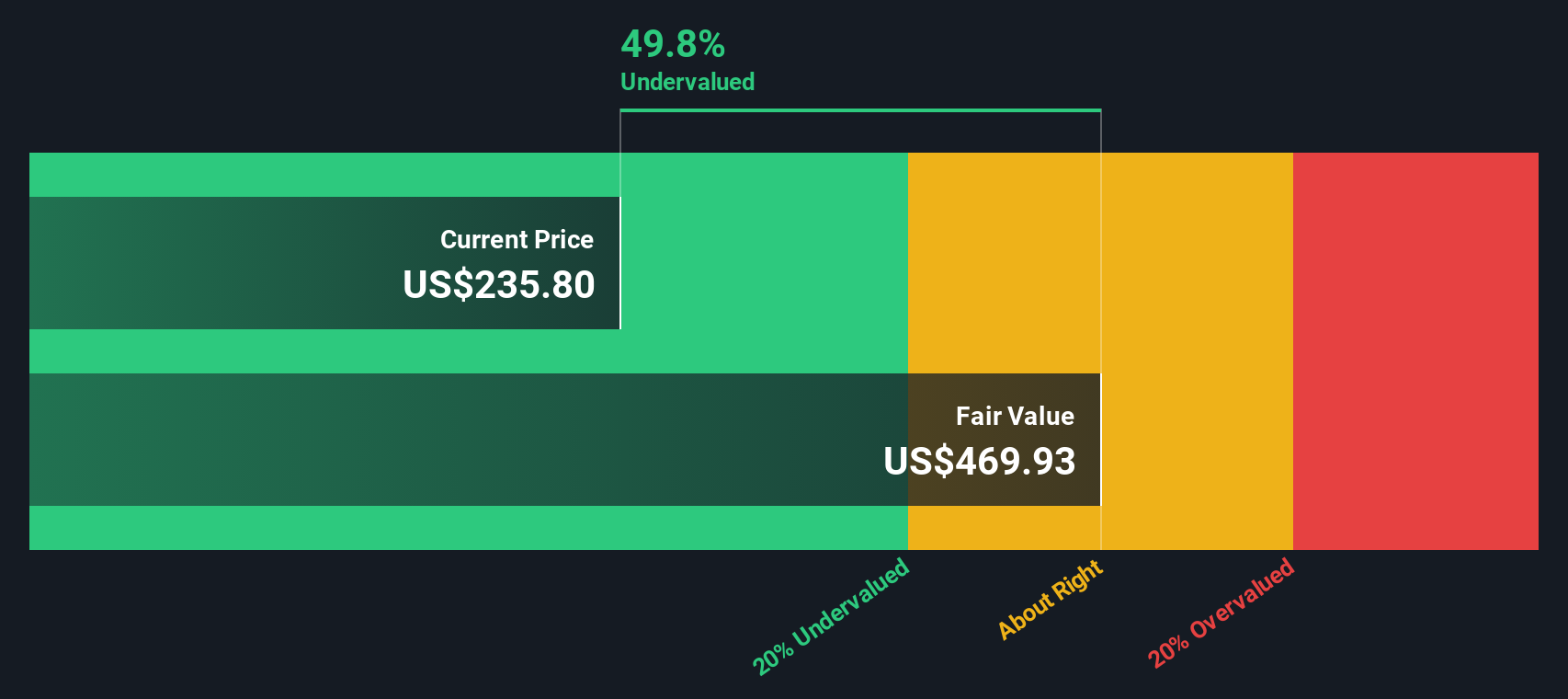

With KRYS trading close to recent analyst targets but showing a very large 3 year total return and an indicated intrinsic discount near 50%, you have to ask yourself: is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 3.2% Overvalued

Krystal Biotech’s most followed narrative pegs fair value at $273.60, slightly below the last close at $282.27, which puts the current price just above that model.

The expansion of Krystal's pipeline, including imminent and near-term clinical readouts in lung disease (AATD, CF), ophthalmology, oncology (NSCLC), and aesthetics, leverages increased R&D productivity, which could drive future revenue growth and diversify earnings beyond a single product.

Curious what sits behind that fair value line? The narrative leans on fast compounding revenue, rising margins, and a lower future earnings multiple than today. The tension between strong growth inputs and a higher discount rate is where the story really gets interesting.

Based on this narrative, Krystal Biotech’s current share price is slightly above the $273.60 fair value estimate, using a 7.06% discount rate and detailed forecasts for future earnings and margins. The model effectively asks whether you agree that revenue can compound at a robust pace while profitability steps up and the P/E multiple trends lower from today’s level over the next few years.

Result: Fair Value of $273.60 (OVERVALUED)

However, you still have to weigh how dependent Krystal is on Vyjuvek today, as well as the uncertainty around future reimbursement decisions in Europe and Japan.

Another View: Cash Flows Point to a Very Different Story

While the popular narrative sees Krystal Biotech as 3.2% overvalued at $282.27 versus a $273.60 fair value, our DCF model presents a very different picture, with an estimated future cash flow value of $562.69, implying a very large gap between price and model value.

That sort of disconnect is unusual and raises a simple question for you as an investor: are analysts being too cautious on long term earnings power, or is the cash flow model relying too heavily on optimistic assumptions?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Krystal Biotech for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 873 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Krystal Biotech Narrative

If you see this differently or prefer to trust your own work, you can test the numbers yourself and shape a custom story in minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Krystal Biotech.

Looking for more investment ideas?

If Krystal Biotech has you thinking bigger about your portfolio, now is the time to scan other focused ideas before the crowd catches on.

- Target potential value by checking out these 873 undervalued stocks based on cash flows that screen for opportunities based on discounted cash flows.

- Ride structural trends in automation and data by reviewing these 24 AI penny stocks that connect directly to artificial intelligence themes.

- Add income angles by scanning these 13 dividend stocks with yields > 3% that combine yield above 3% with listed equity exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.