Please use a PC Browser to access Register-Tadawul

Assessing MannKind (MNKD) Valuation Following FDA Acceptance of Afrezza Pediatric Application

MannKind Corporation MNKD | 5.94 | +2.24% |

MannKind (MNKD) just announced that the FDA has accepted its supplemental biologics license application for Afrezza, this time targeting children and adolescents with type 1 or type 2 diabetes. This development moves the potential for expanded use of Afrezza in younger patients one step closer, and investors are watching the process to see how it could reshape the company’s future revenue streams.

MannKind’s share price has seen renewed momentum lately, jumping over 45% in the past 90 days, with this week’s FDA news sparking added interest. Even so, the stock’s 12-month total shareholder return is still down 17%. When looking at three- and five-year timeframes, long-term holders have been well rewarded with gains of 64% and 167% respectively. Recent catalysts like the Afrezza pediatric application and the publication of trial data are helping optimism build around future growth prospects.

If MannKind’s regulatory progress has you curious about fresh opportunities in the healthcare space, consider exploring See the full list for free.

With investor enthusiasm high after recent gains, the key question now is whether MannKind shares still offer value to buyers or if the market has already factored in expectations for Afrezza’s pediatric expansion.

Most Popular Narrative: 48.3% Undervalued

With MannKind’s most widely followed narrative putting fair value at $10.57, nearly double the last close of $5.47, the stock’s upside potential is catching attention. The assumptions behind this narrative are driven by commercial expansion, pipeline momentum, and ambitious growth targets for both revenue and profit margins.

“Multiple late-stage pipeline programs (inhaled clofazimine for NTM and nintedanib DPI for IPF) are progressing toward key regulatory and clinical milestones. These programs are benefiting from expedited pathways and growing unmet need in chronic respiratory diseases, with the potential to significantly diversify and expand future revenues. Increased adoption of patient-friendly inhaled drug delivery and preparation for additional label updates (including for new patient populations such as gestational diabetes), combined with new physician and consumer marketing campaigns, are likely to improve Afrezza's market share and strengthen net margins through improved scale and operating leverage.”

What if bold projections for earnings and margins are just the beginning? The narrative hints at expansion ambitions and market-changing assumptions. Wondering how this outlook gets MannKind to its high fair value? Dive in and see which growth drivers take center stage.

Result: Fair Value of $10.57 (UNDERVALUED)

However, persistent challenges expanding Afrezza’s adoption or setbacks in key pipeline programs could quickly dampen MannKind’s bullish outlook and trigger a market reassessment.

Another View: Earnings Multiple Tells a Different Story

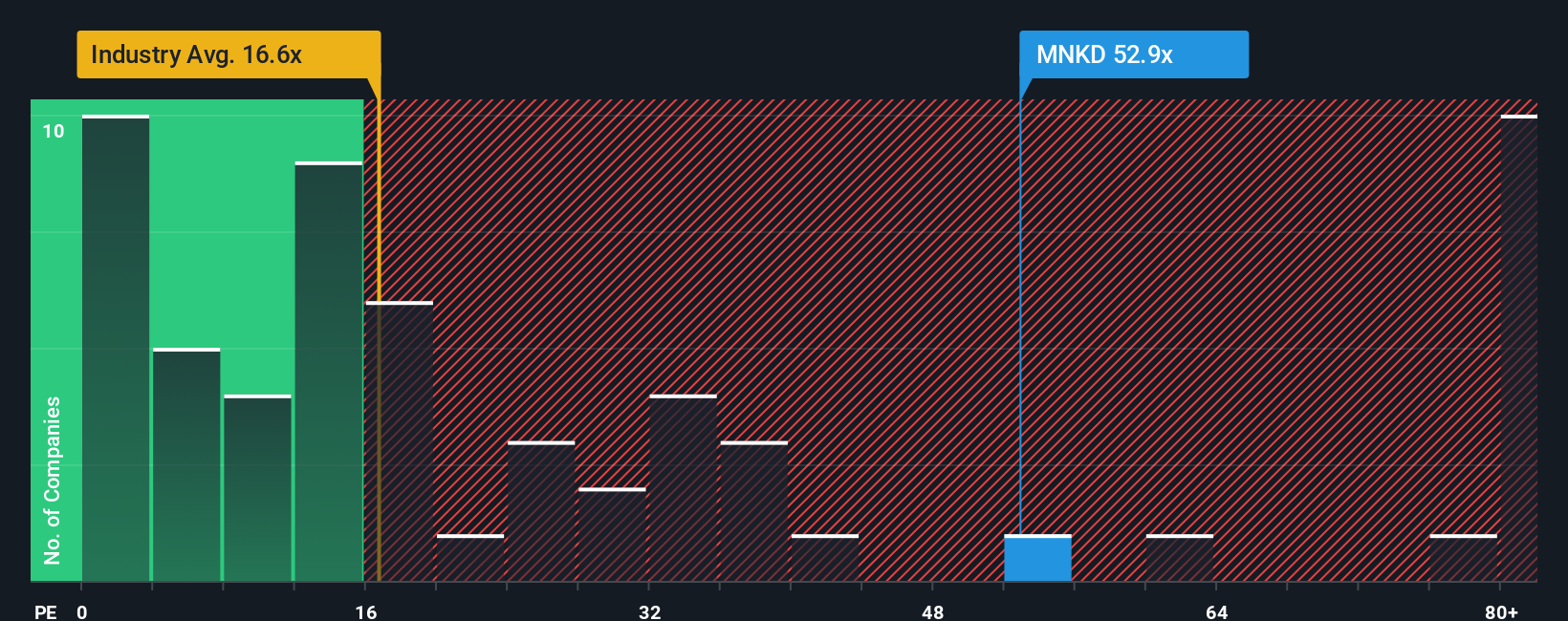

Taking a look at MannKind’s valuation using the most common market ratio, the price-to-earnings ratio sits at 51.2x, which is far higher than the US Biotechs industry average of 16.4x and above the fair ratio of 23.2x. This big gap suggests the shares might be priced for perfection, leaving little room for error if things go off track. Is the market’s optimism too much, or will future growth deliver?

Build Your Own MannKind Narrative

If you want to dig into the numbers and form your own opinion, it only takes a few minutes to craft a personalized outlook. Do it your way

A great starting point for your MannKind research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock your next smart move by searching cutting-edge stock ideas in seconds. The best opportunities can slip by if you don’t take action now.

- Capture the income potential of regular payouts when you check out these 18 dividend stocks with yields > 3%, which offers yields above 3% and resilient fundamentals.

- Uncover tomorrow’s tech trailblazers by reviewing these 24 AI penny stocks, which are pushing the boundaries of artificial intelligence and digital transformation.

- Capitalize on value with these 878 undervalued stocks based on cash flows, which screens for strong free cash flows and pricing missteps the market may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.