Please use a PC Browser to access Register-Tadawul

Assessing Merit Medical Systems (MMSI) Valuation After Board Chair Transition And Recent Share Price Strength

Merit Medical Systems, Inc. MMSI | 82.21 | +0.45% |

Merit Medical Systems (MMSI) is in focus after the board appointed long time director F. Ann Millner as Chair, following Fred P. Lampropoulos’ resignation as director and Chair and his move into a short term consulting role.

The leadership reshuffle comes as the 90 day share price return stands at 17.96% and the 30 day share price return at 11.74%. The 1 year total shareholder return of a 5.05% decline contrasts with 35.83% and 65.33% gains over three and five years, suggesting that longer term momentum has been stronger than in the recent past.

If this board change has you thinking about other healthcare names, it could be a good moment to scout healthcare stocks for more potential ideas.

With the stock up sharply over the past quarter, trading around $93.18 and sitting below an average analyst price target of $103.60, investors now have to ask: is there still value left here, or is the market already pricing in future growth?

Most Popular Narrative: 10% Undervalued

With Merit Medical Systems last closing at $93.18 against a narrative fair value of about $103.55, the current price sits below that fair value estimate and frames the leadership change against a richer earnings story.

The expanding global prevalence of chronic diseases and an aging population are increasing the need for interventional, diagnostic, and therapeutic medical procedures. Merit’s strong growth in cardiovascular and endoscopy segments, robust new product development, and recent acquisitions (such as Biolife and EndoGastric) position the company to capture a larger share of this growing market and drive sustained long-term revenue growth.

Curious what earnings path and margin profile sit behind that fair value gap, and how rich a future P/E multiple this narrative leans on? The full story joins revenue growth expectations, expanding profitability and a premium valuation assumption into one tightly argued case.

Result: Fair Value of $103.55 (UNDERVALUED)

However, this story could look very different if reimbursement for WRAPSODY CIE is delayed again, or if rising tariffs and trade tensions squeeze margins harder than expected.

Another View: Rich Multiples Raise a Flag

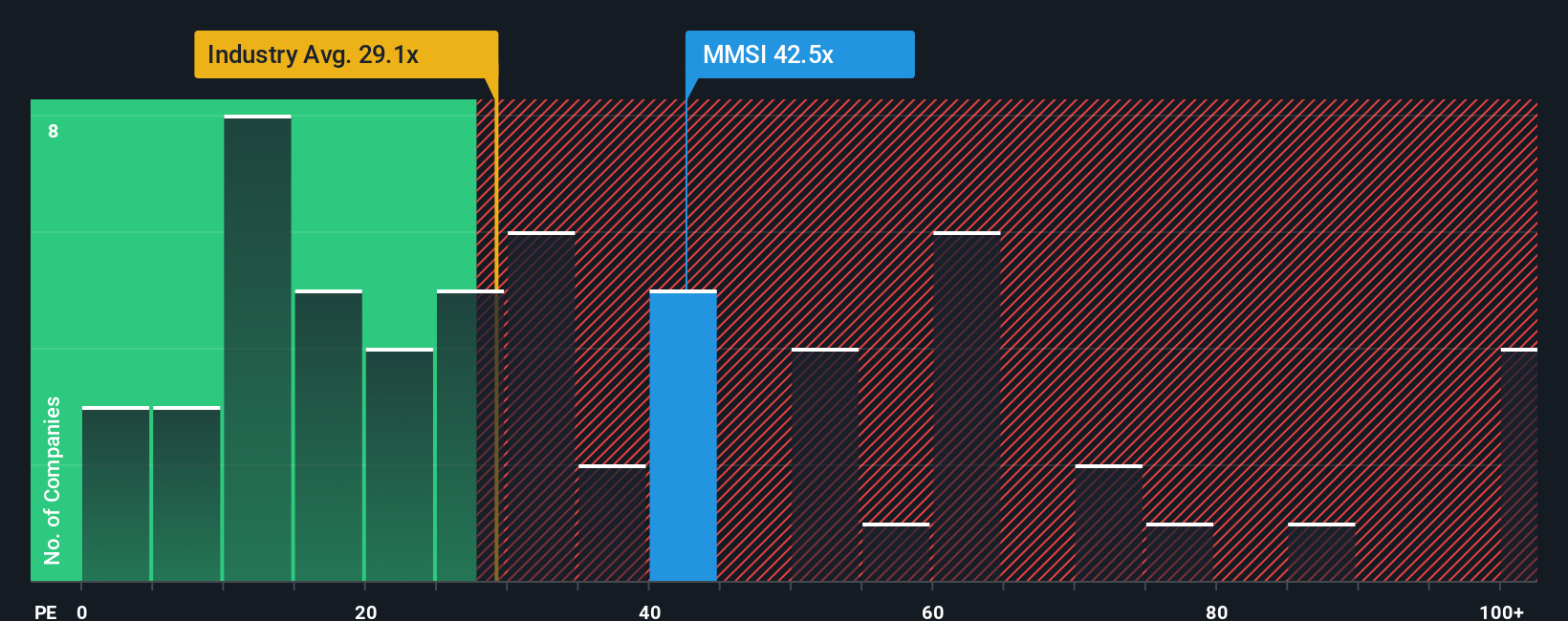

The narrative points to about 10% upside to fair value, but the current P/E of 46.6x tells a different story. It sits well above the US Medical Equipment industry at 30.8x, the peer average at 23.1x, and even the 24.8x fair ratio that the market could move toward over time.

That gap suggests there may be less room for error if growth or margins fall short. The key question is whether you think Merit’s earnings profile justifies paying so far above both peers and its own fair ratio.

Build Your Own Merit Medical Systems Narrative

If you are not fully sold on this view or prefer to stress test the numbers yourself, you can build a fresh thesis in minutes, starting with Do it your way.

A great starting point for your Merit Medical Systems research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger portfolio, do not stop with a single stock story. Use screeners to surface opportunities you might otherwise miss.

- Spot potential value plays early by scanning these 877 undervalued stocks based on cash flows built around cash flow driven metrics rather than short term market noise.

- Zero in on future facing themes by checking out these 28 AI penny stocks where artificial intelligence is at the core of each company’s business model.

- Strengthen your income focus by reviewing these 11 dividend stocks with yields > 3% that highlight higher yielding names with at least 3% payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.