Please use a PC Browser to access Register-Tadawul

Assessing MKS Instruments (MKSI) Valuation After Fresh Analyst Upgrades and a Reinforced Strong Buy Outlook

MKS Instruments, Inc. MKSI | 162.81 | -0.84% |

Fresh analyst upgrades and reaffirmed Buy ratings have pushed MKS (MKSI) back onto investors’ radar, as the semiconductor technology supplier sees confidence in its outlook rise alongside expectations for continued earnings momentum.

Even after a sharp pullback last week, with a 7 day share price return of negative 11.42 percent, MKS is still up meaningfully this year thanks to a 40.26 percent year to date share price return and a 43.96 percent 1 year total shareholder return. This suggests that recent weakness appears more like cooling momentum than a broken story.

If this kind of cyclical semiconductor upswing has you rethinking your watchlist, it might be worth exploring other high growth tech and AI names through high growth tech and AI stocks to spot the next wave of potential leaders.

With earnings accelerating, a Strong Buy analyst consensus, and shares still trading below price targets, is MKS quietly undervalued, or are investors already paying up for all of its future growth potential?

Most Popular Narrative: 15% Undervalued

With MKS last closing at $148.70 against a narrative fair value of $174.85, the story being told hinges on robust, compounding earnings power.

The operational pivot toward a more stable, services driven revenue mix (including higher margin annuity like service streams from the installed base) is increasing business resilience, supporting net margin expansion and reducing earnings volatility.

Curious what kind of revenue mix shift justifies that upside, and what profit multiple it assumes years from now? The narrative leans on sustained growth, rising margins, and a future earnings valuation usually reserved for elite chip names. Want to see the full chain of assumptions that underpins that fair value jump?

Result: Fair Value of $174.85 (UNDERVALUED)

However, high leverage and exposure to cyclical wafer equipment demand could quickly pressure margins and sentiment if the upcycle stumbles.

Another Angle on Value

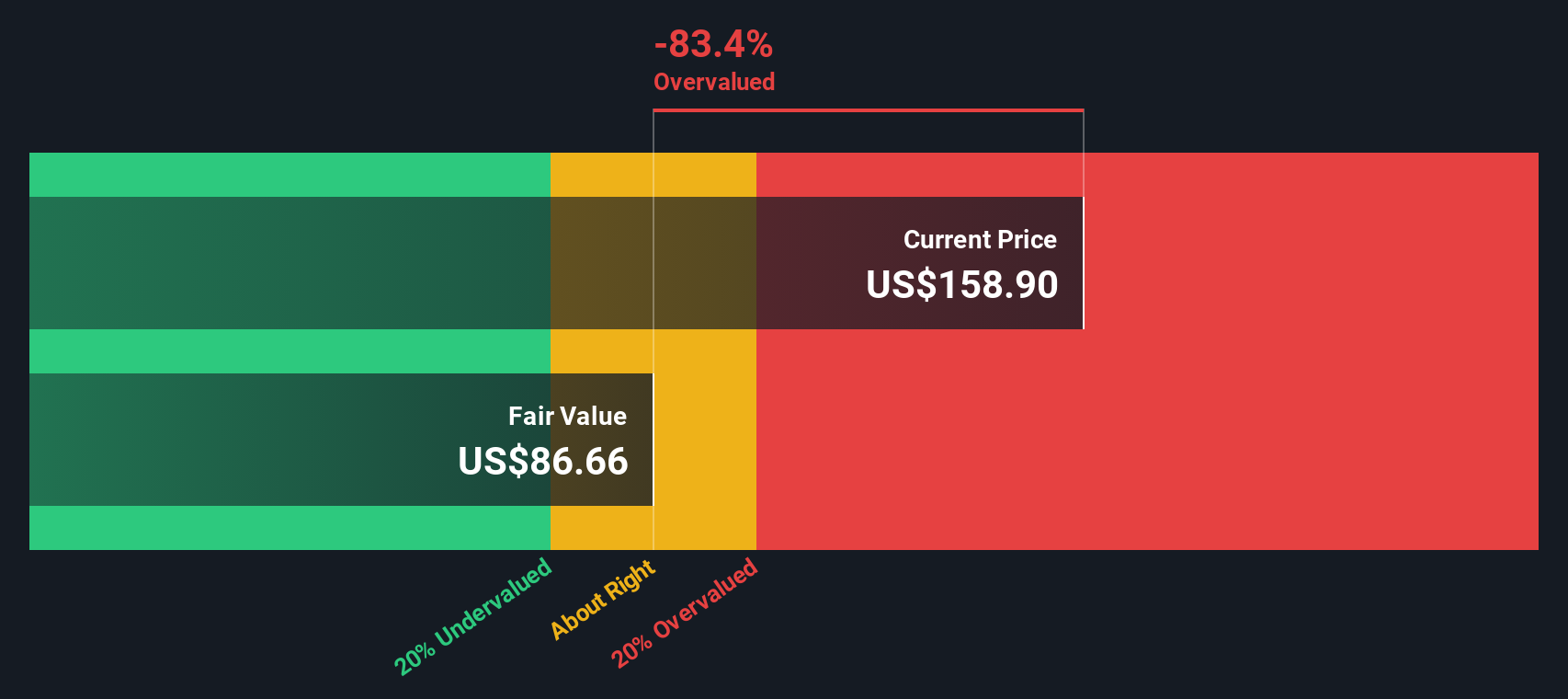

There is a catch. Our SWS DCF model puts MKS's fair value closer to $87.22 per share, which would make the current $148.70 price look expensive, not cheap. Are investors already pricing in a best case earnings ramp that the cash flows do not yet support?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MKS for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MKS Narrative

If this framing does not quite match your view, or you prefer digging into the numbers yourself, you can build a custom narrative in under three minutes: Do it your way.

A great starting point for your MKS research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, you can look for your next opportunity by using the Simply Wall Street Screener to uncover focused, data driven ideas that most investors overlook.

- Capture potential price missteps by targeting companies that look attractively priced through these 908 undervalued stocks based on cash flows, built from detailed cash flow analysis.

- Explore emerging innovation by zeroing in on these 25 AI penny stocks that are involved with automation and artificial intelligence.

- Review these 13 dividend stocks with yields > 3% as part of assessing potential income streams from companies that currently offer dividend yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.