Please use a PC Browser to access Register-Tadawul

Assessing Moelis (MC) Valuation After Mixed Recent Share Price Returns

Moelis & Co. Class A MC | 63.18 | +0.72% |

Moelis stock snapshot after recent performance

Moelis (MC) has drawn investor attention after a recent mix of returns, with the share price last closing at US$70.89 and showing a month decline alongside a gain over the past 3 months.

For context, the stock shows a 1 day return of 2.18%, with a 7 day decline of 2.76% and a 1 year total return decline of 7.38%. Over 3 years and 5 years, total returns of 73.02% and 74.93% highlight how different holding periods have produced very different outcomes.

For Moelis, the recent 2.18% 1 day share price return sits against a 30 day share price return decline of 4.91%, while the 3 year total shareholder return of 73.02% points to a much stronger longer term outcome.

If you are weighing Moelis alongside other ideas, it can help to see how advisory focused names compare with companies that aim for fast growth and owner alignment. Now may be a good moment to broaden your research and check out fast growing stocks with high insider ownership.

With Moelis trading at US$70.89 with a value score of 1, a small 1.74% premium to one intrinsic estimate, and an 11.86% gap to analyst targets, is this a buying window or is future growth already priced in?

Most Popular Narrative: 7.3% Undervalued

Moelis' most followed narrative points to a fair value of $76.50 compared with the last close at $70.89, putting the spotlight on how future earnings and margins could justify that gap.

The analysts have a consensus price target of $78.6 for Moelis based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $90.0, and the most bearish reporting a price target of just $65.0.

Want to see what sits behind that valuation gap? The narrative leans on faster revenue growth, rising margins and a future earnings multiple that assumes Moelis keeps scaling its fee pool. Curious how those pieces fit together into $76.50 of fair value? The full breakdown connects each assumption to that number.

Result: Fair Value of $76.50 (UNDERVALUED)

However, there are still clear swing factors, including the risk that higher hiring and compensation costs squeeze margins if deal activity or fee growth does not keep pace.

Another View: Cash Flows Point to a Richer Price

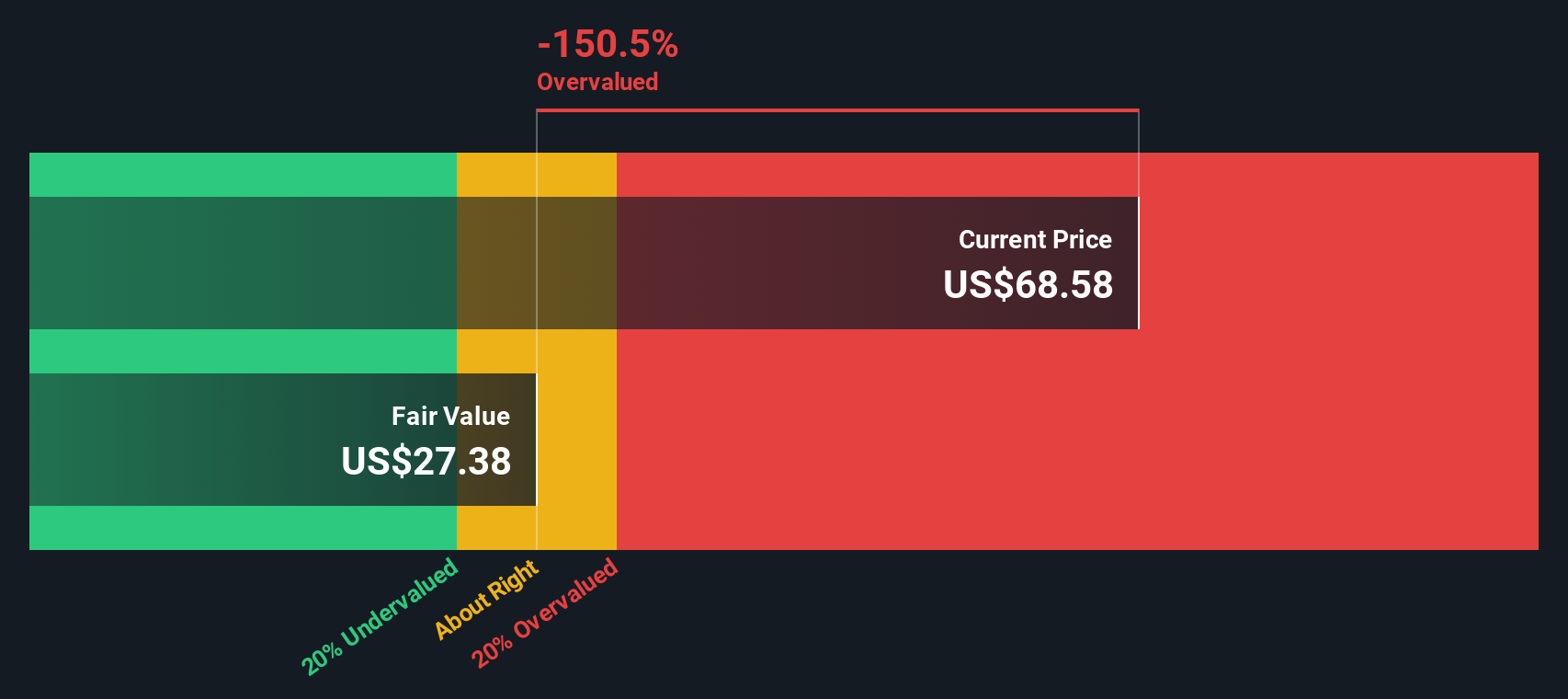

While the most followed narrative sees Moelis as 7.3% undervalued at $76.50, our DCF model paints a slightly different picture, with a fair value estimate of $69.68. On that basis, the current $70.89 price looks a touch expensive rather than cheap.

So which signal should matter more to you: the earnings based fair value at $76.50 or the cash flow based mark at $69.68?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Moelis for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 868 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Moelis Narrative

If you look at the numbers and reach a different conclusion, or simply want to walk through the assumptions yourself, you can build a fresh Moelis story in just a few minutes with Do it your way.

A great starting point for your Moelis research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Moelis has caught your attention, do not stop here. The Screener can quickly surface other opportunities that might fit your style and help round out your research.

- Target potential mispricing by reviewing these 868 undervalued stocks based on cash flows that align with your view on quality and cash flows.

- Tap into powerful themes in artificial intelligence through these 27 AI penny stocks that link real businesses to this long term trend.

- Strengthen your search for income by reviewing these 11 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.