Please use a PC Browser to access Register-Tadawul

Assessing NextDecade (NEXT) Valuation After New Rio Grande LNG Contract Commentary

NextDecade Corp. NEXT | 5.48 | -1.79% |

NextDecade (NEXT) is back in focus after fresh commentary on its Rio Grande LNG project, which is framed as a potential long term supplier to Europe as the region reduces reliance on Russian gas.

The latest commentary around Rio Grande LNG and its long term European role arrives after a sharp 1 day share price return of 4.13% and a 7 day share price return of 8.18%. However, the 1 year total shareholder return of a 41.87% decline shows momentum has been fragile over a longer horizon.

If this LNG story has your attention, it could be worth widening your energy watchlist to include aerospace and defense stocks as another pocket of the market where large capital projects and multi year contracts often drive interest.

With the share price recovering over the past week but still sitting well below its 1 year level and recent commentary highlighting long term LNG contracts, you have to ask yourself: is this a reset entry point, or is the market already pricing in future growth?

Price to Book of 9.1x: Is It Justified?

NextDecade closed at US$5.29, yet its P/B ratio of 9.1x stands well above both its industry and peer averages. This points to a rich valuation compared with many other oil and gas names.

P/B compares the company’s market value to its accounting book value. For a business like NextDecade, which is focused on developing large LNG and carbon capture projects and currently reports minimal revenue and ongoing losses, this metric highlights how much of the share price is tied to expectations rather than current earnings power.

Here, the implication is that with NextDecade still unprofitable, forecast to remain so over the next 3 years, and reporting no meaningful revenue, a 9.1x P/B suggests the market is placing a high value on the Rio Grande LNG and related CCS projects long before they translate into profits.

The gap to benchmarks is wide. The broader US oil and gas industry trades at an average P/B of 1.3x, while NextDecade’s peer group sits around 1.6x. The current 9.1x level therefore prices the company at a multiple that is several times higher than both.

Result: Price to book of 9.1x (OVERVALUED)

However, you also need to weigh project execution and funding risk, since NextDecade currently reports no revenue and a net loss of US$193.476 million.

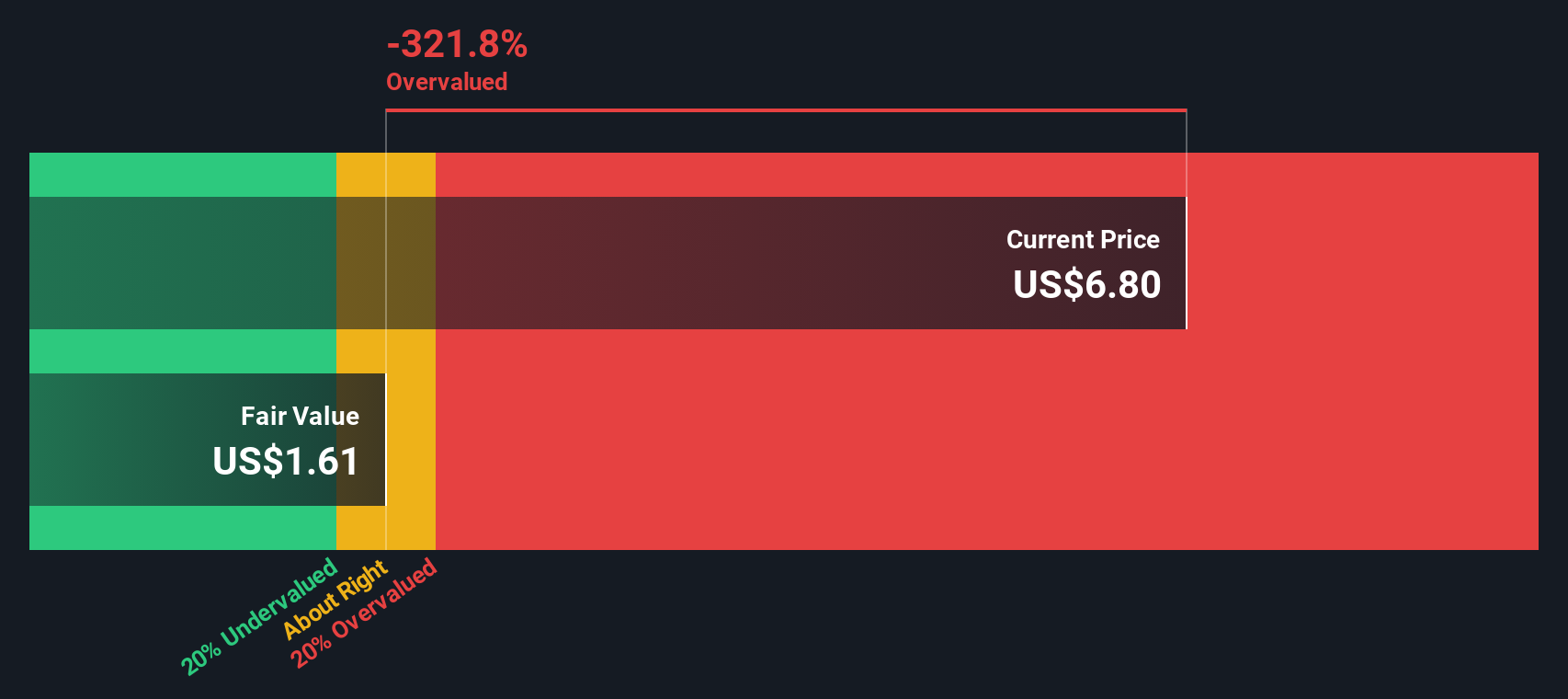

Another View: Our DCF Signals Deep Undervaluation

Here is where the story gets interesting. While the 9.1x P/B ratio looks expensive compared with industry and peers, our DCF model points in the opposite direction, with an estimated fair value of US$121.09 per share versus the current US$5.29. That gap indicates a very different risk reward profile.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NextDecade for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 873 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NextDecade Narrative

If this framework does not quite fit your view or you prefer to stress test the numbers yourself, you can develop a custom thesis in just a few minutes and Do it your way.

A great starting point for your NextDecade research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready to hunt for more investment ideas?

If NextDecade has sharpened your interest, do not stop here; the real edge often comes from comparing a few different opportunities side by side.

- Target potential value gaps by reviewing these 873 undervalued stocks based on cash flows that may offer prices below what their cash flows imply.

- Spot early growth stories by scanning these 3529 penny stocks with strong financials that pair smaller market caps with stronger financial footing.

- Tap into future focused themes by checking out these 109 healthcare AI stocks bringing data driven tools to medicine and diagnostics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.