Please use a PC Browser to access Register-Tadawul

Assessing Nutanix (NTNX) Valuation After Soft Earnings And Weaker Forward Guidance

Nutanix, Inc. Class A NTNX | 39.84 | -3.58% |

Why Nutanix (NTNX) is back in focus after its latest earnings

Nutanix (NTNX) is in the spotlight after reporting Q3 revenue growth of 13.5% year on year, which came in 0.9% below analyst expectations, alongside weaker guidance for the next quarter and full year.

The company also issued the softest revenue outlook versus peers. This has sharpened attention on how its hybrid multicloud and hyperconverged infrastructure business might balance growth ambitions with investor expectations around profitability and consistency.

The softer Q3 revenue print and cautious guidance appear to have fed into Nutanix’s recent share price performance, with the stock now at US$42.81 and a 30 day share price return of 17.67% decline, contributing to a 33.82% decline in one year total shareholder return, but still positive over three and five years.

If this earnings reaction has you reassessing the sector, it could be a useful moment to look across other high growth tech and AI stocks that are drawing attention from investors right now.

With Nutanix shares down sharply over the past year but still well ahead over three and five years, and trading at a sizable discount to analyst targets and some intrinsic estimates, is this a reset creating an entry point, or is the market already baking in future growth?

Most Popular Narrative: 36.9% Undervalued

With Nutanix shares at $42.81 and the most followed narrative pointing to a fair value of about $67.85, the gap between price and narrative expectations is wide enough to get attention.

Analysts are assuming Nutanix's revenue will grow by 15.3% annually over the next 3 years.

Analysts assume that profit margins will increase from 7.4% today to 13.2% in 3 years time.

Want to see what sits behind that higher fair value? The narrative leans on faster earnings, expanding margins, and a future profit multiple that is anything but modest. Curious which specific growth and margin paths are doing the heavy lifting here? The full story connects those assumptions directly to that $67.85 figure.

Result: Fair Value of $67.85 (UNDERVALUED)

However, a sharper shift of workloads to hyperscale public cloud providers, or pressure on Nutanix's margins from higher operating expenses, could challenge that underpriced growth story.

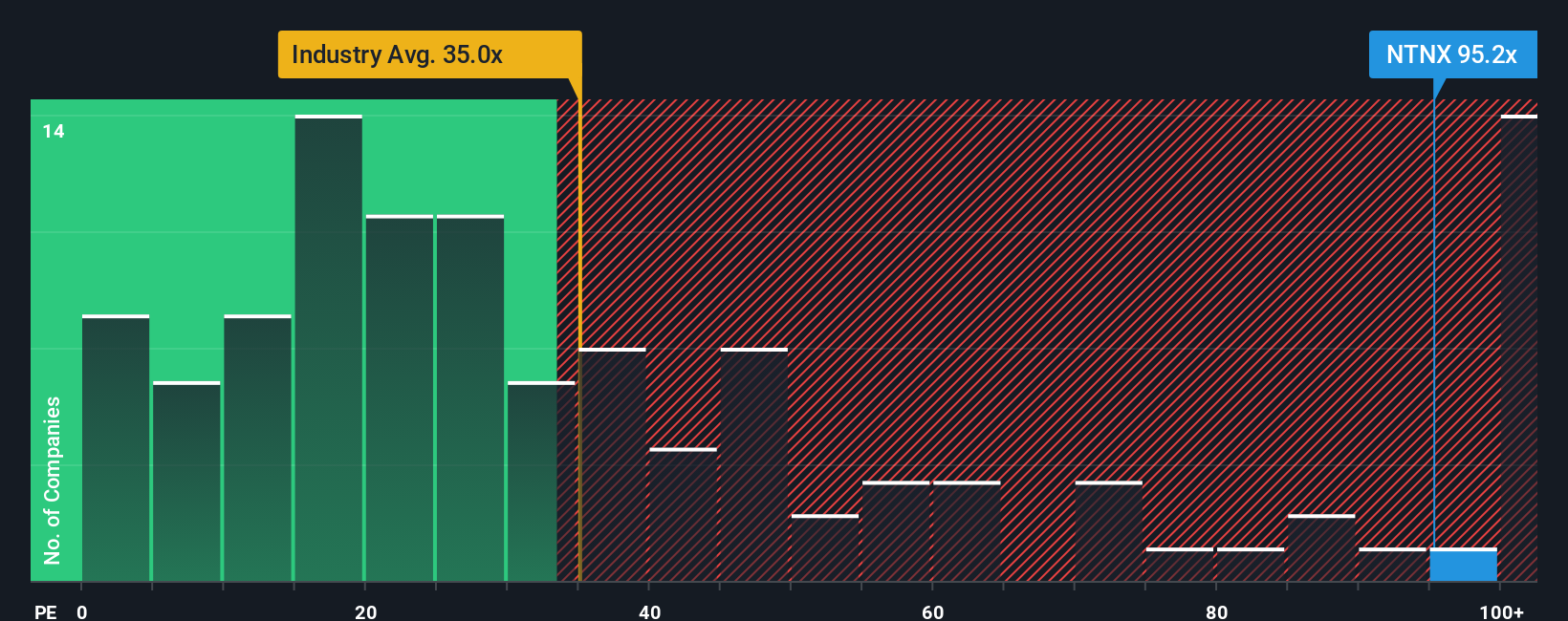

Another Take: Earnings Multiple Sends a Different Signal

While the narrative and cash flow based work suggest Nutanix at $42.81 could be undervalued versus fair value estimates in the high $60s to low $70s, the current P/E of 52.5x tells a more cautious story.

That P/E stands well above the US Software industry average of 30.5x and above the 42.3x fair ratio our models suggest the market could move toward, even though it sits below the 66.5x peer average. In practical terms, the bar for execution and earnings delivery is already quite high. How comfortable are you with that valuation risk if growth stumbles?

Build Your Own Nutanix Narrative

If you look at these numbers and reach a different conclusion, or simply prefer to work from your own assumptions, you can build a fresh Nutanix story in just a few minutes by starting with Do it your way.

A great starting point for your Nutanix research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Nutanix has sharpened your thinking, do not stop here; broaden your opportunity set with focused stock lists that can surface ideas you might otherwise miss.

- Target higher income potential by scanning for companies in these 13 dividend stocks with yields > 3% that may line up with your cash flow goals.

- Spot early movers by reviewing these 24 AI penny stocks that tie artificial intelligence themes to listed businesses.

- Hunt for mispriced opportunities using these 865 undervalued stocks based on cash flows that could fit a value driven approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.