Please use a PC Browser to access Register-Tadawul

Assessing Ocular Therapeutix (OCUL) Valuation After Recent Share Price Volatility

Ocular Therapeutix Inc OCUL | 7.78 | +10.67% |

Ocular Therapeutix (OCUL) has been drawing attention after recent share price swings, with the stock up about 4.2% over the past day but down over the past week, month, and past 3 months.

The recent 4.2% one-day share price gain to US$8.91 comes after a weaker patch, with the 30-day share price return of 20.8% and year-to-date share price return of 24.62% both in decline. This is even as the 1-year total shareholder return of 16.62% and 3-year total shareholder return of 126.14% point to a much stronger longer-term picture than the 5-year total shareholder return of 54.91%.

If Ocular Therapeutix has you thinking about where the next move could come from in healthcare, it may be worth scanning 25 healthcare AI stocks as another source of ideas.

With OCUL trading at US$8.91 alongside an intrinsic value estimate around US$24.58 and mixed recent returns, the key question now is whether you are looking at a genuine discount or a stock where the market is already pricing in future growth.

Most Popular Narrative: 63.1% Undervalued

At US$8.91 against a widely followed fair value view close to US$24.17, Ocular Therapeutix is framed as deeply discounted, with that gap resting on ambitious long term assumptions.

The anticipated approval of AXPAXLI, potentially the first wet AMD product with a superiority label and longer dosing intervals (every 6 to 12 months), may allow Ocular Therapeutix to capture significant market share in a rapidly growing population of elderly patients with retinal disease, unlocking large revenue growth opportunities as the global prevalence of ophthalmic disorders increases.

Want to see what kind of revenue ramp, margin shift, and valuation multiple would need to line up to support that price gap? The full narrative lays out a very specific earnings path, a steep top line curve, and a premium P/E assumption that together underpin that US$24.17 fair value.

Result: Fair Value of $24.17 (UNDERVALUED)

However, this optimistic setup still leans heavily on AXPAXLI clearing key clinical and regulatory hurdles, while high ongoing R&D without clear payback could eventually pressure funding options.

Another View on OCUL’s Price Tag

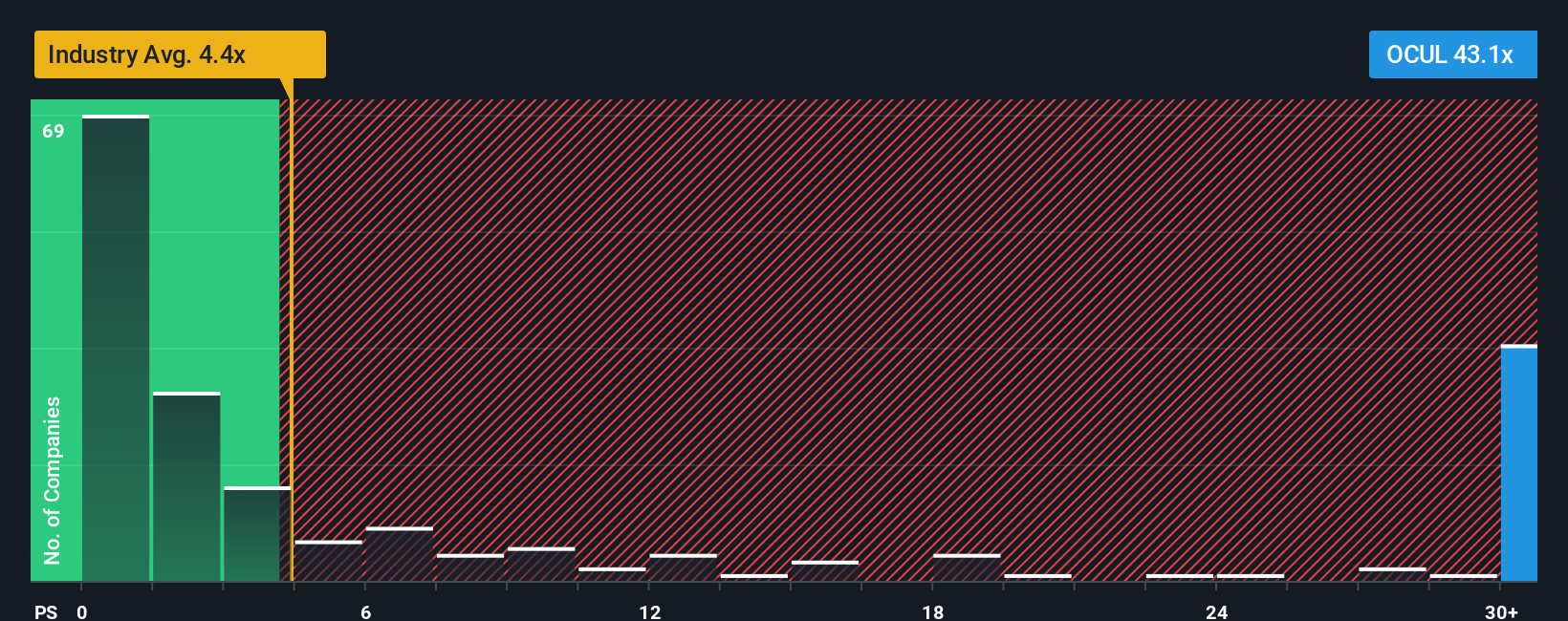

That big discount to fair value from our DCF model sits awkwardly next to how the market is pricing OCUL on sales today. At a P/S of 34x, versus 4.5x for the US Pharmaceuticals industry, 1.3x for peers, and a fair ratio of 0.4x, you are paying a very rich multiple for revenue while the DCF points to deep undervaluation. The question is which signal you place more weight on.

Build Your Own Ocular Therapeutix Narrative

If you see the story differently, or prefer to test the assumptions against your own work, you can build a custom view in minutes with Do it your way.

A great starting point for your Ocular Therapeutix research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If OCUL has sparked your interest, do not stop here, broaden your watchlist with a few focused sets of ideas built from our screeners.

- Target potential mispricings by reviewing 55 high quality undervalued stocks that pair solid fundamentals with prices that sit well below many investors’ expectations.

- Prioritise resilience by scanning our 81 resilient stocks with low risk scores to see companies with steadier risk profiles that may suit a more cautious approach.

- Hunt for underfollowed names by checking the screener containing 25 high quality undiscovered gems that our filters flag as quality businesses flying under most radars.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.