Please use a PC Browser to access Register-Tadawul

Assessing Okta (OKTA) Valuation After Recent Share Price Move And Analyst Target Gap

Okta, Inc. Class A OKTA | 74.29 | -9.18% |

Okta (OKTA) has drawn fresh attention after recent trading, with the shares last closing at $87.71. Investors are weighing that price against the company’s current fundamentals and its recent return profile across different time frames.

The recent 4.87% 1 day share price return at $87.71 sits against a modest 2.12% 30 day share price gain and a 5.31% 90 day share price decline. The 1 year total shareholder return of 3.60% and 3 year total shareholder return of 29.00% suggest longer term holders have seen mixed results, with momentum recently fading.

If Okta has you reassessing your tech exposure, this could be a moment to broaden your watchlist with high growth tech and AI stocks that are catching investor interest right now.

With Okta trading at $87.71 and sitting at an estimated 28% discount to both analyst targets and intrinsic value, the key question is whether this reflects underappreciated potential or if the market already assumes future growth is covered.

Most Popular Narrative: 22.1% Undervalued

With Okta last closing at $87.71 against a narrative fair value of about $112.62, the current gap puts the focus firmly on future earnings power and identity market demand.

The analysts have a consensus price target of $120.917 for Okta based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $142.0 and the most bearish reporting a price target of $75.0.

Want to see what sits behind that wide range of outcomes? The narrative leans on steady revenue gains, rising margins and a premium earnings multiple. Curious how those pieces fit together and what kind of future cash generation they imply?

Result: Fair Value of $112.62 (UNDERVALUED)

However, this hinges on Okta holding its own as larger security platforms push deeper into identity and on its ability to integrate acquisitions without hurting margins.

Another Angle On Okta’s Valuation

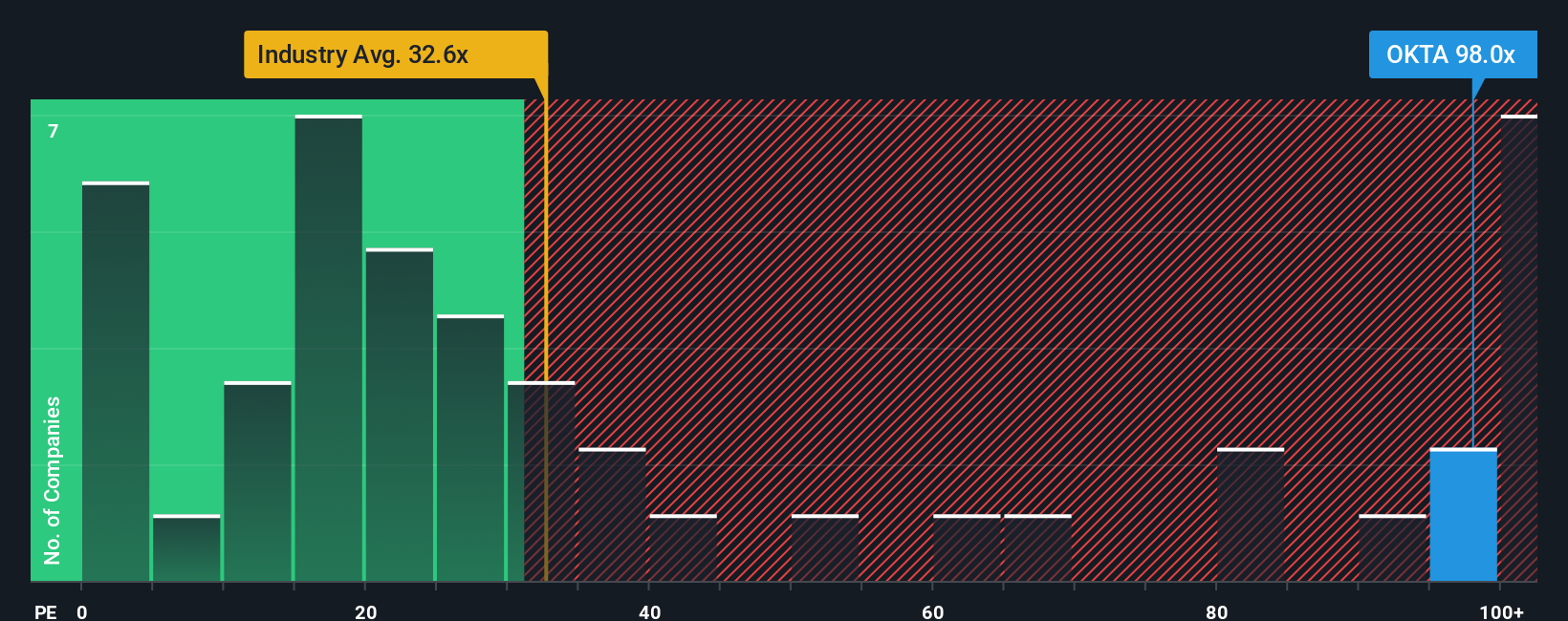

The narrative fair value points to Okta as 22.1% undervalued, but its current P/E of 79.7x tells a different story. That is far above the US IT industry at 30.1x, the peer average at 29x, and even its own 35.7x fair ratio. This hints at real multiple risk if sentiment cools.

Build Your Own Okta Narrative

If this narrative does not quite fit your view, you can weigh the same data and shape your own story for Okta in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Okta.

Looking for more investment ideas?

If Okta is on your radar, do not stop there. You may be missing a wider set of ideas that could sharpen your portfolio and broaden your opportunity set.

- Spot potential value candidates early by scanning these 878 undervalued stocks based on cash flows that currently trade below what their cash flows may justify.

- Tap into the next wave of automation by reviewing these 25 AI penny stocks that are building real businesses around artificial intelligence.

- Boost your income focus by checking out these 14 dividend stocks with yields > 3% that might offer more consistent cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.