Please use a PC Browser to access Register-Tadawul

Assessing Ollie’s Bargain Outlet Holdings (OLLI) Valuation After Rapid Store Expansion And Solid Same Store Sales

Ollie's Bargain Outlet Holdings Inc OLLI | 108.71 | -0.72% |

Why Ollie’s recent growth metrics are back in focus

Ollie's Bargain Outlet Holdings (OLLI) is drawing fresh attention as investors react to its double-digit annual store growth and steady same-store sales gains. This has raised questions about how the company’s expansion is affecting the current share price.

At a share price of $110.31, Ollie’s has seen a 2.84% 1 day share price gain. Its 90 day share price return of 8.69% and 1 year total shareholder return of 1.08% suggest momentum has cooled after a strong 3 year total shareholder return of 96.46%.

If Ollie’s steady store openings have you thinking about other ways growth stories can play out, this could be a good moment to check out fast growing stocks with high insider ownership.

With double digit store growth, steady same store sales and a share price that has cooled after big 3 year gains, is OLLI now quietly undervalued, or is the market already pricing in the next leg of growth?

Most Popular Narrative: 22.1% Undervalued

With Ollie’s last closing at $110.31 against a narrative fair value of $141.67, the current share price sits well below that framework of expectations.

The company is benefiting from a growing value conscious consumer base, amplified by economic uncertainty and inflation, which is driving more customers toward discount retailers like Ollie's. This is boosting both store traffic and revenue growth, as seen by accelerated customer acquisition and rising loyalty program membership. (Revenue)

Curious what kind of revenue path, margin lift, and future earnings multiple are built into that outlook, and how they feed into a fair value near $140?

Result: Fair Value of $141.67 (UNDERVALUED)

However, this hinges on assumptions that could break, including softer same store sales squeezing operating leverage and fewer closeout inventory deals pressuring gross margins.

Another View: Multiples Point To A Richer Price Tag

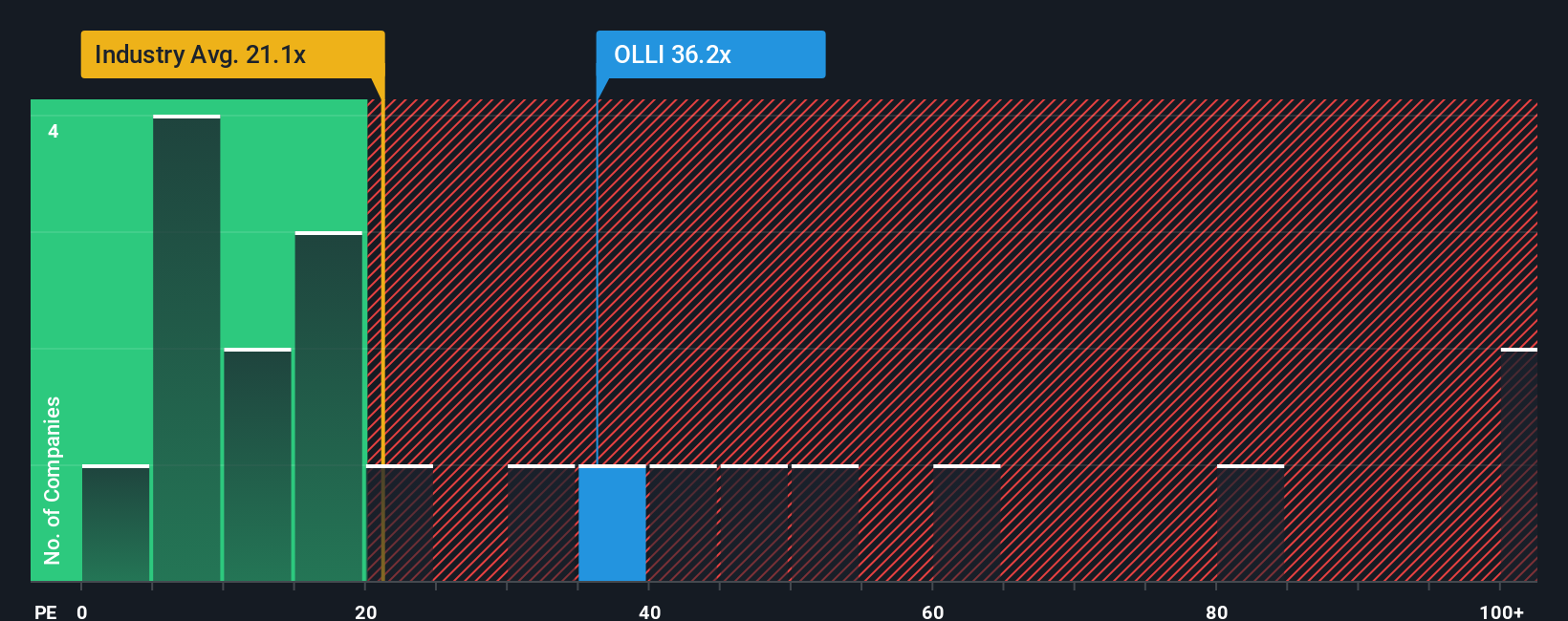

While the narrative fair value of $141.67 suggests upside, the current P/E of 30.3x sits well above both the estimated fair ratio of 18.3x and peer and industry averages of 16.6x and 19.8x. That gap raises a simple question: how much optimism is already in the price?

Build Your Own Ollie's Bargain Outlet Holdings Narrative

If you see the numbers differently or just want to stress test your own view against the data, you can quickly build a custom Ollie’s story yourself by starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Ollie's Bargain Outlet Holdings.

Looking for more investment ideas?

If Ollie’s has you thinking differently about growth and value, do not stop here. Broaden your watchlist with a few focused stock idea shortlists.

- Spot potential bargains early by checking out these 868 undervalued stocks based on cash flows, which may offer more appealing entry points based on their cash flow profiles.

- Tap into powerful tech trends by reviewing these 25 AI penny stocks, which are tied to artificial intelligence themes across different parts of the market.

- Strengthen your income options by scanning these 14 dividend stocks with yields > 3%, which could help you build a more reliable dividend stream.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.