Please use a PC Browser to access Register-Tadawul

Assessing Pacira BioSciences (PCRX) Valuation After Record EXPAREL Quarter Buybacks And Activist Pressure

Pacira Biosciences, Inc. PCRX | 23.22 | +0.17% |

What triggered the latest move in Pacira BioSciences?

Pacira BioSciences (PCRX) has drawn attention after reporting record EXPAREL sales with 7% volume growth in what it called its strongest fourth quarter in three years, along with a completed fourth quarter share repurchase and fresh activist pressure on the board.

Despite record EXPAREL sales and a completed buyback that retired 13.28% of shares under the May 2025 program, Pacira BioSciences’ 1-day share price return of 9.57% decline and 30-day share price return of 6.55% decline contrast with a 1-year total shareholder return of 14.00%. However, longer term total shareholder returns over three and five years remain significantly negative, suggesting short term momentum has softened even as recent operational updates and activist pressure keep attention on future risk and reward.

If Pacira’s latest update has you thinking about other opportunities in the sector, this could be a good moment to scan healthcare stocks for more healthcare names on your radar.

With Pacira trading at a discount to analyst targets and carrying weak three and five year total returns, you have to ask: is this a mispriced recovery story, or is the market already baking in future growth?

Most Popular Narrative: 18.9% Undervalued

With Pacira BioSciences last closing at $23.53 versus a narrative fair value of $29, the gap between price and projected fundamentals is front and center.

Ongoing investments in manufacturing efficiency, including the commissioning of large-scale, lower-cost production suites and optimization of workforce, are driving higher gross margins (guidance raised to 78%-80%), which, combined with reduced operating expenses, should translate to improved net margins and long-term earnings growth.

Curious how margin uplift, forecast revenue expansion, earnings step-up, and a future P/E below the sector average all fit together? The narrative spells out the full earnings path, the profit mix shift, and the valuation bridge backing that higher fair value.

Result: Fair Value of $29 (UNDERVALUED)

However, this depends heavily on EXPAREL remaining resilient, as well as on new partnerships and pipeline assets like PCRX-201 actually translating into commercial traction.

Another View: Multiples Tell a Different Story

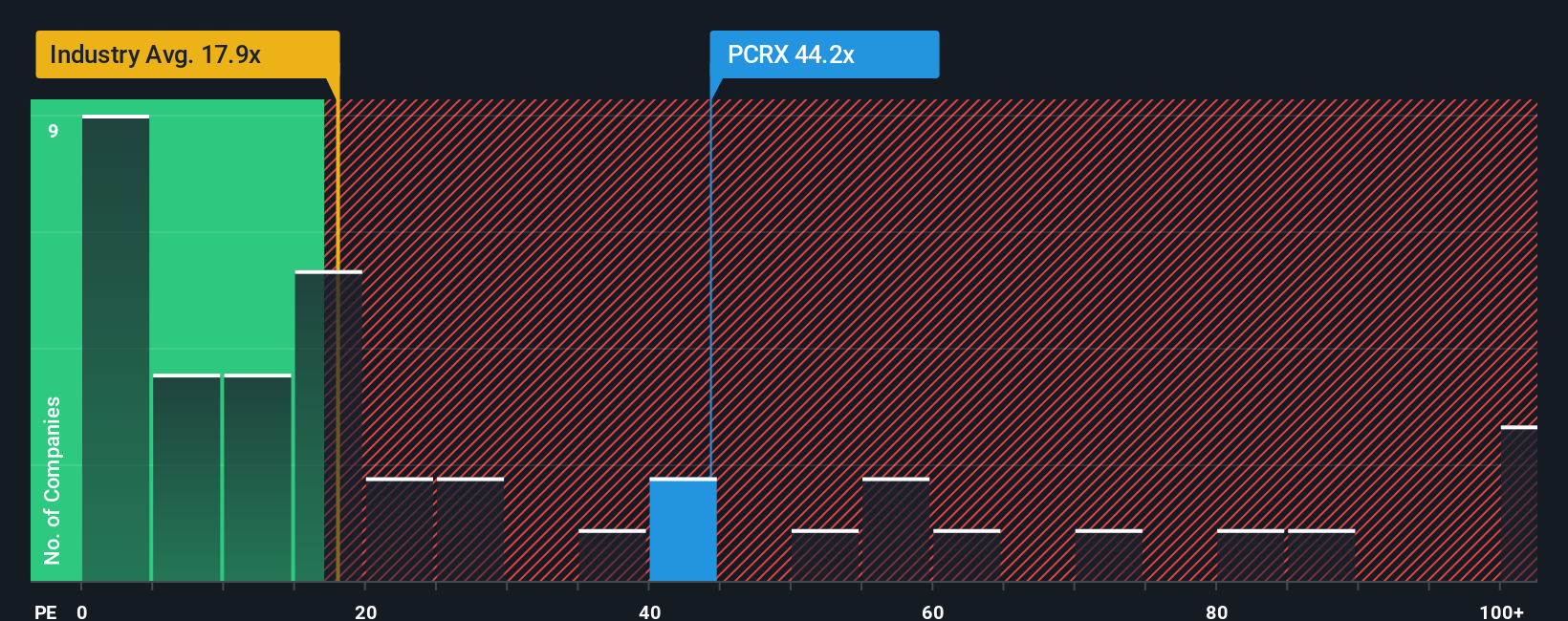

While the narrative fair value of US$29 points to upside, Pacira’s current P/E of 47.2x is more than double the US Pharmaceuticals average of 19.7x, above the peer average of 19.8x, and well ahead of its own fair ratio of 19.4x. That kind of gap can signal either mispricing or real execution risk. Which side do you think the market is pricing in?

Build Your Own Pacira BioSciences Narrative

If you look at this and think the story plays out differently for Pacira, you can test your own assumptions and build a custom view in just a few minutes, starting with Do it your way.

A great starting point for your Pacira BioSciences research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If you are serious about building a stronger portfolio, do not stop at a single stock. Widen your search and pressure test your next moves with targeted screeners.

- Target potential value opportunities by checking out these 879 undervalued stocks based on cash flows that line up strong cash flows with prices that may not fully reflect them.

- Spot future-focused themes by reviewing these 28 AI penny stocks where artificial intelligence sits at the core of each company’s growth story.

- Strengthen your income side by scanning these 12 dividend stocks with yields > 3% that offer yields above 3% while still giving you plenty of names to compare.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.