Please use a PC Browser to access Register-Tadawul

Assessing Patterson-UTI Energy (PTEN) Valuation After Archer Rig Rental Deal In Vaca Muerta

Patterson-UTI Energy, Inc. PTEN | 8.41 | -1.06% |

Archer rig rental deal puts Patterson-UTI Energy in focus

Archer’s new agreement to rent two high spec drilling rigs from Patterson-UTI Energy (PTEN) for work in Argentina’s Vaca Muerta shale has put fresh attention on PTEN’s international drilling footprint.

The Archer rig rental news arrives after a sharp 30 day share price return of 27.18% and a 90 day share price return of 14.64%, even though the 1 year total shareholder return sits at a 5.35% decline. The recent Argentina contract helps explain why momentum appears to be building in the short term. At the same time, the 3 year total shareholder return decline of 50.54% and 5 year total shareholder return of 31.95% show a mixed longer term picture that some investors may see as a reset after earlier gains.

If this kind of contract driven story has your attention, it could be a good time to scan other aerospace and defense stocks that are also tied to large, operationally complex projects.

With the shares up strongly in the past month, trading around US$7.44 and sitting close to the average analyst target, the bigger question is whether PTEN’s sizeable intrinsic discount hints at mispricing or if the market is already factoring in future growth.

Most Popular Narrative: 3.4% Overvalued

The most followed narrative puts Patterson-UTI Energy’s fair value at $7.20, slightly below the $7.44 last close, and builds that view from detailed cash flow assumptions.

The analysts have a consensus price target of $7.467 for Patterson-UTI Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0 and the most bearish reporting a price target of $6.25.

Want to see what is sitting behind that spread in targets? The narrative leans heavily on future margins, earnings power and a compressed valuation multiple. The focus is on how those three inputs interact over time, not just the end price.

Result: Fair Value of $7.20 (OVERVALUED)

However, you still need to watch for softer drilling and completion activity, as well as high ongoing capital spend, which could pressure margins and delay any earnings recovery story.

Another Angle on Value

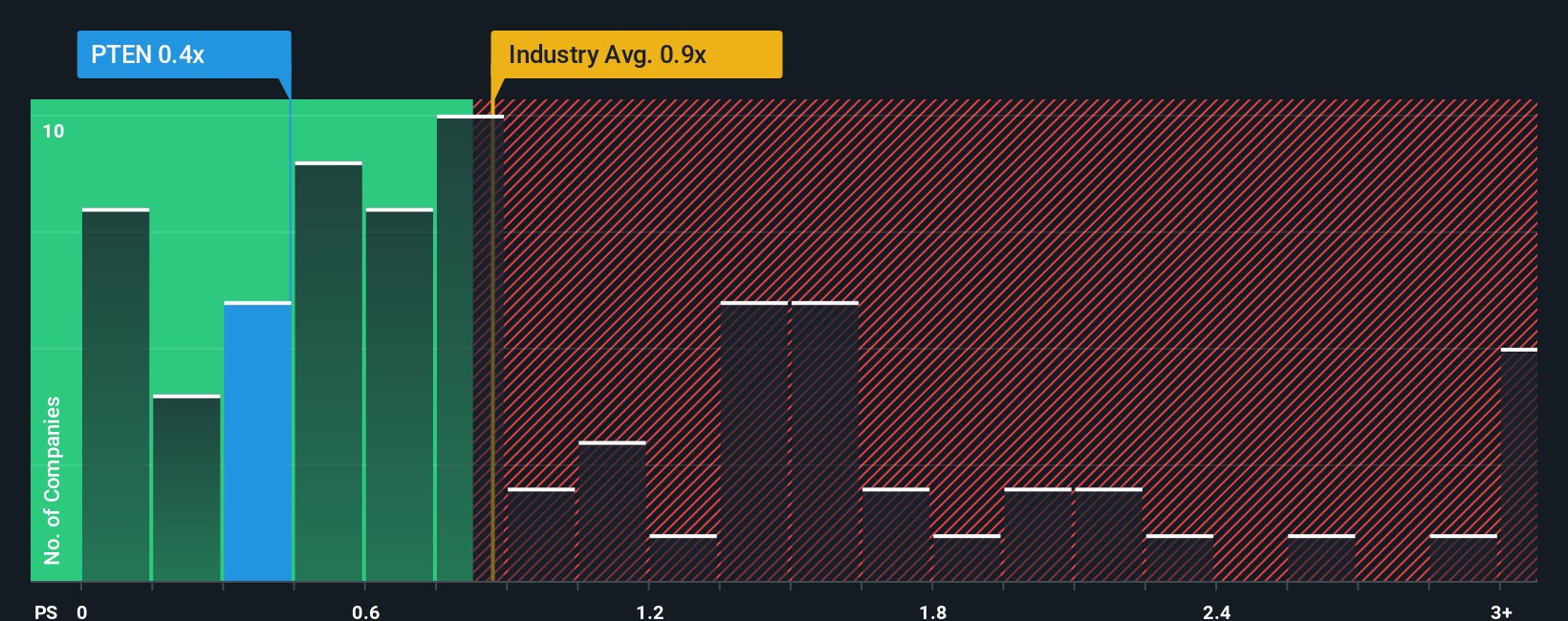

That 3.4% premium to the $7.20 fair value is based on cash flow assumptions, but the current P/S of 0.6x tells a different story. It sits well below the US Energy Services industry at 1.3x and under the 0.7x fair ratio this model suggests the market could move toward. That kind of gap often reflects real business risks, but it can also mean expectations are already fairly low. Which side of that trade off do you think is more likely to play out?

Build Your Own Patterson-UTI Energy Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a custom view in a few minutes: Do it your way.

A great starting point for your Patterson-UTI Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about finding your next move, do not stop at one stock. Use the screener to spot ideas before everyone else is talking about them.

- Pinpoint potential high risk high reward opportunities by scanning these 3511 penny stocks with strong financials that meet your financial filters instead of chasing headlines.

- Explore the AI theme by checking out these 24 AI penny stocks that align with your view on growth, risk and long term potential.

- Compare price and fundamentals by reviewing these 880 undervalued stocks based on cash flows where market expectations already look compressed, then decide which stories deserve a closer look.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.