Please use a PC Browser to access Register-Tadawul

Assessing Phibro Animal Health (PAHC) Valuation After Strong Q2 Results And Higher 2026 Earnings Guidance

Phibro Animal Health Corporation Class A PAHC | 51.85 | +1.51% |

Phibro Animal Health (PAHC) is back in focus after reporting second quarter results that show much higher sales and net income versus a year earlier, along with updated 2026 earnings guidance and a reaffirmed dividend.

The recent guidance update and stronger quarterly results have come after a sharp run in the shares, with a 30 day share price return of 31.47% and a year to date share price return of 39.01%. Longer term momentum is reflected in a 1 year total shareholder return of 100.93% and a 3 year total shareholder return above 2.5x, suggesting investors have been reassessing both growth potential and risk around Phibro Animal Health.

If this kind of earnings driven move has your attention, it could be a good moment to see what else is working in related areas and review 26 healthcare AI stocks as another set of ideas to research.

With the shares up strongly and the latest results and guidance now on the table, the key question is whether Phibro Animal Health still trades at a discount or whether the market is already pricing in future growth.

Most Popular Narrative: 20.6% Overvalued

Phibro Animal Health last closed at $51.85, while the most followed narrative anchors fair value around $43, using a 6.96% discount rate and detailed long term forecasts.

The company's strong recent growth is heavily dependent on the integration of the acquired Zoetis Medicated Feed Additive business and related cost synergies, which are non repeatable. Forward guidance suggests legacy product growth will slow to flat or low single digits. This implies the current trajectory of accelerating revenue and EBITDA growth is unsustainable and likely to normalize, impacting revenue and earnings growth expectations.

Curious how that view still supports a higher earnings base and richer margins than today, while using a lower future P/E than many peers? The narrative leans on a specific blend of moderate revenue growth, margin uplift and a disciplined valuation multiple to reach its $43 fair value.

Result: Fair Value of $43 (OVERVALUED)

However, if protein consumption trends, vaccine and nutritional specialties growth, or the Phibro Forward program exceed current expectations, this overvaluation narrative could be challenged.

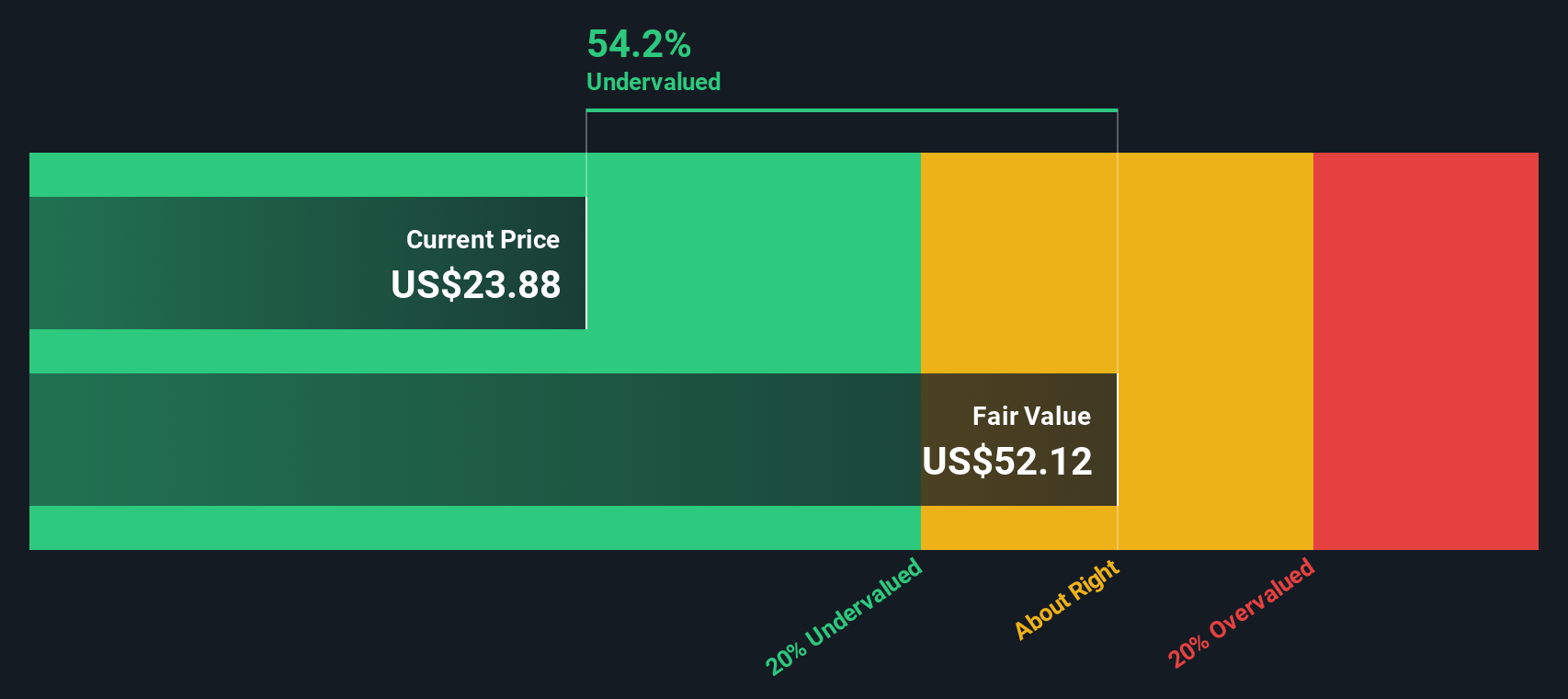

Another Take: Our DCF Model Sees Deep Value

While the most followed narrative pegs Phibro Animal Health at about 20.6% overvalued versus a $43 fair value, our DCF model paints a very different picture, with fair value at $119.16 versus a $51.85 share price. That gap suggests investors face a very different question: is the cash flow view too optimistic, or are near term worries doing too much of the talking?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Phibro Animal Health for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 52 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Phibro Animal Health Narrative

If you look at these views and feel they do not quite fit your own research style, you can test the numbers yourself and build a complete Phibro Animal Health story in just a few minutes with Do it your way

A great starting point for your Phibro Animal Health research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about putting this research into action, do not stop at one company. Use the screener to uncover other angles before the crowd does.

- Lock in a stronger starting point for long term compounding by reviewing our list of 52 high quality undervalued stocks that might suit your approach.

- Strengthen your focus on resilience by checking out the solid balance sheet and fundamentals stocks screener (45 results) and see which companies match your comfort level.

- Get ahead of the market by scanning our screener containing 24 high quality undiscovered gems and spot ideas that many investors may not yet be watching.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.